Cosmetics are products designed to enhance or transform one's appearance, with an emphasis on skin, hair, and overall aesthetic appeal. They offer a wide range of items, including makeup, skincare, hair care, and smell. Cosmetics are widely used for personal grooming, self-expression, and confidence development. They are available in a variety of forms, including creams, powders, lotions, and sprays, to satisfy a wide range of beauty needs.

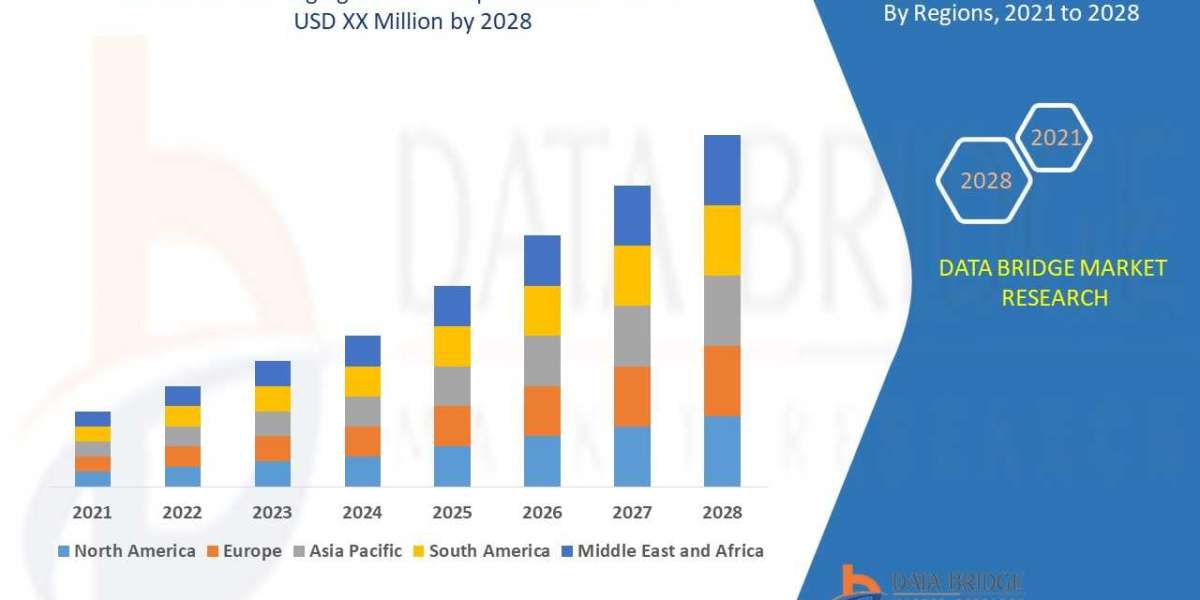

According to SPER Market Research, ‘India Cosmetic Products Market Size- By Product Type, By Distribution Channel - Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ States that the India Cosmetic Products Market is estimated to reach USD XX billion by 2033 with a CAGR of 11.16%.

Drivers:

Increasing disposable income in the newly formed middle class - As their income increases, middle-class consumers spend more on cosmetics and personal care. This growth in spending power is driving increased demand for cosmetics, including skincare, makeup, and hair care items. When consumers want to look better and feel better overall, the beauty industry expands as well, giving India a more lucrative market for cosmetic companies. The rising affluence of the middle class contributes significantly to the expansion of the country's cosmetics industry overall as well as to consumer spending on personal hygiene goods.

For further details and in-depth insights, download our no-cost free sample of the report - https://www.sperresearch.com/report-store/india-cosmetic-products-market.aspx?sample=1

Restraints:

Development of cosmetic products is impacted by regulatory developments - Regulation changes in the Indian cosmetics industry could hinder product development by raising the risks of noncompliance and complexity. It takes a lot of time and resources to adjust to new regulations, such as those pertaining to ingredient restrictions and labelling requirements. Because cosmetic companies have to navigate the difficulties of compliance, this can slow down the rate of product innovation by delaying the release of new products. Formulation adjustments are restricted by the need for meticulous testing and compliance with several regulatory standards, which hinders the general growth and vitality of the Indian cosmetics industry and reduces the flexibility of cosmetic manufacturers.

The Indian cosmetics market has been significantly impacted by the COVID-19 outbreak.

The industry saw several challenges as well as shifts in customer behaviour: The outbreak's lockdowns and restrictions had an effect on the supply chain for cosmetics. Temporary shutdown of manufacturing plants, distribution networks, and retail stores led to delays and shortages in the supply chain.

Modifications to Consumer Behaviour: The epidemic altered consumer choices and conduct. The need for personal hygiene goods such as soaps, hand washes, and sanitisers increased as hygiene became more important. Skincare products with health-promoting and immune-boosting properties gained popularity.

The Indian market for cosmetic products is dominated by Western India. The presence of important retail and distribution networks, a sizable urban population, and greater disposable incomes make this region—Maharashtra, which includes Mumbai—a major hub for the cosmetics sector. Major players in the market are The Estee Lauder Companies, L'Oreal SA, Unilever PLC, Revlon Inc, Vellvette Lifestyle Private Limited (Sugar Cosmetics), and others.

Key Target Audience:

- Cosmetic Manufacturers

- Retailers and Distributors

- Beauty and Personal Care Brands

- E-commerce Platforms

- Advertising and Marketing Agencies

- Investment Firms and Venture Capitalists

- Product Development Teams

- Consumer Insights Teams

- Brand Managers

- Regulatory Bodies and Government Agencies

India Cosmetic Products Market Segments:

By Product Type:

- Color Cosmetics

- Hair Styling and Coloring Products

By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies/Drug Stores

- Online Retail Stores

- Other Distribution Channels

For More Information, refer to below link –

Related Report –

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant – U.S.A.

SPER Market Research

+1-347-460-2899