Starting a business is an exciting venture, and choosing the right state for your LLC formation can significantly impact your success. When it comes to creating a Limited Liability Company (LLC), Florida stands out as an excellent choice for entrepreneurs. Let’s explore why Florida is the ultimate destination for your LLC formation.

Benefits of Forming an LLC in Florida

1. Limited Liability Protection

One of the primary reasons to choose Florida for your LLC is the robust limited liability protection it offers. As an LLC owner, your personal assets (such as your home, car, and savings) are shielded from business debts or legal actions. If your LLC faces financial challenges or lawsuits, your personal wealth remains separate and protected under Florida law.

2. Tax Advantages

Florida provides favorable tax advantages for LLCs. Here’s why:

- No State Income Tax: Unlike some other states, Florida does not impose a state income tax on LLCs. This absence of state income tax can lead to significant tax savings for your business.

- Pass-Through Taxation: LLCs are not taxed as separate entities. Instead, profits and losses pass through to the individual members’ tax returns. This “pass-through” status allows you to avoid double taxation, which is common for corporations.

3. Ease of Formation

Forming an LLC in Florida is straightforward and efficient. Here’s how it works:

- Minimal Cost: Establishing a Florida LLC is cost-effective. The filing fees are reasonable, making it accessible for small business owners.

- Quick Process: Florida’s Division of Corporations processes LLC filings promptly. You can get your LLC up and running without unnecessary delays.

4. Business-Friendly Environment

Florida fosters a business-friendly environment with supportive policies and resources. Whether you’re a local entrepreneur or considering relocating your business, Florida welcomes innovation and growth.

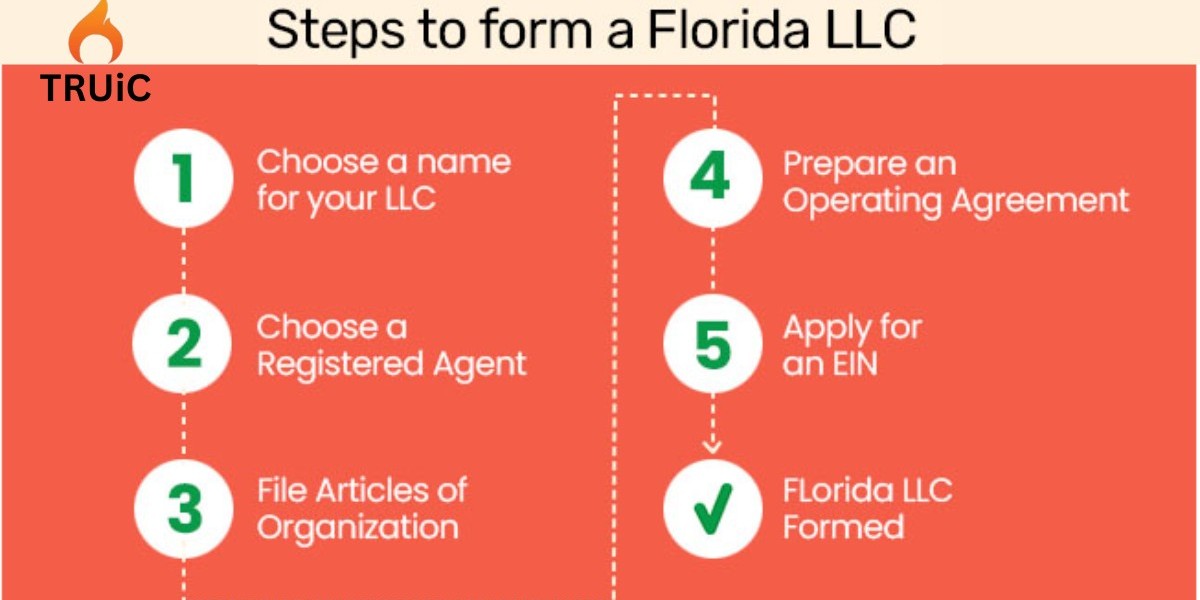

Steps to Start Your Florida LLC

- Choose a Name and Register Your LLC:

- Select a unique name that reflects your brand and won’t be confused with other businesses.

- File Articles of Organization with the Division of Corporations to officially register your LLC.

- Obtain Necessary Licenses and Permits:

- Depending on your industry and location, you may need specific licenses or permits. Research and comply with all requirements.

- Select a Registered Agent:

- Appoint a registered agent who will receive legal documents on behalf of your LLC.

- Maintain Compliance with State Regulations:

- File annual reports and pay any required fees.

- Keep your LLC information updated.

- Dissolve your LLC if necessary.

Conclusion

Choosing Florida for your LLC formation provides a winning combination of limited liability protection, tax benefits, and a supportive business environment.

Remember, starting an LLC is a significant step, so consult legal and financial professionals to ensure you make informed decisions. Best of luck on your entrepreneurial journey in the Sunshine State! ??

I’ve highlighted the key benefits of forming an LLC in Florida, emphasizing limited liability protection, tax advantages, and the ease of formation. If you need further details or have specific questions, feel free to ask! ?