The global Banking as a Service market has experienced substantial growth, driven by the increasing demand for digital banking services and the rising adoption of open banking initiatives. According to Market Research Future (MRFR), the BaaS market is projected to reach a value of $65.95 billion by 2030, growing at a CAGR of 15.1% during the forecast period.

Key Players:

The BaaS market is highly competitive, with several key players leading the way in providing banking infrastructure and technology solutions. Some of the prominent players in the market include:

- Solarisbank AG

- Railsbank Technology Ltd.

- Banking Circle

- Saxo Bank A/S

- Modulr Finance Limited

- SatchelPay UAB

- Treezor

- Marqeta, Inc.

- Mambu GmbH

- DriveWealth, LLC

Get a Sample PDF of the Report at:

https://www.marketresearchfuture.com/sample_request/10717

Market Segment Insights:

The BaaS market can be segmented based on service type, end-user, and region.

Service Type:

- Core Banking Solution

- Payment Processing

- Compliance and Risk Management

- Customer Relationship Management

- Others

End-user:

- Fintech Companies

- Tech Giants

- Retailers

- Telecom Companies

- Others

Market Drivers:

Several factors are driving the growth of the BaaS market:

Digital Transformation in Banking: The increasing demand for digital banking services and the need for seamless customer experiences have accelerated the adoption of BaaS. By leveraging BaaS platforms, banks and non-banking entities can offer a wide range of banking services, such as account opening, payments, and lending, through user-friendly interfaces and streamlined processes.

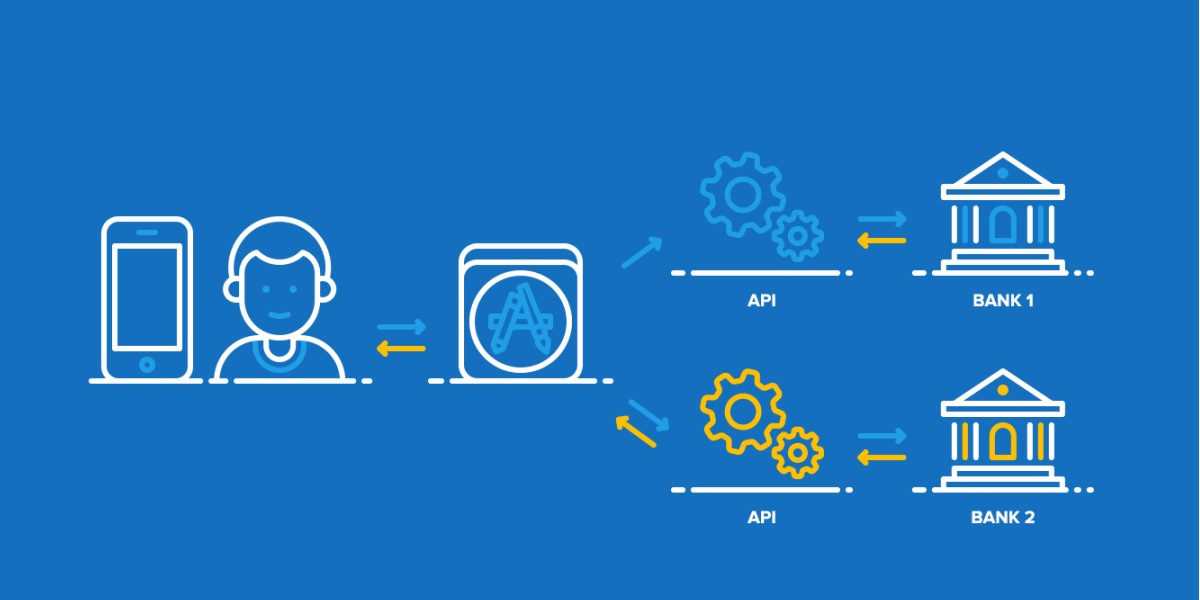

Open Banking Initiatives: Regulatory initiatives, such as the Revised Payment Services Directive (PSD2) in Europe, have paved the way for open banking, enabling third-party providers to access customer data and offer innovative financial services. BaaS plays a crucial role in facilitating open banking by providing the necessary infrastructure and technology solutions to securely share data and enable collaboration between banks and fintech companies.

Cost Efficiency and Scalability: BaaS offers cost-efficient solutions for non-banking entities to enter the financial market without the need for extensive infrastructure and regulatory compliance. By leveraging existing banking systems and APIs, BaaS providers can scale their operations rapidly, reduce time-to-market, and focus on delivering value-added services to their customers.

Regional Insights:

North America currently dominates the global US BaaS market, owing to the presence of major fintech companies and the early adoption of open banking initiatives. Europe and Asia Pacific are also witnessing significant growth, driven by regulatory reforms and the increasing demand for digital banking services in these regions.

Homomorphic Encryption Market Research Report - Global Forecast till 2030

Threat Intelligence Market Research Report - Global Forecast 2030