Understanding the Period Copy Feature in QuickBooks

QuickBooks, a leading accounting software, provides numerous features designed to streamline financial management for businesses. Among these, the Period Copy feature stands out for its utility in creating specific time-bound segments of your financial data without affecting the entirety of your company file.

This functionality is essential for businesses looking to maintain accurate records for different periods, facilitating tasks such as audits, financial reviews, or providing data to stakeholders.

The essence of the Period Copy feature lies in its ability to replicate your company's financial data for a chosen period, creating a standalone file.

Delving deeper, the Period Copy feature is not just about creating a duplicate of your data; it's about strategic financial management. By segmenting your financial history, you provide your business with a tool for better decision-making, allowing for targeted analysis and reporting.

Benefits of Using the Period Copy Feature

The advantages of utilising the Period Copy feature in QuickBooks extend beyond mere data duplication. First and foremost, it offers unparalleled ease in financial data management, particularly for businesses required to regularly report on specific periods. It simplifies the process of providing accurate, time-bound financial information without the risk of altering the permanent company file.

By creating a Period Copy, businesses can easily comply with such requests, ensuring that the audit process proceeds smoothly without any unnecessary complications.

Moreover, this feature empowers businesses to perform targeted analyses on their financial data. Whether looking to understand the financial impact of a specific project, assessing performance over a distinct period, or planning based on historical data, the Period Copy provides a solid foundation for informed decision-making.

Steps to Create a Period Copy in QuickBooks

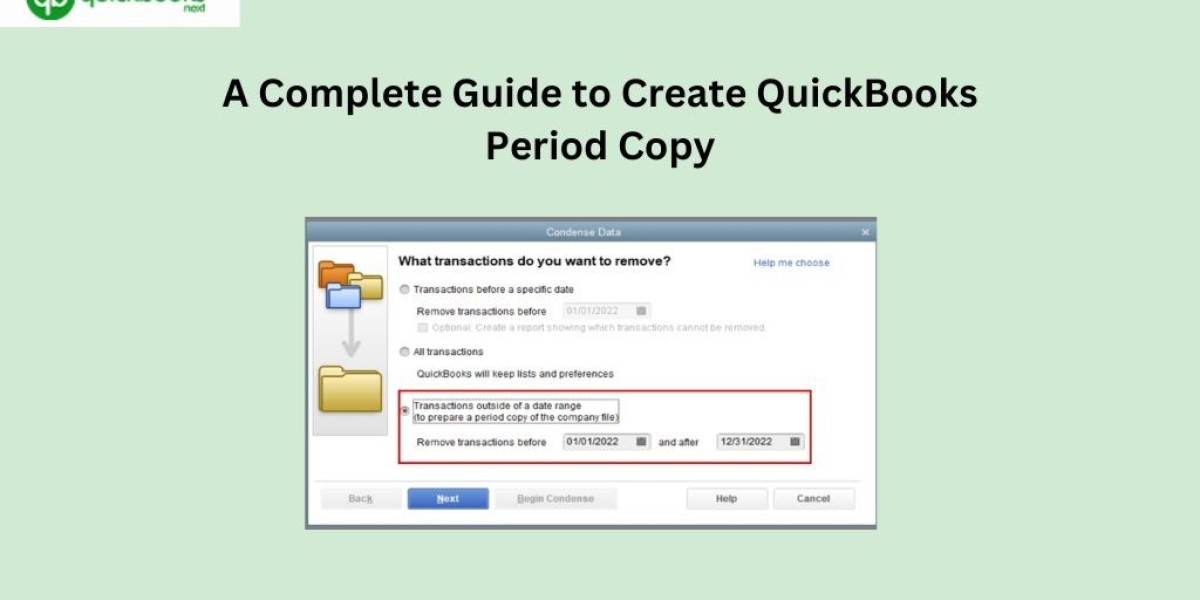

Create QuickBooks period copy is a straightforward process that can be accomplished in a few steps. Firstly, navigate to the File menu, select Utilities, then choose the Condense Data option. This will lead you to the option to create a Period Copy, where you can specify the start and end dates for the period you wish to replicate.

After the creation process is complete, you will have a new QuickBooks file (.QBW) that contains all transactions and financial data within the specified period. This file operates independently of your main company file, allowing you to make any necessary adjustments or analyses without affecting your original data.

Customizing Your Period Copy Settings

Customizing the settings of your Period Copy can further enhance its usefulness. QuickBooks allows for various customization options, including the ability to include or exclude certain types of transactions or data. For instance, you may choose to exclude estimates or sales orders from your Period Copy if they are not relevant to the period being examined.

Another important aspect of customization is the handling of inventory. QuickBooks provides options for how inventory is treated in the Period Copy, which is crucial for businesses that need to maintain accurate inventory records. Choosing the right settings can help ensure that your Period Copy reflects the true financial state of your business during the specified period.

It's also possible to customise how customer and vendor information is included in the Period Copy. Depending on your needs, you may opt to include detailed transaction history for each customer and vendor or limit the information to summary-level data. This flexibility allows businesses to tailor the Period Copy to their specific requirements, making it a powerful tool for financial management.

Choosing the Right Time Period for Your Period Copy

Selecting the appropriate time period for your Period Copy is critical to its effectiveness. The chosen period should reflect the specific financial data you need to review, report on, or analyse. Common time frames include fiscal years, quarters, or the duration of specific projects.

When determining the time period, consider the objectives of creating the Period Copy. If the goal is to prepare for an audit, ensure the period covers all dates of interest to the auditors. For performance analysis, align the period with the start and end dates of the project or initiative being evaluated.

It's also important to consider the volume of transactions within the chosen period. Periods with a high volume of transactions may require more time to process and could result in larger Period Copy files. In such cases, ensure your computer has sufficient resources to handle the task efficiently.

Tips for Managing Your Period Copies Effectively

Managing your Period Copies effectively is key to maximising their value. First, establish a clear naming convention for your Period Copy files. Include the time period and any other relevant identifiers in the file name to ensure easy retrieval.

Secondly, store your Period Copies in a secure, organised location. Consider using cloud storage solutions to ensure data redundancy and accessibility. This also facilitates easy sharing with stakeholders who may need access to the financial data.

Lastly, periodically review your collection of Period Copies and delete any that are no longer needed. This helps manage storage space and maintain an efficient file management system.

Restoring Data from a Period Copy

Restoring data from a Period Copy is a straightforward process in QuickBooks. Open QuickBooks, go to the File menu, select Open or Restore Company, and then choose to restore a backup copy (.QBB). Navigate to the location of your Period Copy, select the file, and follow the prompts to restore the data into QuickBooks.

It's important to note that restoring data from a Period Copy should be done with caution. Ensure that you are not overwriting any current data that is needed. It’s often best to restore the Period Copy to a new QuickBooks file to prevent any unintended data loss.

Troubleshooting Common Issues with the Period Copy Feature

Despite its utility, users may encounter issues with the Period Copy feature in QuickBooks. Common problems include errors during the creation process, incomplete data in the Period Copy, or difficulties restoring from a Period Copy.

To troubleshoot, first ensure that your QuickBooks is updated to the latest version, as updates often include fixes for known issues. If problems persist, reviewing the QuickBooks support documentation or contacting QuickBooks support can provide solutions specific to your issue.

Best Practices for Using Period Copies in QuickBooks

To ensure the best results from using Period Copies, adhere to a few best practices. Regularly create Period Copies to maintain up-to-date snapshots of your financial data. This is especially useful for businesses with dynamic financial landscapes.

Additionally, consider limiting access to your Period Copies to authorised personnel only. This helps protect sensitive financial data and ensures that any modifications are made with oversight.

Lastly, integrate the use of Period Copies into your regular financial review processes. This ensures that your business leverages the full capabilities of QuickBooks in managing and analysing financial data.

Conclusion:

The QuickBooks Period Copy feature is a powerful tool for businesses seeking to manage their financial data with precision and flexibility. By understanding how to create, customise, and manage Period Copies, businesses can enhance their financial oversight, simplify audits and reporting, and make informed decisions based on accurate historical data.

With the steps and best practices outlined in this guide, you are well-equipped to leverage the Period Copy feature to its full potential. Remember, the key to effective financial management in QuickBooks lies not just in understanding its features but in integrating them into your regular financial processes.