South Korea Foreign Exchange Market Overview

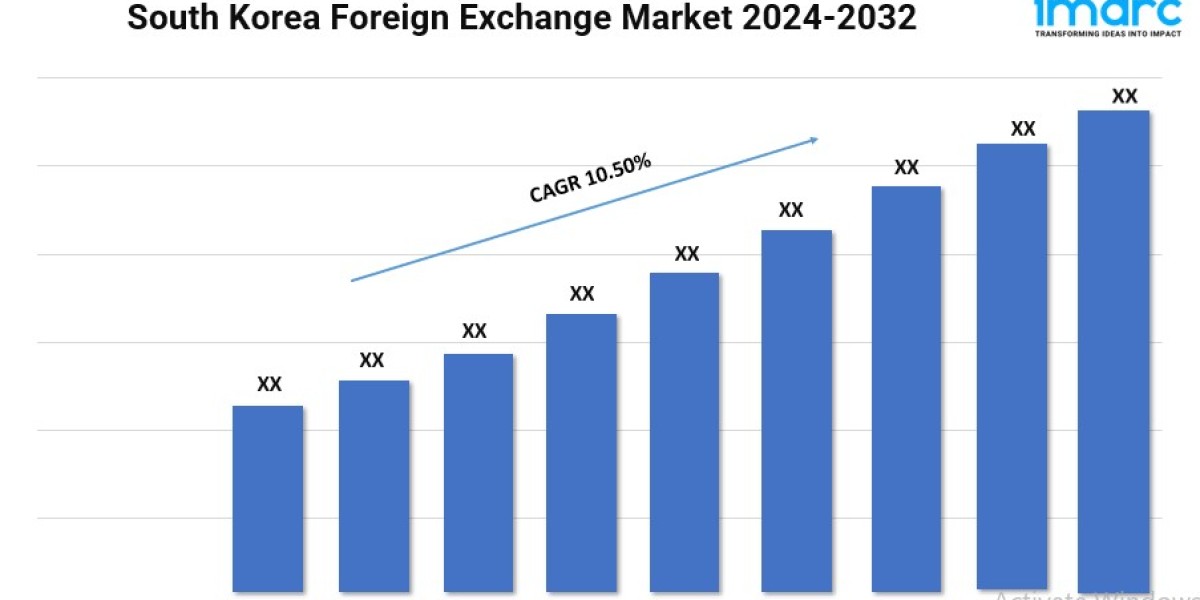

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 10.50% (2024-2032)

The South Korea foreign exchange market is expanding rapidly, owing to several interconnected factors. According to the latest report by IMARC Group, the market is projected to exhibit a growth rate (CAGR) of 10.50% during 2024-2032.

Download sample copy of the Report: https://www.imarcgroup.com/south-korea-foreign-exchange-market/requestsample

South Korea Foreign Exchange Industry Trends and Drivers:

The South Korea foreign exchange market is expanding rapidly, owing to several interconnected factors. Primarily, the market is driven by the nation's strong international trade and its status as a top exporter in industries including shipbuilding, electronics as well as autos. Besides this, the substantial foreign exchange activity required by the high amount of trade transactions is especially important when it comes to major currencies like the US dollar, Chinese yuan, and Japanese yen. Additionally, the financial policies of the nation aimed at maintaining a stable currency to support trade competitiveness play a pivotal role in shaping the South Korea foreign exchange market. In line with these factors, the influx of foreign investments and portfolio flows into South Korea's equities and bond markets also contribute to the dynamic nature of its foreign exchange market.

Key trends in the South Korea foreign exchange market include the increasing adoption of digital and algorithmic trading platforms, which enhance transaction efficiency and transparency. Moreover, the government and financial institutions are also leveraging advancements in blockchain and fintech to streamline foreign exchange processes and reduce settlement risks. In addition to these factors, the rising integration of the South Korean won into global trading systems, supported by bilateral currency swap agreements and initiatives to internationalize the currency, is expanding the market's scope. Furthermore, the participation of multinational corporations and global banks in the foreign exchange market underscores its importance in the regional financial ecosystem. Apart from this, the evolving regulations to ensure market stability and competitiveness are anticipated to drive growth in the South Korea foreign exchange market over the forecasted period.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging South Korea foreign exchange market trends.

South Korea Foreign Exchange Industry Segmentation:

The report has segmented the market into the following categories:

Counterparty Insights:

- Reporting Dealers

- Non-Financial Customers

- Others

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145