Global Telecom Order Management Industry: Key Statistics and Insights in 2025-2033

Summary:

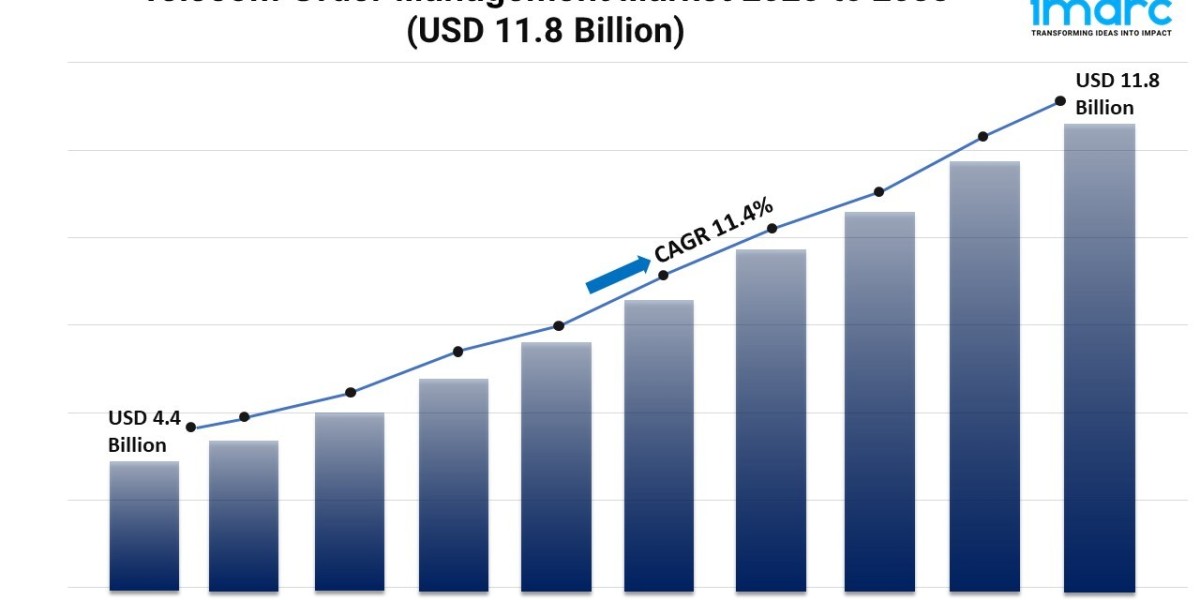

- The global telecom order management market size reached USD 4.4 Billion in 2024.

- The market is expected to reach USD 11.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.4% during 2025-2033.

- North America leads the market, accounting for the largest telecom order management market share.

- Solution represents the majority of the market share in the component segment because of its ability to offer comprehensive telecom order management solutions that encompass various functionalities, including order capture, processing, provisioning, and fulfillment.

- Cloud-based holds the biggest share in the telecom order management industry.

- Large organization remain a dominant segment in the market due to the rising focus on maintaining brand reputation.

- Wired accounts for the leading network type segment.

- The expansion of connected devices and subscribers is a primary driver of the telecom order management market.

- The rising adoption of advanced technologies and deployment of fifth generation (5G) networks are reshaping the telecom order management market.

Request for a sample copy of this report: https://www.imarcgroup.com/amines-market/requestsample

Industry Trends and Drivers:

- Expansion of Connected Devices and Subscribers:

The increasing popularity of smartphones, IoT devices, and smart gadgets is driving the demand for telecom order management solutions. With millions of new devices coming up to connect to the network, telecom providers are already dealing with an unprecedented volume of service requests. Order management solutions standardize processes by automating order intake, tracking, and fulfillment, so that every service request is handled quickly. This expansion is important for telecom operators to meet the growing demands of connected users who expect smooth service activation and troubleshooting. These orders should be managed correctly as they are crucial in avoiding errors, reducing service downtime and enhancing customer satisfaction, all of which are vital as telecom companies fight to keep a growing subscriber base. This has become a critical issue, especially in the current competitive telecom environment, as being able to manage a large number of orders accurately and quickly has become important for operational efficiency.

- Rising Adoption of Advanced Technologies:

The market is being driven by the integration of big data analytics, machine learning (ML), and artificial intelligence (AI). These technologies allow providers to manage resources more effectively, automate mundane tasks, and even forecast order volumes. AI-based systems can assist with order processing by identifying areas of the process where delays are most likely to occur and by sending orders automatically to the correct departments, thus accelerating order processing times. In addition, ML algorithms help in identifying potential points of service disruption, thereby enabling corrective action to be taken before they impact customers. Big data analytics also assists the operators in understanding customer preferences and optimizing order flow. This digital capability does the job on the back-end, and also helps the telecom companies to provide their customers with personalized and focused order workflows that enhance satisfaction and loyalty in a sector where differentiation by service is crucial.

- Deployment of Fifth Generation (5G) Networks:

The coming of 5G technology has enhanced the speed, connectivity and service potential of the telecom sector and therefore calls for efficient order management systems to keep up. This is because 5G network provides new and improved services such as ultra-low latency for autonomous vehicles and high-speed mobile broadband. These services need very accurate and intricate order fulfillment processes that normal systems cannot manage well. There are order management solutions for 5G that can meet the requirements of these services, including the higher order volumes and the need for customized service configurations. The availability of 5G-enabled order management systems helps telecom providers to launch new services with minimum breaks, which in turn leads to customer delight and business excellence in a highly competitive market.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging telecom order management market trends.

Telecom Order Management Market Report Segmentation:

Breakup By Component:

- Solution

- Customer Order Management

- Service Order Management

- Service Inventory Management

- Service

- Integration and Installation Services

- Consulting Services

- Support Services

Solution accounts for the majority of shares as it encompasses various functionalities, including order capture, processing, provisioning, and fulfillment.

Breakup By Deployment Mode:

- On-premises

- Cloud-based

Cloud-based dominates the market because of its ability to provide improved scalability and flexibility.

Breakup By Organization Size:

- Large Organization

- Small and Medium Organization

Large organization represents the majority of shares due to the rising focus on maintaining brand reputation.

Breakup By Network Type:

- Wireless

- Wired

Wired holds the majority of shares, which can be attributed to the increasing need for reliability and high-speed connectivity.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to a large market for telecom order management driven by strategic partnerships and collaborations among technology vendors and solution providers to develop and deploy advanced solutions.

Top Telecom Order Management Market Leaders:

The telecom order management market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Cerillion

- Cognizant

- Comarch SA

- Fujitsu Limited (Furukawa Group)

- Infosys Limited

- International Business Machines Corporation

- Oracle Corporation

- Pegasystems Inc.

- elefonaktiebolaget LM Ericsson

- Wipro Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163