FinTech Blockchain Market Overview:

The “Global FinTech Blockchain Market ” is an in-depth look at the FinTech Blockchain Market , with a focus on global market trends and analysis. This study seeks to provide an overview of the FinTech Blockchain Market industry as well as detailed market segmentation by segment and geography. The FinTech Blockchain Market is expected to expand rapidly over the forecast period. The research contains critical information on the market positions of the top FinTech Blockchain Market firms, as well as significant industry trends and opportunities.

Market Scope :

To validate the market size and estimate the market size by different segments, top-down and bottom-up methodologies are utilized. The research’s market estimates are based on the sale price (excluding any discounts provided by the manufacturer, distributor, wholesaler, or traders). Weights applied to each section based on usage rate and average sale price are used to determine percentage splits, market shares, and segment breakdowns. The percentage adoption or usage of the provided market Size in the relevant area or nation is used to determine the country-wise splits of the overall market and its sub-segments.

Sample Request For FinTech Blockchain Market : https://www.maximizemarketresearch.com/request-sample/13770

Segmentation of FinTech Blockchain Market :

by Application

Payments, clearing, and settlement

Exchanges and remittance

Smart contracts

Identity management

Compliance management/Know Your Customer (KYC)

Others (cyber liability and content storage management

Investment in the cryptocurrency and blockchain industry increased dramatically in 2022, growing from $5.4 billion in 2020 to more than $30 billion. Globally, there has been tremendous growth in awareness of the potential role of crypto and its underlying technology in current financial institutions. Increased activity in the field has also prompted more action from central banks, with several pondering the introduction of digital currencies similar to China's digital yuan. It has also provoked more regulatory scrutiny. China entirely prohibited crypto mining and trade, while India was the first to follow suit. Other governments, however, have continued to strongly promote fintech exploration and solutions.

by Industry

Vertical Banking

Non-banking financial services

Insurance

SkuChain, established in the United States, attempts to connect bankers in advanced economies with customers in emerging and developing countries, despite a lack of previous commerce or data with these emerging market enterprises. The venture proposes a 'collaborative commerce platform,' which combines payments (such as a credit letter or bank transfer); finance (such as operating loans or short-term exchange loans); and visibility (assimilation with back office systems such as Systems Applications and Products in Data Processing or an Enterprise Resource Planning system). Hijro is another U.S. startup that is developing a blockchain-based financial operating network for international commerce, with real-time business-to-business payment transactions, distribution network financing, and a peer-to-peer working capital marketplace that provides financial service partners and non-bank lenders, such as alternative finance providers, asset-based lenders, and hedge funds, with an effective alternative for lending along the global supply chain.

Table of content for the FinTech Blockchain Market includes:

1. Global FinTech Blockchain Market: Research Methodology

2. Global FinTech Blockchain Market: Executive Summary

· Market Overview and Definitions

o Introduction to Global FinTech Blockchain Market

· Summary

o Key Findings

o Recommendations for Investors

o Recommendations for Market Leaders

o Recommendations for New Market Entry

3. Global FinTech Blockchain Market: Competitive Analysis

· MMR Competition Matrix

o Market Structure by region

o Competitive Benchmarking of Key Players

· Consolidation in the Market

o M&A by region

· Key Developments by Companies

· Market Drivers

· Market Restraints

· Market Opportunities

· Market Challenges

· Market Dynamics

· PORTERS Five Forces Analysis

· PESTLE

· Regulatory Landscape by region

o North America

o Europe

o Asia Pacific

o Middle East and Africa

o South America

· COVID-19 Impact

4. Global FinTech Blockchain Market Segmentation

· Global FinTech Blockchain Market, by Type (2021-2029)

· Global FinTech Blockchain Market, by Product (2021-2029)

· Global FinTech Blockchain Market, by Application (2021-2029)

· Global FinTech Blockchain Market, by End-User (2021-2029)

5. Regional FinTech Blockchain Market(2021-2029)

· Regional FinTech Blockchain Market, by Type (2021-2029)

· Regional FinTech Blockchain Market, by Product (2021-2029)

· Regional FinTech Blockchain Market, by Application (2021-2029)

· Regional FinTech Blockchain Market, by End-User (2021-2029)

· Regional FinTech Blockchain Market, by Country (2021-2029)

6. Company Profile: Key players

· Company Overview

· Financial Overview

· Global Presence

· Capacity Portfolio

· Business Strategy

· Recent Developments

Inquiry For Report : https://www.maximizemarketresearch.com/inquiry-before-buying/13770

Key Players of FinTech Blockchain Market :

Primary and secondary research is used to discover industry titans, while primary and secondary research is utilized to assess market revenue. The core research included in-depth interviews with a variety of thought leaders and industry experts, including experienced front-line personnel, CEOs, and marketing specialists. Secondary research comprised an examination of well-known manufacturers’ annual and financial reports. Secondary data is utilized to calculate percentage splits, market shares, growth rates, and global market breakdowns, which are then cross-checked against primary data. The following are a few companies working in the FinTech Blockchain Market industry.

- 1. AWS

2. IBM

3.Microsoft

3. Ripple

4. Chain

5. Earthport

6. Bitfury

7. BTL

8. Oracle

9. Digital Asset

10. Circle

11. Factom

12. Alphapoint

13. Coinbase

14. Abra

15. Auxesis

16. Bitpay

17. Blockcypher

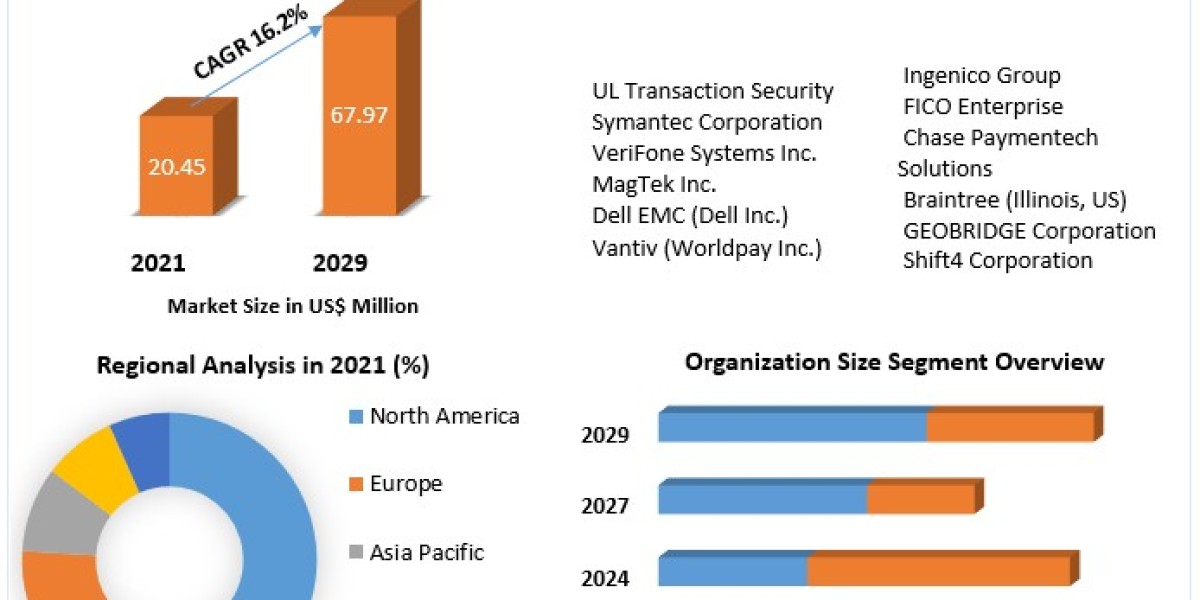

Regional Analysis :

The FinTech Blockchain Market research focuses into geographic analysis, which is further separated by sub-regions and nations. Profit projections and market share statistics for each country are included in this section of the research. This component of the study examines each region’s and country’s share and growth rate throughout the forecasted time period.

The report provides a thorough PESTEL analysis for all five regions, including North America, Europe, Asia Pacific, the Middle East, Africa, and South America, after considering political, economic, social, and technical issues effecting the FinTech Blockchain Market in various sectors.

Request Customization For Report : https://www.maximizemarketresearch.com/request-customization/13770

COVID-19 Impact Analysis on FinTech Blockchain Market :

Customer behaviour has changed as a result of the COVID-19 virus across all areas of society. Businesses, on the other hand, will need to revise their strategy to account for changing market supply. This report provides an overview of the COVID-19’s influence on the FinTech Blockchain Market and will assist you in developing your business in accordance with the new industry norms.

Under the COVID-19 Impact section, the FinTech Blockchain Market Report delivers a 360-degree research ranging from the agile supply chain and trade restrictions to regional government policies and the firm’s future impact. Primary market research (2021-2029), instances of venture rivalry, the benefits and drawbacks of large corporate channels, and industry growth trends (2021-2029) have all been provided.

Key Questions Answered in the FinTech Blockchain Market Report are :

- How big is the market for FinTech Blockchain Market ?

- Which regional market will emerge as the market leader in the next years?

- Which application category is expected to develop the fastest?

- What opportunities for growth could exist in the FinTech Blockchain Market industry in the next years?

![Minerai de silex ardent - Guide Natlan [Genshin]](https://insta.tel/upload/photos/2024/09/ElApJSVo1GVyaP7pbWbP_19_0039c0297708d5a051ab5502a4483014_image.png)