The report "Retimer Market by PCIe (PCIe 1.0, PCIe 2.0, PCIe 3.0, PCIe 4.0, PCIe 5.0, PCIe 6.0), CXL, USB, SATA, HDMI, ThunderBolt, Ethernet, DisplayPort Interfaces, Servers, Storage Devices, Accelerators, Workstations, Routers, Gaming PCs - Global Forecast to 2029" The global retimer market is projected to reach USD 1,022.2 million by 2029 from USD 613.6 million in 2024; it is expected to grow at a CAGR of 10.7%.

The major drivers for the retimer market include rising demand for high-speed data transmission, the surging requirement for improved signal integrity, and the growing adoption of cloud computing owing to data centers expansion. Some emerging factors of the growth include the increasing implementation of edge computing and the growing use of retimer technology in automotive and industrial IoT applications. Technical hurdles in retimer deployment across high-speed data environments, and performance degradation due to compatibility issues are expected to be restraining factors for the retimer market. The availability of alternative solutions that are used for the same functions and regulatory and compliance related challenges are expected to create challenges for the retimer market. The rapid increase in Ethernet usage because of the need for faster and more reliable network connections, is also a significant factor driving the adoption of retimers. Retimers help improve signal quality, which is essential for high-speed Ethernet applications. The expansion of telecommunication infrastructure in emerging markets such as BRICS nations is also an important factor driving the growth of the retimer market.

CXL interface retimer segment to grow at a significant CAGR during the forecast period.

CXL interface retimers are expected to grow at a significant CAGR during the forecast period, driven by their applications in Al and ML. They enable direct memory access between devices, help bypass the CPU, and reduce the latency. This feature is beneficial for data-intensive workloads like Al and ML technologies. In Al workloads, CXL enables faster data processing by allowing GPUs to access large datasets stored in memory without the latency typically associated with traditional memory management techniques. They restore and equalize signals, compensating for jitter and channel frequency loss. This capability ensures that the data transmitted remains accurate and reliable in high-speed data applications.

Server application segment to grow at a significant CAGR between 2024 and 2029.

The server application segment is expected to grow at a significant CAGR during the forecast period due to rising demand for enhancing signal integrity and enabling high-speed data transfer. One of the primary functions of retimers in server applications is to enhance signal integrity across high-speed data paths. As server architectures evolve to support faster data transfer rates, such as those defined by PCIe 5.0 and PCIe 6.0, the need for robust signal conditioning becomes critical. With the ability to maintain low latency—often adding only minimal delay—retimers facilitate efficient communication between CPUs, GPUs, and other peripherals, making them essential for modern data centers that demand robust performance for applications such as AI and large-scale data processing.

Retail segment to grow at a significant CAGR during the forecast period.

The retail end user segment is attributed to grow with a significant CAGR in the forecast period. The retail sector has changed in recent years on the wheel of the fast adoption of digital technologies and e-commerce platforms. While retailers are increasingly dependent on high-speed data transmission for a wide range of applications, demand for retimers increases consequently. They have major functions in maintaining the integrity and reliability of data signals, which is important in ensuring seamless operations across online and brick-and-mortar stores, among other retail channels.

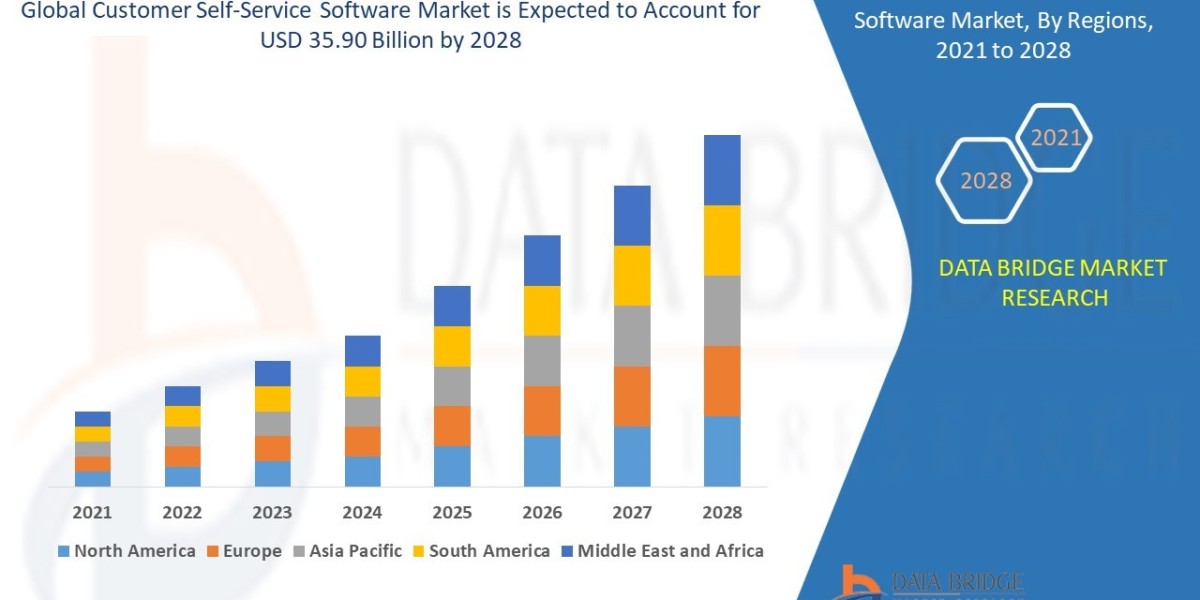

Asia Pacific region is likely to grow at a significant CAGR during the forecast period.

The Asia Pacific region is projected to grow at a high CAGR during the forecast period due to various drivers across its countries. China is home to retimer manufacturers such as Montage Technology, Saidi Semiconductor (Shenzhen) Co., Ltd., and Linkreal Co., Ltd. The manufacturers of such retimers in China continually engage in research and development to come up with sophisticated retimers that are used in data centers and cloud computing. The Indian government's Digital India initiative, through which the country is trying to become the powerhouse of digitization, is attracting increased investments in data centers, cloud computing, and high-speed networks, hence enabling faster adoption of retimers. The demand for retimers in Japan is being driven by the rapid growth experienced within data centers due to a huge demand for cloud computing and big data analytics. Data centers, as they proliferate, raise the demand for high-speed, reliable data transmission solutions; hence, it makes such a device indispensable as a retimer.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=224754448

Some of the key players in the retimer market include Astera Labs, Inc. (US), Broadcom (US), Marvell (US), Renesas Electronics Corporation (Japan), Texas Instruments Incorporated (US), Parade Technologies, Ltd. (Taiwan), Intel Corporation (US), Diodes Incorporated (US), Microchip Technology Inc. (US), Montage Technology (China), Rambus (US), Semtech Corporation (US), Phison Electronics (Taiwan), Nuvoton Technology Corporation (Taiwan) and Kandou Bus SA (Switzerland).