Key Inclusions

- A detailed assessment of the current market landscape of CAR-T-cell immunotherapies with respect to type of developer (industry and non-industry), phase of development (approved, phase III, phase II / III, phase II, phase I / II, phase I, clinical (phase unknown), preclinical), therapeutic area (oncological disorders, non-oncological disorders and undisclosed), key target indication (acute lymphoblastic leukemia, B-cell lymphoma, multiple myeloma, non-Hodgkin lymphoma, acute myeloid leukemia, hepatocellular carcinoma, diffuse large B-cell lymphoma, pancreatic cancer, gastric cancer, lung cancer, mantle cell lymphoma, ovarian cancer, breast cancer and follicular lymphoma), key target antigen (CD19, BCMA, CD19 / CD22, GPC3, NY-ESO-1 and others), source of T-cells (autologous and allogeneic), route of administration (intravenous, intratumoral, intraperitoneal, intrapleural, intracranial and others), dose frequency (single dose, multiple doses and split doses), patient segment (children, adults and seniors) and type of therapy (monotherapy and combination therapy). Additionally, it highlights the most active industry and non-industry players (in terms of number of pipeline candidates) engaged in the development of CAR T cell therapies. Further, chapter also includes developer landscape analysis based on some relevant parameters, including year of establishment, company size (small, mid-sized and large) and location of headquarters (North America, Europe and Asia Pacific).

- An analysis of key insights derived from the study featuring a competitive analysis, highlighting the popular target antigens related to hematological malignancies and solid tumors. Additionally, it includes CAR construct analysis of clinical-stage CAR-T therapies based on the generation of CAR (first generation, second generation, third generation and fourth generation), type of binding domain (murine, humanized, fully human and rabbit derived), type of virus used (lentivirus and retrovirus), type of gene transfer method used (transduction and transfection) and type of co-stimulatory domain used.

- A detailed analysis of completed, ongoing and planned clinical studies related to CAR-T cell therapies, based on several relevant parameters, such as trial registration year, enrolled patient population, trial recruitment status, trial phase, target patient segment, type of sponsor / collaborator, most active players and regional distribution of trials.

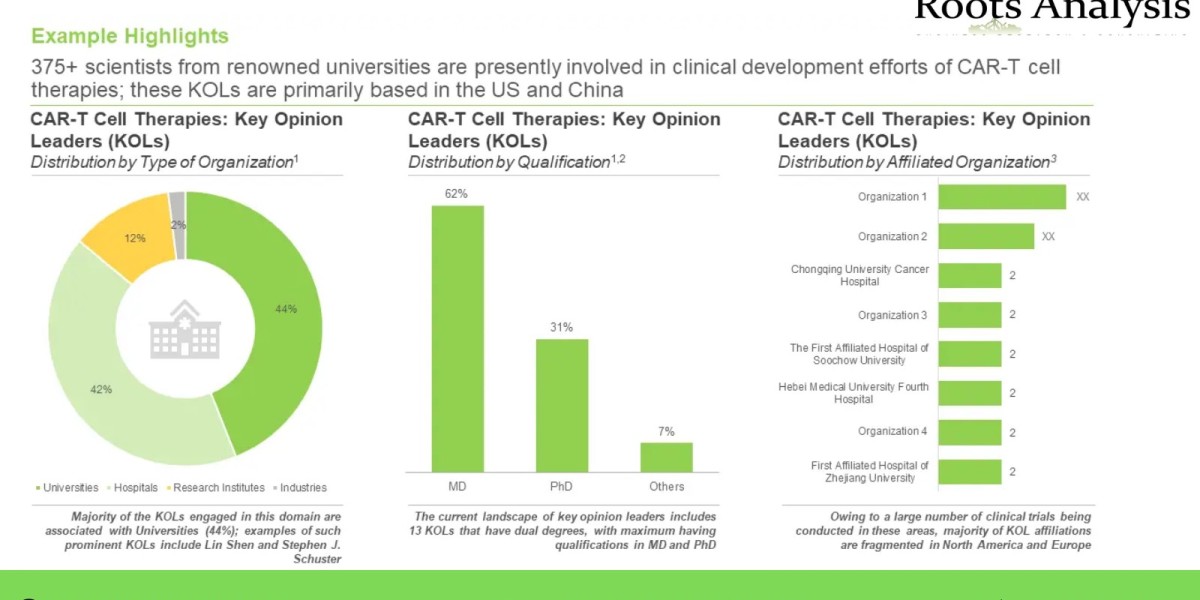

- An insightful analysis highlighting the key opinion leaders (KOLs) in this domain featuring an analysis of the various principal investigators of clinical trials related to CAR-T cell therapies, considering them to be KOLs, who are actively involved in R&D of CAR-T cell therapies. In addition, the chapter presents an analysis, comparing the relative expertise of KOLs based on a proprietary scoring criterion and that of a third party.

- Elaborate profiles of marketed and mid- to late-stage clinical products (phase I/II or above); each profile features an overview of the therapy, its mechanism of action, dosage information, details on the cost and sales information (wherever available), clinical development plan, and key clinical trial results.

- An analysis of various type of partnership that have been inked between several stakeholders in the domain of CAR-T-cell therapies, covering various type of partnership such as, R&D agreements, license agreements (specific to technology platforms and product candidates), product development and commercialization agreements, manufacturing agreements, clinical trial collaborations, product supply management agreements, joint ventures and others.

- An analysis of the investments that have been made into companies that have proprietary CAR-T cell-based products / technologies, including seed financing, venture capital financing, capital raised from IPOs and subsequent offerings, grants and debt financing.

- An in-depth analysis of patents related to CAR-T cell therapies, filed / granted till 2022, based on several relevant parameters, such as type of patent (granted patents, patent applications and others), publication year, geographical distribution, Cooperative Patent Classification (CPC) symbols, emerging focus areas, type of applicant, leading players (on the basis of number of patents) and patent benchmarking. In addition, it features a patent valuation analysis which evaluates the qualitative and quantitative aspects of the patents.

- A case study on manufacturing cell therapy products, highlighting the key challenges, and a detailed list of contract service providers and in-house manufacturers involved in this space.

- An elaborate discussion on various factors that form the basis for the pricing of cell-based therapies. It features different models / approaches that a pharmaceutical company may choose to adopt to decide the price of a CAR-T cell based immunotherapy that is likely to be marketed in the coming years.

- A review of the key promotional strategies being adopted by the developers of the approved CAR-T cell therapies, namely Kymriah®, Yescarta®, Tecartus™, Breyanzi®, Abecma™, Carvykti™.

- Elaborate profiles of the several leading players in the domain of CAR-T cell therapies. Each company profile includes an overview of the developer and brief description of the product portfolio specific to CAR-T cell therapies, technology portfolio (if available), recent developments related to T-cell immunotherapies and manufacturing capabilities of the companies. Additionally, we have provided details of the strategic / venture capital investments made in these companies.

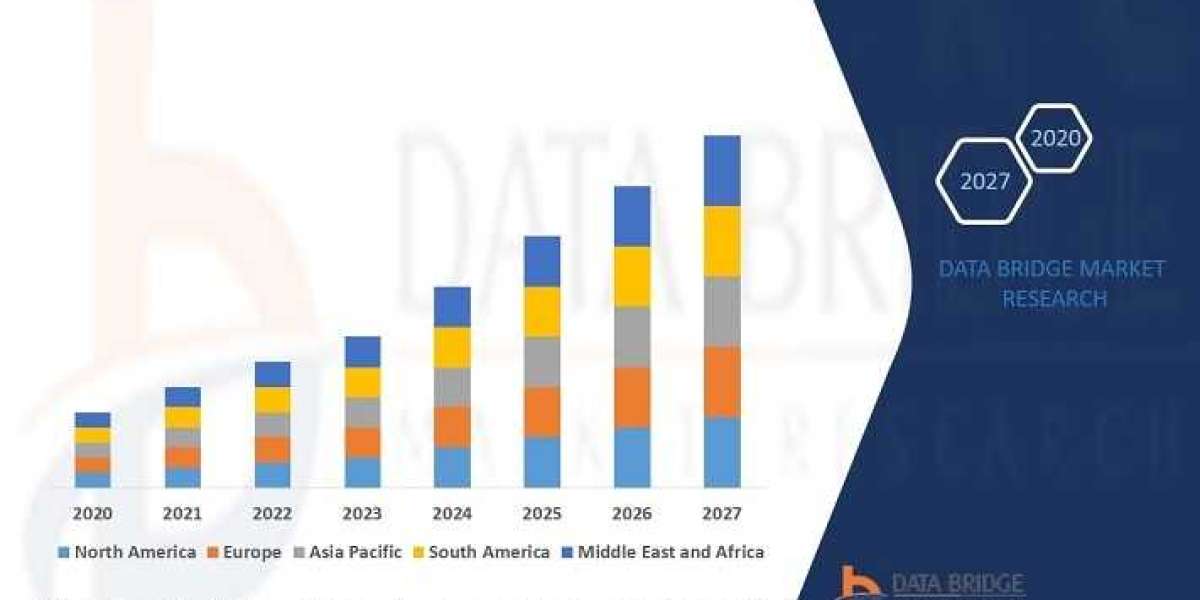

- The projected opportunity within the CAR T cell therapy market is expected to be well distributed across key / emerging players and different geographical regions

The report also features the likely distribution of the current and forecasted opportunity across important market segments, mentioned below:

- Target Indication(s)

- Non-Hodgkin’s Lymphoma

- Multiple Myeloma

- Acute Lymphoblastic Leukemia

- Chronic Lymphocytic Leukemia

- Hodgkin’s Lymphoma

- Acute Myeloid Leukemia

- Ovarian Cancer

- Generalized Myasthenia Gravis (MG)

- Renal Cell Carcinoma

- Target Antigen

- CD19

- BCMA

- CD19/22

- Others

- Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

- Rest of the World

Key Questions Answered

- What are the prevalent R&D trends related to CAR-T cell therapies?

- What are the clinical conditions can be treated using CAR-T cell therapies?

- Who are the leading industry and non-industry players in this market?

- In which geographies, extensive research on CAR-T cell therapy is being conducted?

- What kind of partnership models are commonly adopted by industry stakeholders?

- Who are the key investors in the CAR-T cell immunotherapy domain?

- Who are the key opinion leaders / experts from renowned academic and research institutes which can help drive product development efforts in this domain?

- How is the intellectual property landscape for global CAR-T cell therapies likely to evolve in the foreseen future?

- Who are the key service providers (CMOs / CDMOs) with capabilities to develop and manufacture CAR-T cell therapies?

- What are the key factors that are likely to influence the evolution of the CAR-T cell immunotherapies market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What are the key promotional strategies used by companies having marketed products?

Get more details on the CAR-T Cell Therapy Market report https://www.rootsanalysis.com/reports/view_document/car-t-therapies-market/269.html

You may also be interested in the following titles:

Antiviral Drugs Development: Are we Prepared for the Next Viral Pandemic?

Roots Analysis Consulting - the preferred research partner for global firms

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415