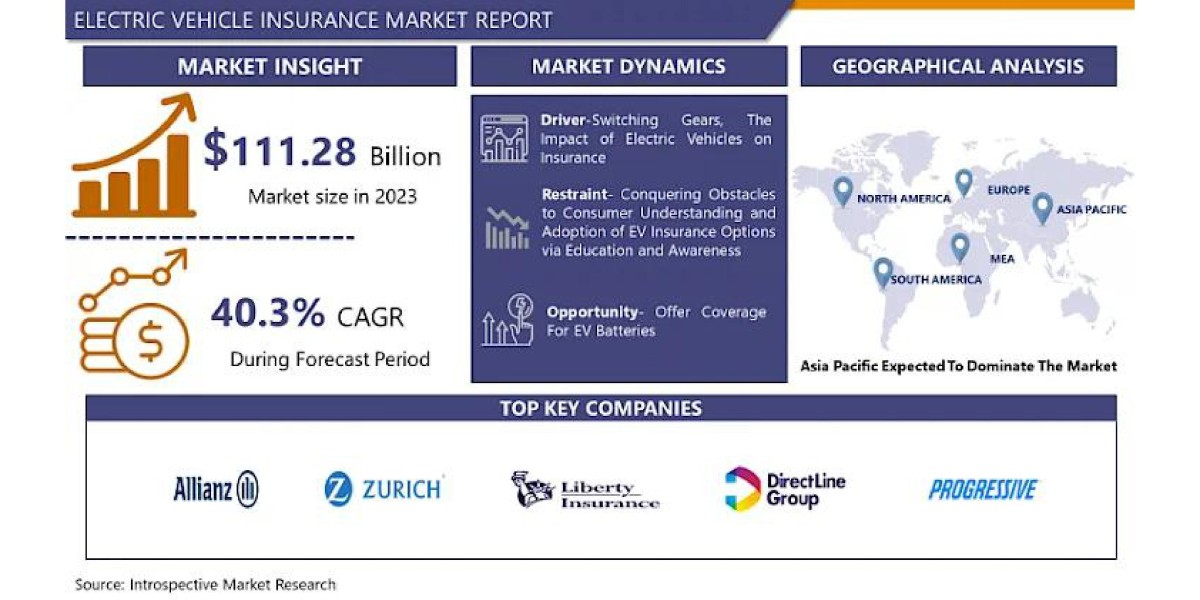

The Electric Vehicle (EV) Insurance Market is witnessing sizable growth, paralleling the fast enlargement of the electrical car industry. As more consumers and agencies transition to electric powered automobiles, the call for specialized coverage merchandise tailor-made to the precise wishes of EVs has surged. EVs include distinct characteristics which includes better upfront expenses, luxurious battery systems, and superior technology like self reliant driving and connectivity features, which all require tailor-made insurance. Traditional car coverage fashions won't completely address the complexities and dangers associated with EVs, consisting of coverage for battery damage, charging infrastructure, and even the availability of EV-licensed restore centers. Insurers are actually adapting their services to mirror those factors, developing policies that cowl elements like roadside assistance for charging, specialised restore offerings, and liability coverage for charging station mishaps. The inclusion of telematics in EVs also permits insurers to offer usage-based coverage (UBI), in which premiums are adjusted based on using conduct and battery utilization, main to greater customized and value-powerful insurance alternatives for drivers

Moreover, governments round the sector are promoting the adoption of electric vehicles via incentives, subsidies, and regulations aimed toward reducing carbon emissions. This is expected to have a positive impact at the EV insurance market, as those incentives regularly encourage customers to invest in EVs, sooner or later increasing the call for related coverage products. Additionally, the upward thrust of electrical business fleets in logistics and public transport sectors is driving the demand for fleet-precise EV insurance policies.

Click here to order a sample copy of the Global Electric Vehicle Insurance market report @

https://introspectivemarketresearch.com/request/16391

Major Companies in Global Electric Vehicle Insurance Market

- Allianz (Germany)

- AXA (France)

- Zurich Insurance Group (Switzerland)

- Liberty Mutual Insurance Company (U.S.)

- Aviva (U.K.)

- Direct Line Insurance Group plc (U.K.)

- The Progressive Corporation (U.S.)

- GEICO (U.S.)

- Allstate Insurance Company (U.S.)

- State Farm Mutual Automobile Insurance Company (U.S.)

- Other Key Players

The latest report on the Electric Vehicle Insurance Market provides a detailed analysis of the market for the years 2024 to 2032. It presents a comprehensive overview of the global Electric Vehicle Insurance industry, incorporating all key industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Electric Vehicle Insurance market. Moreover, the research covers crucial chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to grasp the market direction and development in the present and forthcoming years.

Have different Market Scope & Business Objectives; Enquire for customized study @

https://introspectivemarketresearch.com/inquiry/16391

Global Electric Vehicle Insurance Market is Segmented as Below:

By Propulsion Type

- Battery Electric Vehicles (BEV)

- Hybrid

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Coverage Type

- Accidental Damage

- Theft or Malicious Damage

- Car Battery & Auto Parts Replacement

- Others

Top Impacting Factors:

High Purchase and Repair Costs

EVs commonly have better prematurely buy prices and extra luxurious components especially batteries in comparison to standard inner combustion engine (ICE) automobiles. The price of repairing or replacing batteries, combined with the want for specialized repair facilities, ends in higher rates. Insurers must account for these costs in their policies, which has a large impact at the pricing and shape of EV insurance.

Advancements in EV Technology

The continuous evolution of EV era, consisting of self-reliant driving abilities, connectivity features, and software-driven overall performance, requires insurers to provide more specialized insurance. As EVs grow to be smarter and more connected, dangers related to software program malfunctions, cyberattacks, and autonomous injuries have to be included into insurance models. These technological improvements additionally create opportunities for usage-based coverage (UBI), where premiums are decided based totally on using behavior and vehicle usage facts amassed via telematics.

Government Policies and Incentives

Governments global are incentivizing EV adoption via subsidies, tax breaks, and guidelines aimed at lowering carbon emissions. These incentives increase the overall EV market, which in flip increases the call for EV-particular insurance merchandise. Additionally, some governments are pushing for mandatory insurance rules that cowl EV-particular dangers, such as battery replacement or charging station liability, using growth in this quarter.

Charging Infrastructure and Range Anxiety

The availability and reliability of charging infrastructure play a important position in influencing EV insurance rules. Many insurers are actually inclusive of roadside help for charging-associated problems, inclusive of walking out of battery electricity or harm to domestic charging devices. As the charging network expands and variety anxiety decreases, insurers may additionally adjust their charges or upload coverage for incidents associated with charging.

By Regions: -

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16391

This report sample includes:

1. Brief Introduction to the research report.

2. Table of Contents (Scope covered as a part of the study)

Top players in the market

3. Research framework (presentation)

4. Research methodology adopted by Coherent Market Insights

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +1-773-382-1049