London

Roots Analysis has announced the addition of the “Live Biotherapeutic Products ” report to its list of offerings.

Owing to the complex manufacturing processes, requirement of advanced GMP production facilities and the limited availability of inherent expertise, microbiome therapeutic developers are actively outsourcing certain manufacturing operations, in addition to expanding their in-house capabilities.

Key Market Insights

Presently, more than 25 players offer live biotherapeutic products contract manufacturing

This segment of the industry is dominated by the presence of mid-sized players (51-200 employees) and start-ups / small players (2-50 employees), which collectively represent more than 80% of the total contract manufacturers. In addition, about 30% firms were founded post 2010.

35+ production facilities dedicated to microbiome-based therapies have been established globally

Europe has emerged as the key manufacturing hub for microbiome-based candidates, featuring the presence of nearly 60% of the total manufacturing facilities. This is followed by facilities located in Asia-Pacific and North America. Prominent manufacturing hubs within Europe include (in decreasing order of number of facilities) Italy, France, the Netherlands and the UK.

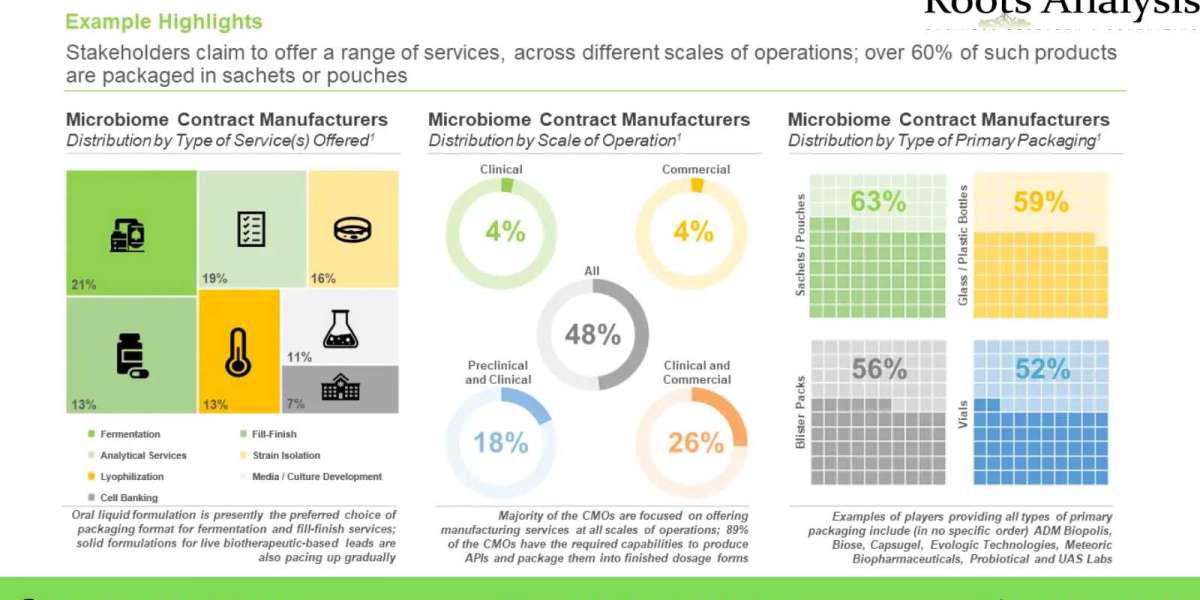

Approximately 50% of the players carry out microbiome manufacturing operations across all scales of operation

Nearly 78% of the total industry stakeholders have the required capabilities to manufacture microbiome-based therapies at the commercial scale. In addition, 96% players are capable of manufacturing microbiome-based therapies for clinical purposes.

Over 50% in-house manufacturers in this field are based in North America

Interestingly, more than 55% of such players are start-ups, while over 36 are mid-sized players, and 7% are large and very large firms. Further, close to 18% in-house manufacturers offer development and manufacturing services for live biotherapeutic products at both clinical and commercial scales.

Partnership activity in this domain has increased at a CAGR of over 34%, between 2016 and 2021

Research agreements emerged as the most popular type of partnership model adopted by industry stakeholders (36%), followed by product development agreements (18%) and acquisitions (12%). It is worth mentioning that around 83% of the expansion projects undertaken by industry stakeholders were initiated since 2020.

70 microbiome therapeutics developers are likely to forge strategic alliances with contract manufacturers

Around 57% of the drug developers are based in North America, followed by Europe (33%). In addition, 29% of drug developers are dominated by the presence of start-ups (established post 2015), indicating that the market is likely to be driven by such players.

More than 140 clinical trials evaluating microbiome drugs have been registered worldwide

Clinical research activity, in terms of number of trials registered, is reported to have increased at a CAGR of 26%, during the period 2016-2021. Of the total, close to 49% of the studies are active and recruiting patients, followed by those that have already been completed (36%).

Currently, 62% of the overall microbiome contract manufacturing capacity is installed for commercial operations

The maximum (59%) installed capacity belongs to companies based in Europe; the region has higher number of players having multiple production facilities. This is followed by Asia Pacific (32%) and North America (9%).

Global demand for microbiome-based live biotherapeutic products is anticipated to grow at a CAGR of 36%, during 2022-2031

The commercial demand for microbiome-based live biotherapeutic products is projected to increase at a CAGR of 37.9%. Further, the clinical demand for microbiome-based live biotherapeutic products in phase III trials is projected to increase at a CAGR of 16.4%.

Europe and Asia-Pacific are anticipated to capture over 65% of the market share, in 2035

In terms of type of product manufactured, the current market is driven by APIs (close to 65%); this trend is unlikely to change in the foreseen future. Further, based on type of formulation, majority of the revenue share (45%) of the overall market in 2035 is likely to be driven by oral liquids.

To request a sample copy / brochure of this report, please visit this

https://www.rootsanalysis.com/reports/microbiome-contract-manufacturing/request-sample.html

Key Questions Answered

- Who are the key players engaged in offering contract manufacturing services for microbiome therapeutics?

- What are the key challenges faced by microbiome contract manufacturers?

- Who are the most likely partners (microbiome-based live biotherapeutic drug developers) for microbiome contract manufacturers?

- What are the various initiatives undertaken by big pharma players in this domain?

- What is the annual clinical demand for microbiome-based live biotherapeutics?

- What is the current, installed contract manufacturing capacity for live biotherapeutics?

- What percentage of live biotherapeutics manufacturing operations are currently outsourced to service providers?

- What are the key factors influencing the make (manufacture in-house) versus buy (outsource) decision in this field?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What are the anticipated future trends related to live biotherapeutics manufacturing?

The financial opportunity within the live biotherapeutic products and microbiome contract manufacturing market has been analyzed across the following segments:

- Type of Product Manufactured

- API

- FDF

- Type of Formulation

- Solids

- Oral Liquids

- Injectables

- Type of Primary Packaging Used

- Blister Packs

- Glass / Plastic Bottles

- Pouches / Sachets

- Vials

- Scale of Operation

- Clinical

- Commercial

- Company Size

- Small

- Mid-sized

- Large

- Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

The report includes profiles of key players (listed below); each profile features an overview of the company, details related to its service portfolios, facilities dedicated to microbiome manufacturing, recent developments and an informed future outlook.

- Capsugel

- Jeneil Biotech

- UAS Labs

- Biose

- Cerbios-Pharma

- Inpac Probiotics

- NIZO

- Winclove Probiotics

- BJP Laboratories

For additional details, please visit

https://www.rootsanalysis.com/reports/view_document/microbiome-contract-manufacturing/306.html or email sales@rootsanalysis.com

You may also be interested in the following titles:

- Peptide Therapeutics: Contract API Manufacturing Market: Industry Trends and Global Forecasts, 2022-2035

- Biopharmaceutical Excipient Manufacturing Market: Industry Trends and Global Forecasts, 2022-2035

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415

+44 (122) 391 1091