Latest report features new 2024 economic impact data, including critical insights concerning the industry’s recovery from the pandemic, the value of Usage-Based Insurance Industry and the leadership and advancements in the areas of responsible tourism and maritime practices.

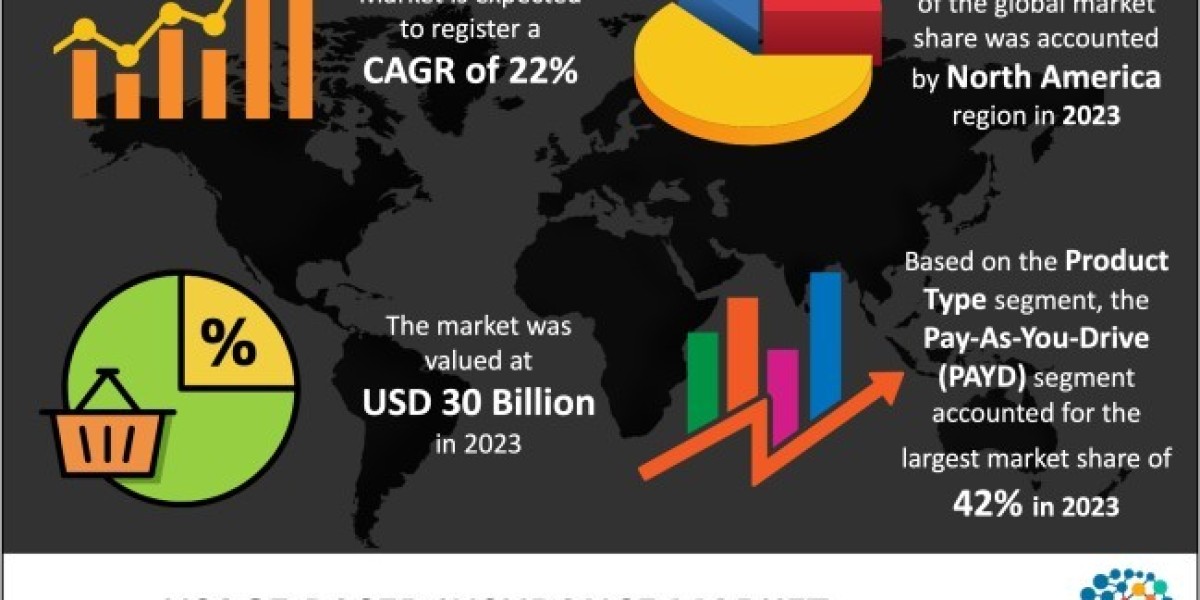

The Global Usage-Based Insurance Market is expected to rise with an impressive CAGR % and generate the highest revenue by 2033

Get Access to PDF Sample of Usage-Based Insurance Market Status and Trend Analysis 2024-2033@ https://www.thebrainyinsights.com/enquiry/sample-request/14105

The global Usage-Based Insurance market exhibits comprehensive information that is a valuable source of insightful data for business strategists during the decade 2024-2033. Based on historical data, Usage-Based Insurance market report provides key segments and their sub-segments, revenue, and demand & supply data. Considering technological breakthroughs of the market Usage-Based Insurance industry is likely to appear as a commendable platform for emerging Usage-Based Insurance market investors.

The most significant players coated in global Usage-Based Insurance market report: Allianz SE, Allstate Corporation, Aviva Life Insurance, AXA, Insurethebox, Liberty Mutual Insurance Company, Mapfre S.A, Nationwide Mutual Insurance Company, Progressive Casualty Insurance Company, UNIPOLSAI ASSICURAZIONI S.P.A

The product spectrum of the market, constituting:

by Product Type:

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

- Manage-How-You-Drive (MHYD)

- Others

by Technology:

- On-Board Diagnostics

- Smartphone

- Hybrid

- Black Box

- Others

by Vehicle Type:

- Passenger

- Commercial

The application landscape of the market, comprising:

The report provides a comprehensive view on the Usage-Based Insurance market. To understand the competitive landscape in the market, an analysis of Porter’s Five Forces model for the Usage-Based Insurance market has also been included. The study encompasses a market attractiveness analysis, wherein application segments are benchmarked based on their market size, growth rate and general attractiveness.

Read full Research Study at @ https://www.thebrainyinsights.com/report/usage-based-insurance-market-14105

The Usage-Based Insurance market analysis is an in-depth examination of many critical elements that contribute to the development of the market. The research is based on trustworthy qualitative records, mainly about socio-economic aspects, to comprehend how the market transforms. The keyword market segments are segmented and analysed to help identify growth areas. It helps to better understand the market breakdown as per segments by Type and by region specified as

- North America

- Europe

- Asia Pacific

- Europe

- Middle East, & Africa

The study also features key strategies, including product/business portfolio, market share, financial status, regional share, segment revenue, SWOT analysis, mergers and acquisitions, key product development, joint ventures and industry partnership expansion. The study will also provide a list of players emerging in the Usage-Based Insurance market. With the tables and figures, the report provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Global Usage-Based Insurance market report estimates the revenue, industry size, types, applications, players share, production volume, and consumption to get an understanding of the demand and supply chain of the market. The report encompasses technical data, raw materials, volumes, and manufacturing analysis of the global Usage-Based Insurance market. The research study delivers future projections for prominent opportunities based on the analysis of the subdivision of the market. The study meticulously unveils the market and contains substantial details about the projections with respect to industry, remuneration forecast, sales graph, and growth prospects over the forecast timeline.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Usage-Based Insurance market analysis from 2024 to 2033 to identify the prevailing Usage-Based Insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Usage-Based Insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Usage-Based Insurance market trends, key players, market segments, application areas, and market growth strategies.

Enquire for customization in Report @ https://www.thebrainyinsights.com/enquiry/request-customization/14105

Detailed TOC of Global Usage-Based Insurance Market Research Report, 2024-2033

1 Market Overview

1.1 Product Overview and Scope of Usage-Based Insurance

1.2 Classification of Usage-Based Insurance by Type

1.2.1 Overview: Global Usage-Based Insurance Market Size by Type: 2018 Versus 2024 Versus 2033

1.2.2 Global Usage-Based Insurance Revenue Market Share by Type in 2024

1.3 Global Usage-Based Insurance Market by Application

1.3.1 Overview: Global Usage-Based Insurance Market Size by Application: 2018 Versus 2024 Versus 2033

1.4 Global Usage-Based Insurance Market Size and Forecast

1.5 Global Usage-Based Insurance Market Size and Forecast by Region

1.6 Market Drivers, Restraints and Trends

1.6.1 Usage-Based Insurance Market Drivers

1.6.2 Usage-Based Insurance Market Restraints

1.6.3 Usage-Based Insurance Trends Analysis

2 Company Profiles

2.1 Company

2.1.1 Company Details

2.1.2 Company Major Business

2.1.3 Company Usage-Based Insurance Product and Solutions

2.1.4 Company Usage-Based Insurance Revenue, Gross Margin and Market Share (2021, 2022, 2023 and 2024)

2.1.5 Company Recent Developments and Future Plans

3 Market Competition, by Players

3.1 Global Usage-Based Insurance Revenue and Share by Players (2021, 2022, 2023 and 2024)

3.2 Market Concentration Rate

3.2.1 Top3 Usage-Based Insurance Players Market Share in 2024

3.2.2 Top 10 Usage-Based Insurance Players Market Share in 2024

3.2.3 Market Competition Trend

3.3 Usage-Based Insurance Players Head Office, Products and Services Provided

3.4 Usage-Based Insurance Mergers and Acquisitions

3.5 Usage-Based Insurance New Entrants and Expansion Plans

4 Market Size Segment by Type

4.1 Global Usage-Based Insurance Revenue and Market Share by Type (2018-2024)

4.2 Global Usage-Based Insurance Market Forecast by Type (2024-2033)

5 Market Size Segment by Application

5.1 Global Usage-Based Insurance Revenue Market Share by Application (2018-2024)

5.2 Global Usage-Based Insurance Market Forecast by Application (2024-2033)

6 Regions by Country, by Type, and by Application

6.1 Usage-Based Insurance Revenue by Type (2018-2033)

6.2 Usage-Based Insurance Revenue by Application (2018-2033)

6.3 Usage-Based Insurance Market Size by Country

6.3.1 Usage-Based Insurance Revenue by Country (2018-2033)

6.3.2 United States Usage-Based Insurance Market Size and Forecast (2018-2033)

6.3.3 Canada Usage-Based Insurance Market Size and Forecast (2018-2033)

6.3.4 Mexico Usage-Based Insurance Market Size and Forecast (2018-2033)

7 Research Findings and Conclusion

8 Appendix

8.1 Methodology

8.2 Research Process and Data Source

8.3 Disclaimer

9 Research Methodology

10 Conclusion

Continued….

Media Contact

Avinash D

Organization: The Brainy Insights

Phone: +1-315-215-1633

Email: sales@thebrainyinsights.com

Web: www.thebrainyinsights.com