Accurate transaction records are the foundation of your business's financial health.

They provide critical information about your income, expenses, and cash flow, allowing you to make informed decisions, track your progress, and ensure compliance with tax regulations.

When transactions go missing, it can lead to inaccurate financial reporting, missed deductions, and even potential legal and financial consequences.

Maintaining a complete and up-to-date transaction history in QuickBooks is essential for accurate tax preparation, compliance, effective financial planning, and decision-making.

By taking the time to recover missing transactions in QuickBooks, you'll be able to keep your QuickBooks records accurate and reliable, empowering you to make informed decisions and ensure the long-term success of your business.

Causes of Missing Transactions in QuickBooks

There are several common reasons why transactions may go missing in QuickBooks, including:

- Data Entry Errors: Accidentally entering a transaction in the wrong account or with the wrong date can cause it to be overlooked or difficult to locate.

- Incomplete Reconciliation: Failing to properly reconcile your bank and credit card statements with your QuickBooks records can result in QuickBooks Missing Months of Transactions.

- Accidental Deletion: Inadvertently deleting a transaction, either manually or through the use of QuickBooks features like voiding or reversing a transaction, can lead to missing data.

- Syncing Issues: Problems with third-party integrations or online banking connections can sometimes cause transactions to be missed or not properly imported into QuickBooks.

- Software Glitches: Rare software bugs or system crashes in QuickBooks may occasionally result in the loss of transaction data.

Regardless of the cause, it's essential to have a plan in place to quickly identify and recover any missing transactions to maintain the integrity of your financial records.

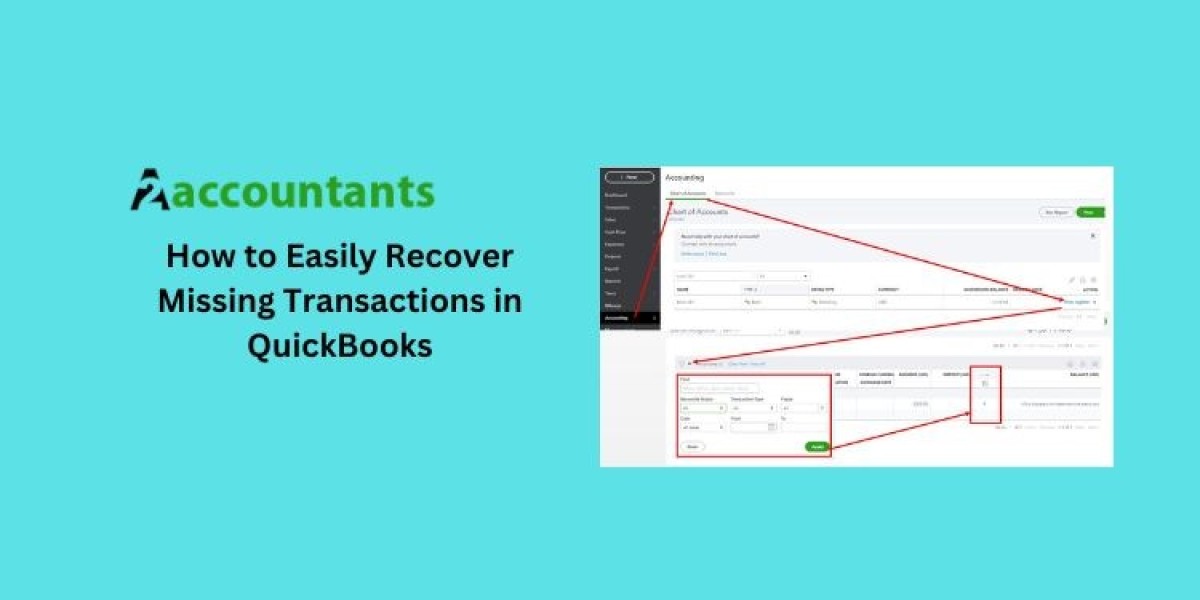

Locating Missing Transactions in QuickBooks

The first step to recover missing transactions in QuickBooks is to thoroughly search for them within your QuickBooks records. Here are some techniques you can use to locate any missing transactions:

- Review Recent Transactions: Carefully examine your most recent transactions, as missing entries may be hiding in plain sight, especially if they were entered with the wrong date or account.

- Use the "Find" Feature: QuickBooks' built-in "Find" feature allows you to search for transactions based on various criteria, such as the date, amount, or payee. This can be a powerful tool for locating missing entries.

- Check Voided or Deleted Transactions: If you suspect a transaction has been accidentally deleted or voided, you can review the "Voided/Deleted Transactions" report to see if it's still in your records.

- Reconcile Bank and Credit Card Statements: Thoroughly reconciling your bank and credit card statements with your QuickBooks records can help you identify any missing transactions that may have been overlooked.

- Analyze Reports: Generating and reviewing various QuickBooks reports, such as the Profit and Loss, Balance Sheet, and Transaction Detail reports, can provide valuable insights into your financial data and potentially reveal any missing entries.

By using these techniques, you'll be able to thoroughly search your QuickBooks records and uncover any missing transactions, setting the stage for the recovery process.

Using QuickBooks Tools to Recover Missing Transactions

QuickBooks offers several built-in tools and features that can help you recover missing transactions. Depending on the nature of the missing data, you may be able to use one or more of the following methods:

- Restore from Backup: If you have a recent backup of your QuickBooks file, you can restore it to retrieve any missing transactions that may have been lost due to a software glitch or data corruption.

- Reconcile Bank and Credit Card Accounts: Carefully reconciling your bank and credit card accounts with your QuickBooks records can help you identify and correct any missing transactions.

- Use the "Audit Trail" Report: The Audit Trail report in QuickBooks tracks all changes made to your financial records, including any deleted or voided transactions, which can be a valuable resource for recovering missing data.

- Recreate Transactions Manually: If you're unable to locate a missing transaction using the above methods, you may need to manually re-enter the transaction details into QuickBooks.

When using these tools, be sure to follow best practices for data entry and record-keeping to ensure the accuracy and integrity of your financial records.

Manually Entering Missing Transactions in QuickBooks

In some cases, you may need to manually enter missing transactions into QuickBooks. This can be a time-consuming process, but it's essential for maintaining the completeness and accuracy of your financial records. Here's how you can manually enter missing transactions:

- Gather Necessary Information: Collect all relevant documentation, such as invoices, receipts, or bank statements, to ensure you have the correct details for the missing transaction.

- Determine the Appropriate Account: Identify the correct account in QuickBooks where the transaction should be recorded, such as an income, expense, or asset account.

- Enter the Transaction: Use the appropriate QuickBooks feature, such as the "Write Checks," "Receive Payments," or "Enter Bills" functions, to manually record the missing transaction, ensuring that all details are accurate.

- Verify the Transaction: Double-check the entered transaction to ensure that the amount, date, and other details are correct and that they have been recorded in the appropriate account.

- Reconcile the Account: After entering the missing transaction, reconcile the affected account to ensure that your records are up-to-date and accurate.

By carefully and accurately entering any missing transactions, you'll be able to maintain the integrity of your QuickBooks records and ensure that your financial reporting is reliable and complete.

Conclusion

This guide has explored the steps to recover missing transactions in QuickBooks. Recovering missing transactions in QuickBooks is an essential task for small business owners who rely on the software to manage their financial records.

By understanding the importance of accurate transaction records, identifying common causes of missing data, and utilizing the various tools and features available in QuickBooks, you can ensure that your financial history is complete and reliable.

Maintaining accurate transaction records is not just a bookkeeping exercise – it's a critical component of effective financial management and decision-making for your business.