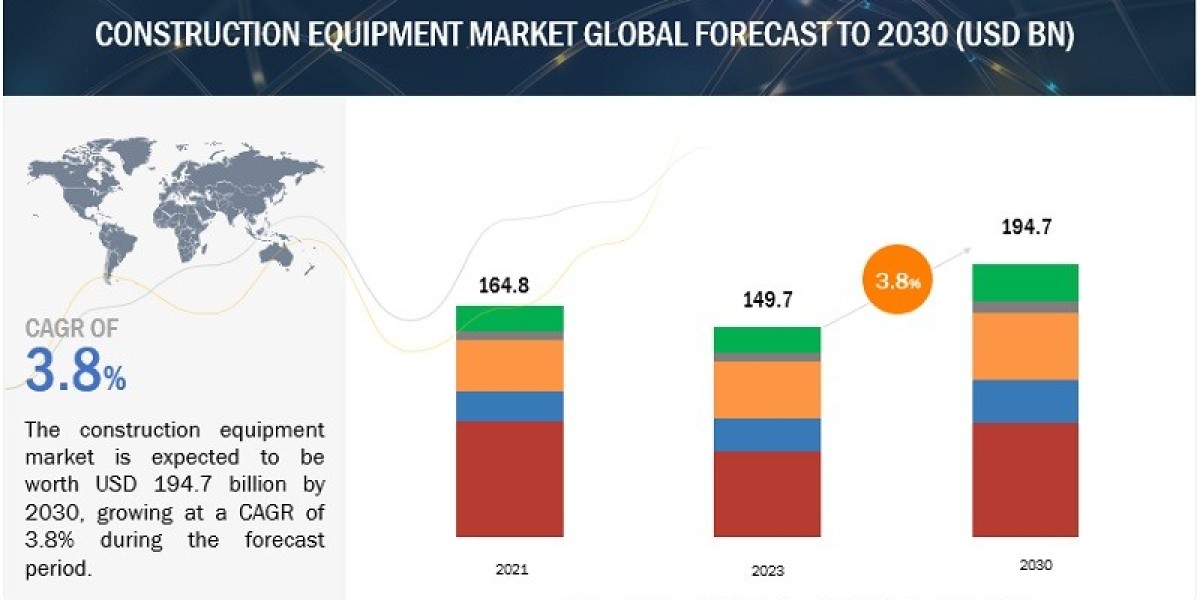

The construction equipment industry is projected to grow from USD 149.7 billion in 2023 to USD 194.7 billion by 2030, at a CAGR of 3.8%. The construction equipment rental business is picking up steam and seems to be having a positive impact on the global construction equipment industry which will offer promising growth opportunities for the futuristic growth of the market.

Based on Region, it is predicted that Asia Pacific will maintain its dominance in the worldwide market for construction equipment throughout the forecast period. The construction equipment industry in China, which is anticipated to be the biggest market in Asia, is mostly to blame for the domination. The demand for construction equipment such as Crawler Excavators, Road Rollers, and others will drive the Asian construction equipment industry in the years to come due to the expanding infrastructure development activities such as the construction of railway lines, roads, new commercial complexes, and others. With the aid of significant investments and product innovation, China is advancing towards sustainable growth in the construction equipment industry, which increases its competitiveness. To create new products and break into mid- to high-end markets, domestic construction equipment manufacturers spend money on research and development. The presence of major construction equipment producers in the nation, including SANY Group, Xuzhou Construction Machinery Group, Liugong Construction Machinery Co., Ltd., and others, is what drives the market's expansion.

According to the China Electronic Information Industry Development (CCID), the government investment associated with new infrastructure projects is expected to reach USD 1.43 trillion to USD 2.51 trillion by 2025. The government started the construction of the Shanghai Metro Line (Phase 1) project of 28 km in Q1 of 2022 between Chuansha Road Station to Dongjing Road Station in Shanghai. This project involved a heavy investment of nearly USD 5,715 million and is expected to be complete by the end of 2024. Such heavy investments in infrastructure development projects will create huge opportunities for selling construction equipment like crawler excavators, wheeled loaders >80 HP, pick and carry cranes, and others in the country.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=179948937

By equipment category, the earth-moving equipment segment is estimated to account for the largest market share in 2023 followed by the material-handling equipment segment which is estimated to be the second-largest segment throughout the forecast period. Earth-moving equipment including excavators (crawler and wheeled), loaders (backhoe, skid-steer), and motor graders are considered in excavators are key components and its continuously rising demand to account for the significant share in the overall earth-moving equipment market which in turn will shape the overall market. Companies including Deere & Company, Caterpillar AG, and CNH Industrial are focusing on expanding and upgrading their models of earthmoving equipment that function as jack-of-all-trades at construction sites. Building and infrastructure projects are driving historic demand for excavators. Currently, small models of excavators increasingly are replacing backhoes and front-end loaders that traditionally have been used to dig holes or move piles of dirt.

The electric construction equipment industry is growing at a significant rate. This increasing demand for electric construction equipment is propelled by environmental concerns, cost efficiency, and technological advancements. Electric equipment produces lower emissions, complying with stricter regulations and reducing pollution. Lower operating costs and improved energy efficiency make electric options attractive, with battery technology enhancements further enhancing viability. Also, renewable energy integration expands and the construction industry emphasizes long-term sustainability, electric construction equipment gains prominence for its ability to align operational needs with environmental responsibility, which would consequently push the demand for construction equipment in this segment.

Based on the propulsion type, diesel-powered construction equipment leads the market during the forecast period. This is due to the diesel-fueled construction equipment is extensively utilized due to its ability to offer higher torque and enhance equipment mobility. The necessity for heavy equipment with greater torque is fulfilled by diesel engines, which also feature higher compression ratios. While the CNG/RNG/LNG-powered construction equipment is expected to grow with the highest growth rate owing to the upcoming emission regulations. This trend of electrification in construction equipment is expected to grow at a higher rate during the forecast period. All these factors would keep the demand for diesel-fuelled as well as CNG-powered equipment in the coming years.

The global construction equipment industry is moderately fragmented. However, few global players have a sizable share in the market, namely Caterpillar, Komatsu Ltd., Deere & Company, Hitachi Construction Machinery Co., Ltd., and AB Volvo. These Leading companies have largely benefitted from their well-established supply chain and strong geographical presence. Players adopted strategies such as new product launches, advanced technology integration, collaborations, partnerships, and agreements to strengthen their position in the construction equipment industry. Among these new product launches accounted for a significant share of all the growth strategies adopted by companies in the Construction equipment industry.

Key Market Players

The construction equipment industry is dominated by players such as Caterpillar (US), Komatsu Ltd. (Japan), Hitachi Construction Machinery Co., Ltd. (Japan), Xuzhou Construction Machinery Group (China), and Deere & Company (US). These companies have strong distribution networks at the global level.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=179948937