Starting a business in the UK can be both exciting and daunting, but one of the most effective ways to give your business a professional edge is by setting up a limited company. This guide will help you navigate the process of forming a limited company in the UK, outlining everything from the benefits to the costs, required documents, and tax advantages. Whether you're a freelancer or a small business owner, understanding these steps will put you on the path to success.

1. The Advantages of Setting Up a Limited Company in the UK

Deciding to set up a limited company in the UK comes with several key benefits that make it an attractive option for many entrepreneurs. Let’s dive into some of the most compelling reasons to consider this business structure.

1.1. Limited Liability Protection

One of the main reasons business owners choose to set up a limited company is for the protection it offers. Limited liability means that your personal finances are kept separate from your business finances. In simple terms, if your business runs into financial trouble, your personal assets (like your house or car) are not at risk. This is a huge benefit compared to operating as a sole trader, where personal assets could be used to pay off business debts.

1.2. Enhanced Professional Image

In the business world, perception matters. Operating as a limited company can make your business appear more established and credible. Clients and customers are often more willing to engage with companies rather than individuals, especially when it comes to larger contracts or deals. The term "Limited" or "Ltd" after your company name gives your business a professional edge that can be particularly beneficial in competitive industries.

1.3. Tax Efficiency

Tax efficiency is another significant benefits of setting up a limited company in the UK. Unlike sole traders, who pay income tax on their earnings, limited companies are subject to corporation tax, which is currently set at a lower rate of 19% as of 2024. Additionally, company owners can pay themselves through dividends, which are taxed at a lower rate than salaries. This dual approach to income can result in significant tax savings.

1.4. Easier Access to Funding

Raising funds can be easier when operating as a limited company. Investors and banks often prefer to work with limited companies because of the clear legal structure and limited liability. This can make it easier to secure loans, attract investment, or even bring on partners to help grow the business.

2. How to Register a Limited Company Online in the UK

Now that you understand the benefits, let’s explore the process of registering your limited company. Fortunately, the UK government has made this process straightforward, and you can complete most of it online.

2.1. Choosing a Company Name

Your company name is crucial, as it represents your brand and how customers will identify you. The name must be unique and cannot be identical or too similar to an existing company name. The Companies House website has a tool that allows you to check if your desired company name is available. It's also important to ensure that the name complies with the UK’s company naming rules, which include restrictions on certain words and phrases.

2.2. Appointing Directors and Shareholders

A limited company must have at least one director and one shareholder, though these can be the same person. The director is legally responsible for running the company and ensuring that it meets its statutory obligations. You’ll need to provide details of your directors and shareholders, including their names, addresses, and shares held.

2.3. Preparing Required Documents

When setting up your company, you will need to prepare and submit several important documents:

- Memorandum of Association: This is a legal document that all initial shareholders sign to agree to form the company.

- Articles of Association: These are written rules about how the company is to be run, agreed upon by the shareholders or guarantors.

These documents are critical as they set out the structure and rules of your company.

2.4. Registering with Companies House

Once you have your name, directors, shareholders, and documents ready, you can register your company online through the Companies House website. The process is relatively quick and can be completed in a few hours. The registration fee for online applications is £12, but if you prefer to submit your application by post, the fee is £40.

3. The Costs of Setting Up a Limited Company in the UK in 2024

The cost of setting up a limited company is often lower than many expect, making it an accessible option for new businesses. Here’s a breakdown of the costs you can expect:

3.1. Registration Fees

The basic cost of registering your company is £12 if you do it online, or £40 if you apply by post. This is a one-time fee paid to Companies House.

3.2. Additional Costs

While the registration fee is low, there may be additional costs depending on your needs. For instance, you might want to hire an accountant to help with your company’s financial affairs, which could cost anywhere from £150 to £600 annually, depending on the complexity of your business.

You may also incur costs if you choose to use a registered office address service, which allows you to use a professional address instead of your home address for company registration. These services typically range from £50 to £150 per year.

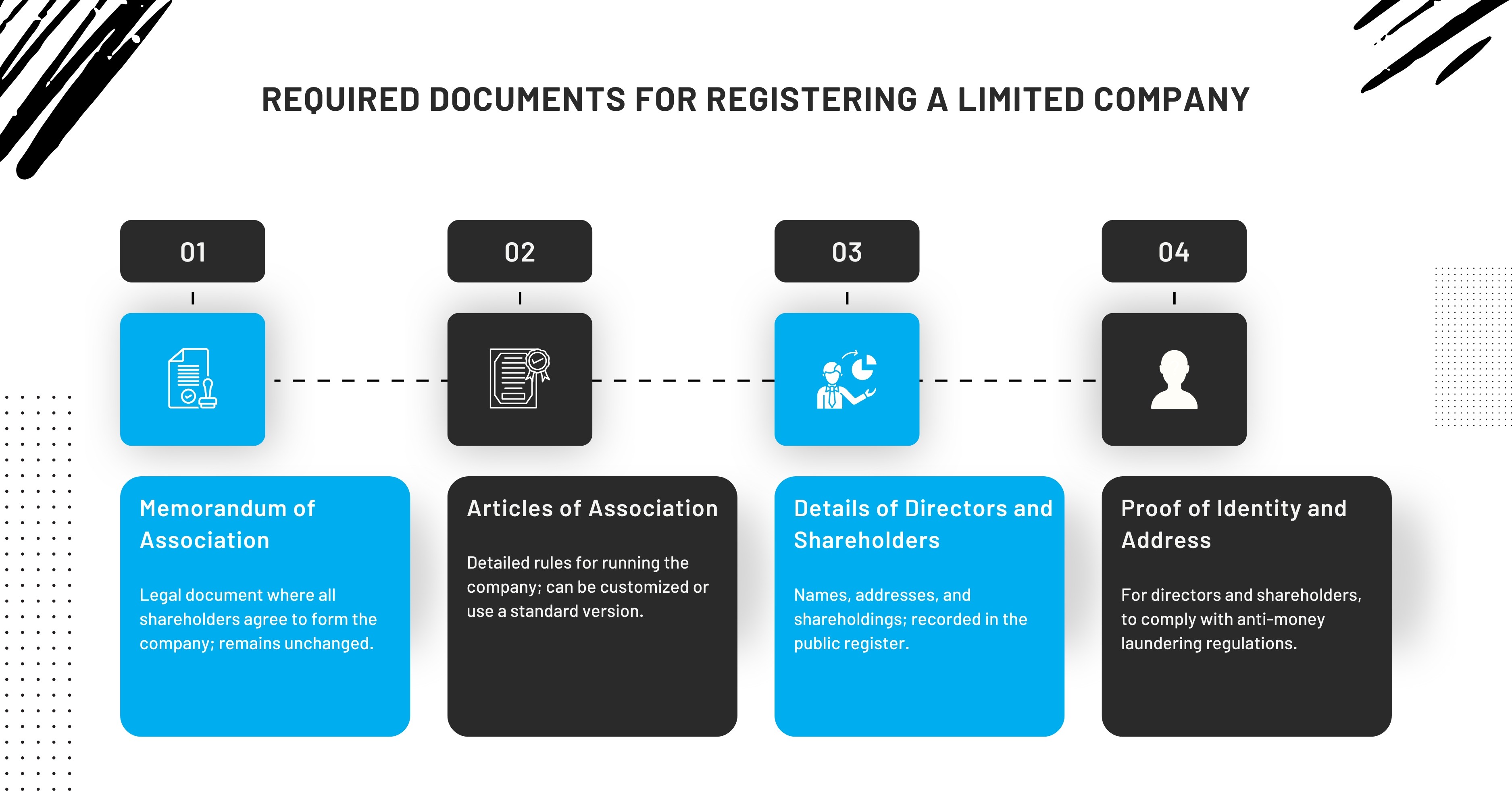

4. Documents Needed to Set Up a Limited Company in the UK

Before you can officially register your company, you’ll need to gather a few important documents. These ensure that your company is set up properly and in compliance with UK law.

4.1. Memorandum of Association

This document is a legal requirement and is essentially a statement signed by all shareholders agreeing to form the company. It’s a standard document that doesn’t change once the company is registered.

4.2. Articles of Association

The Articles of Association are more detailed and outline how your company will be run. This document can be customized to fit your company’s specific needs, but most companies use a standard version provided by Companies House.

4.3. Details of Directors and Shareholders

You’ll need to provide specific information about the directors and shareholders of the company, including their names, addresses, and the number of shares they hold. This information will be recorded in the public register maintained by Companies House.

4.4. Proof of Identity and Address

Finally, you may need to provide proof of identity and address for the directors and shareholders. This is to comply with anti-money laundering regulations and ensure that your company is set up legally.

5. Tax Benefits of a Limited Company in the UK

Tax efficiency is a major draw for setting up a limited company. Here’s how you can benefit:

5.1. Lower Corporation Tax

As mentioned earlier, limited companies in the UK pay corporation tax on their profits, which is set at 19% for 2024. This is often lower than the income tax rate paid by sole traders, especially for higher earners.

5.2. Dividend Payments

Company owners can pay themselves in dividends, which are taxed at a lower rate than salary income. For the 2024/25 tax year, the dividend allowance is £2,000, meaning you can earn up to this amount in dividends before paying any tax.

5.3. Claiming Business Expenses

Running a limited company allows you to claim various business expenses, reducing your overall tax liability. This can include office supplies, travel expenses, and even a portion of your home office costs if you work from home.

6. How to Set Up a Limited Company as a Freelancer in the UK

If you’re a freelancer, setting up a limited company can provide significant benefits, including a more professional image and potential tax savings. Here’s how to do it:

6.1. Decide if a Limited Company is Right for You

As a freelancer, you might be considering whether a limited company is the best option for you. The key advantages include limited liability, tax efficiency, and enhanced credibility. However, keep in mind that running a limited company involves more paperwork and administrative responsibilities compared to operating as a sole trader.

6.2. Register Your Company Online

Follow the steps outlined above to register your limited company online in UK. You’ll need to choose a company name, appoint yourself (and any others) as a director, and decide how many shares to issue.

6.3. Separate Your Personal and Business Finances

One of the first things you should do after setting up your limited company is to open a business bank account. This will help you keep your personal and business finances separate, making it easier to manage your accounts and prepare for tax season.

6.4. Consider Hiring an Accountant

Finally, while it’s possible to manage your company’s finances on your own, many freelancers choose to hire an accountant to handle things like corporation tax returns, VAT returns, and payroll. An accountant can also help you make the most of your tax allowances and ensure that you comply with all legal requirements.

Conclusion

Setting up a limited company in the UK is a strategic move that offers numerous benefits, from limited liability protection to tax efficiency. By following the steps outlined in this guide, you can establish your company with confidence and start enjoying the advantages that come with this business structure. Whether you’re a freelancer or a small business owner, taking the time to understand the process and prepare the necessary documents will help you avoid common pitfalls and ensure a smooth setup. If you’re unsure about any part of the process, consider seeking professional advice to help you get started on the right foot.

#UKCompanySetup

FAQs

1. What are the main benefits of setting up a limited company in the UK?

Setting up a limited company in the UK offers several advantages, including limited liability protection for personal assets, potential tax savings through corporation tax and dividend payments, enhanced credibility with clients, and easier access to funding.

2. How much does it cost to set up a limited company in the UK in 2024?

The basic cost for online registration with Companies House is £12. If you choose to register by post, the fee is £40. Additional costs may include accounting services, a registered office address, and other administrative fees, which can vary based on your specific needs.

3. What documents do I need to set up a limited company in the UK?

To set up a limited company, you will need a Memorandum of Association, Articles of Association, and details of your directors and shareholders. You may also need to provide proof of identity and address for anti-money laundering checks.

4. Can I set up a limited company if I am a freelancer?

Yes, freelancers can set up a limited company in the UK. This can offer advantages such as limited liability, tax efficiency, and a more professional image. However, it also comes with additional administrative responsibilities compared to being a sole trader.

5. What are the tax benefits of setting up a limited company in the UK?

The main tax benefits include paying corporation tax at 19%, which is generally lower than income tax rates for sole traders, and the ability to pay yourself through dividends, which are taxed at a lower rate than salary income. You can also claim business expenses to reduce your taxable profit.

6. How long does it take to register a limited company in the UK?

If you register online through Companies House, your company can be set up within a few hours, assuming all your documents and information are in order. Postal applications take longer, typically around 8 to 10 days.