As a QuickBooks user, you may have encountered the frustrating issue of failed recurring transactions. Recurring transactions in QuickBooks are a powerful feature that allows you to automatically generate and record repeating financial transactions, such as invoices, bills, and payments.

This functionality can significantly reduce the time and effort required to manage your accounting tasks, enabling you to focus on other critical aspects of your business. However, when these transactions fail, it can disrupt your accounting processes and lead to further complications.

In this comprehensive guide, we'll explore the common reasons for recurring transactions in QuickBooks failure and provide a step-by-step approach to resolving these issues.

Common Reasons for Recurring Transactions to Fail in QuickBooks

Despite the advantages of recurring transactions, they can sometimes fail to process successfully. Understanding the common reasons for these failures is the first step in resolving the issue. Some of the most frequent causes of failed recurring transactions in QuickBooks include:

- Insufficient Funds: If the bank account or credit card associated with the recurring transaction does not have enough funds to cover the payment, the transaction will fail.

- Expired or Invalid Payment Information: When the credit card or bank account information used for the recurring transaction becomes outdated or invalid, the transaction will be unable to process.

- Incorrect Scheduling: Errors in the frequency or timing of the recurring transaction can lead to failed attempts.

- Deactivated or Deleted Customers/Vendors: If the customer or vendor associated with the recurring transaction has been deactivated or deleted in QuickBooks, the transaction will not be able to process.

- QuickBooks Data File Corruption: In some cases, issues with the QuickBooks data file itself, such as corruption or damage, can cause recurring transactions to fail.

Step-by-Step Guide to Fixing Failed Recurring Transactions in QuickBooks

Now that you understand the common reasons for recurring transaction failures let's dive into the step-by-step process to resolve these issues and get your recurring transactions back on track.

1. Identify the Cause of the Failed Transaction

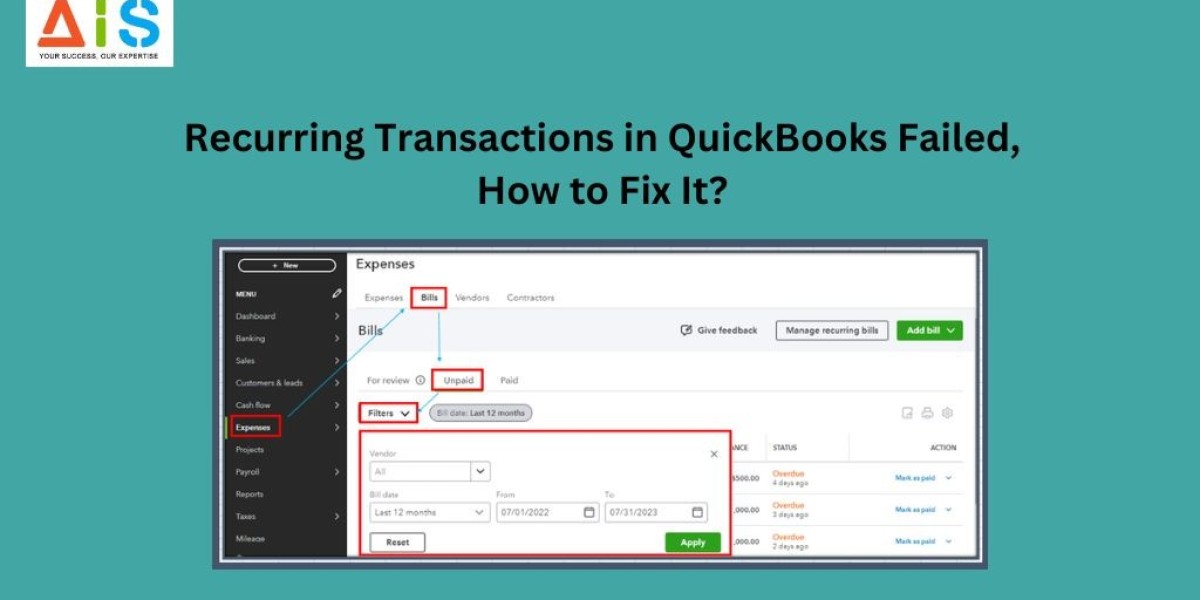

The first step in troubleshooting failed recurring transactions is to identify the root cause. Start by reviewing the transaction history in QuickBooks and looking for any error messages or notifications associated with the failed transaction. This information can provide valuable clues about the underlying issue.

Additionally, you can check the bank or credit card statements associated with the recurring transaction to see if there were any declined payments or insufficient funds. This can help you determine if the problem is related to the payment method.

2. Update Payment Information (if necessary)

If the failed recurring transaction is due to expired or invalid payment information, you'll need to update the associated bank account or credit card details in QuickBooks. To do this:

- Go to the "Customers" or "Vendors" menu in QuickBooks and locate the record for the affected customer or vendor.

- Click on the "Payment" tab and update the payment method information with the correct, up-to-date details.

- Save the changes and try running the recurring transaction again.

3. Verify Scheduling and Frequency

Ensure that the scheduling and frequency of the recurring transaction are set up correctly in QuickBooks. Double-check the following:

- The transaction is scheduled to occur at the appropriate interval (e.g., weekly, monthly, quarterly).

- The "Next Due Date" and "Last Run Date" are accurate and in line with the scheduled frequency.

- The transaction is not set to occur on a date that does not exist in a particular month (e.g., the 30th of February).

4. Reactivate or Restore Deleted Customers/Vendors

If the failed recurring transaction is associated with a customer or vendor that has been deactivated or deleted in QuickBooks, you'll need to reactivate or restore the record. Here's how:

- Go to the "Customers" or "Vendors" menu and search for the affected record.

- If the record is deactivated, click the "Make Active" button to reactivate it.

- If the record has been deleted, you may need to restore it from a backup or contact QuickBooks support for further assistance.

5. Repair or Rebuild the QuickBooks Data File

In some cases, issues with the QuickBooks data file itself can cause recurring transactions to fail. If you've tried the previous steps and are still experiencing problems, you may need to repair or rebuild the data file. Here's how:

- Back up your QuickBooks data file to a secure location.

- Open QuickBooks and go to the "File" menu, then select "Utilities" and "Verify Data."

- If the verification process identifies any issues, proceed to the "Rebuild Data" option.

- Follow the on-screen instructions to complete the rebuild process.

Conclusion

Recurring transactions in QuickBooks fail for various reasons. By understanding the common causes of these failures and following the step-by-step troubleshooting guide outlined in this article, you can quickly identify and resolve the issue, ensuring the smooth operation of your recurring transactions.