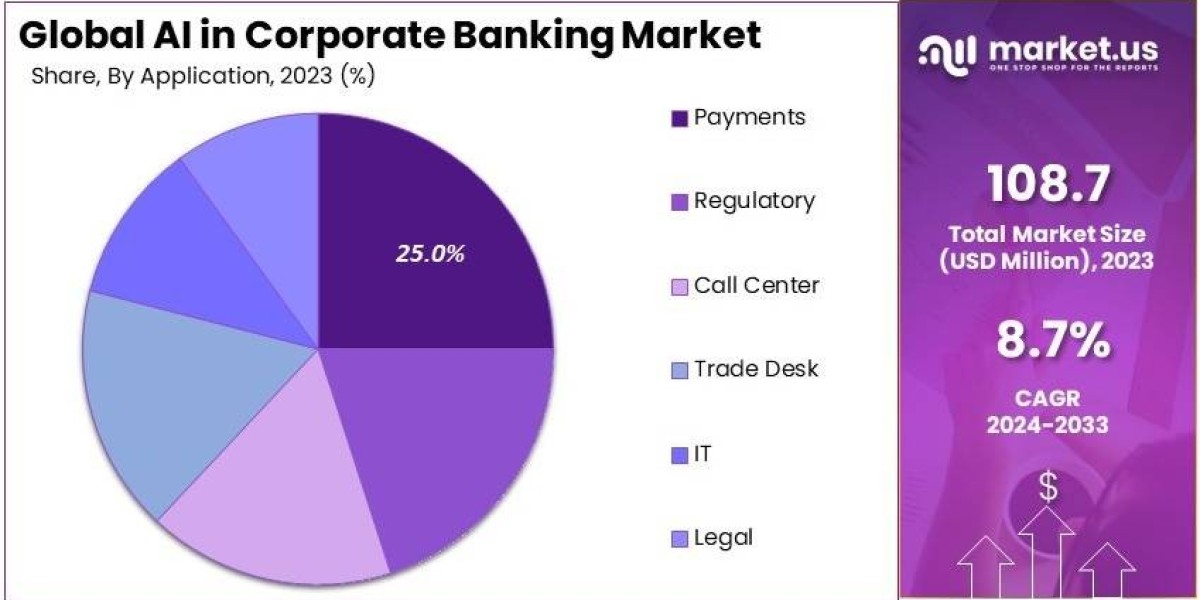

AI in the corporate banking market is rapidly changing how financial institutions operate and serve their clients. Artificial Intelligence (AI) technologies are making banking more efficient, secure, and customer-centric. By leveraging machine learning, natural language processing, and data analytics, banks can streamline their operations, enhance decision-making, and offer personalized services. This shift is transforming the landscape of corporate banking, providing both challenges and opportunities for financial institutions.The Global AI in Corporate Banking Market size is expected to be worth around USD 250.3 Million by 2033, from USD 108.7 Million in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

Major Growth Factors

Several factors are driving the growth of AI in corporate banking. First, the increasing volume of data generated by businesses and transactions demands advanced tools to analyze and interpret it effectively. AI helps in managing this data, offering insights that were previously unattainable. Additionally, the need for operational efficiency is pushing banks to automate routine tasks, reducing costs and minimizing human error. Regulatory pressures for better compliance and fraud prevention are also encouraging banks to adopt AI solutions. Finally, the rising customer expectations for faster and more personalized services are compelling banks to invest in AI technologies.

Read More @https://market.us/report/ai-in-corporate-banking-market/

Emerging Trends

AI is introducing several exciting trends in corporate banking. One prominent trend is the integration of AI with big data analytics, allowing banks to offer highly personalized services based on customer behavior and preferences. Another trend is the use of AI-powered chatbots and virtual assistants, which provide 24/7 customer support and handle routine inquiries efficiently. AI is also being used for predictive analytics, helping banks forecast market trends and make informed investment decisions. Additionally, there is a growing interest in AI-driven cybersecurity solutions to protect sensitive financial data from evolving threats.

Top Use Cases

AI is proving valuable in various use cases within corporate banking. One key application is in risk management, where AI models analyze financial data to identify potential risks and provide recommendations for mitigation. In credit scoring, AI enhances the accuracy of assessments by evaluating a wider range of factors beyond traditional metrics. Fraud detection is another critical area, with AI systems identifying unusual patterns and flagging potential fraudulent activities in real-time. AI is also transforming customer service through automated chatbots and virtual assistants, which handle a significant volume of customer interactions efficiently.

Challenges

Despite its benefits, the integration of AI in corporate banking comes with challenges. One major challenge is the need for high-quality data; AI systems are only as good as the data they are trained on, and poor data quality can lead to inaccurate results. There are also concerns about the transparency and explainability of AI decisions, particularly in areas like credit scoring and risk management. Additionally, banks face significant costs in implementing and maintaining AI systems, which can be a barrier for smaller institutions. Compliance with regulations and data privacy concerns also pose challenges, as banks must ensure their AI systems adhere to legal standards.

Opportunities

AI presents numerous opportunities for corporate banking. Banks can enhance their operational efficiency by automating routine tasks, allowing employees to focus on more strategic activities. The ability to offer personalized services and tailored financial products can lead to increased customer satisfaction and loyalty. AI also opens up opportunities for better risk management and fraud detection, reducing potential losses and improving financial security. Additionally, AI can facilitate more informed decision-making by providing deeper insights into market trends and customer behavior, helping banks stay competitive in a rapidly changing environment.

Conclusion

In conclusion, AI is significantly impacting the corporate banking market, offering both transformative benefits and substantial challenges. As banks continue to embrace AI technologies, they are finding new ways to enhance efficiency, improve customer service, and manage risks more effectively. While there are hurdles to overcome, such as data quality and regulatory compliance, the opportunities presented by AI are driving innovation and growth in the sector. By navigating these challenges and leveraging AI's capabilities, financial institutions can position themselves for long-term success in the evolving banking landscape.