QuickBooks Payroll Direct Deposit Form? Look no further! Whether you are a small business owner managing your own payroll or an HR professional responsible for employee compensation, understanding how to write an accurate and effective direct deposit form is crucial.

The direct deposit form is a critical document that allows employees to have their paychecks deposited directly into their bank accounts. By eliminating the need for paper checks, it not only saves time but also reduces the risk of lost or stolen checks.

Why Use Intuit QuickBooks Payroll Direct Deposit Form?

Using the Intuit QuickBooks Payroll Direct Deposit Form can significantly streamline your payroll process. One of the primary reasons to implement this system is the convenience it offers both employers and employees. For businesses, direct deposits reduce the administrative burden associated with processing payroll checks, allowing for quicker and more efficient payment cycles.

Moreover, utilizing a direct deposit system minimizes the risks associated with check theft or loss. QuickBooks Direct Deposit Form, Transactions are safer and more secure when conducted electronically. Employees can rest easy knowing that their hard-earned money is safely transferred to their accounts without the worry of physical checks being misplaced or intercepted.

Understanding the Components of the Form

The Intuit QuickBooks Payroll Direct Deposit Form, it’s important to understand its key components. The form generally includes several sections that require precise information. Typically, the first part asks for the employee's personal information, including their full name, address, and Social Security number.

Another vital section of the form is the bank account information. Here, employees must provide their bank name, account number, and the type of account—either checking or savings. It’s essential that this section is filled out correctly, as any errors can lead to incorrect deposits, causing confusion and potential financial issues for both the employee and the employer.

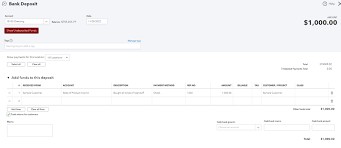

Step-by-Step Guide on Filling Out the Form

Filling out the Intuit QuickBooks Payroll Direct Deposit Form may seem intimidating at first, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary information before you begin to fill out the form. This includes personal details like full name, address, Social Security number, and relevant banking information.

It’s important to double-check that all names are spelled correctly and that the Social Security number matches official documents. Any discrepancies can lead to complications during the payroll process. Once you have accurately filled out this section, proceed to the bank account information. Ensure that the account number is entered correctly and that you specify whether it is a checking or savings account.

Common Mistakes to Avoid When Completing the Form

While filling out the Intuit QuickBooks Payroll Direct Deposit Form, there are several common mistakes that you should be mindful of to ensure accuracy. One of the most frequent errors is providing incorrect bank account details. This can happen if employees are not careful while writing down their account numbers, especially if they are switching banks or accounts. A simple typo can lead to funds being deposited into the wrong account, causing frustration and complications.

Another common mistake is neglecting to review the personal information section thoroughly. It’s easy for employees to overlook small details like a missing initial or an incorrect address, but these errors can lead to significant issues in payroll processing. Always encourage employees to double-check their information before submitting the form. Taking a few extra moments to review can save both the employer and the employee a lot of time and hassle later.

Tips for Ensuring Accuracy and Efficiency

To ensure that the Intuit QuickBooks Payroll Direct Deposit Form is filled out accurately and efficiently, consider implementing a few best practices. Firstly, it’s a good idea to provide employees with a checklist of the required information before they start filling out the form. This can include details like their bank information, personal identification, and any necessary signatures.

This can serve as a visual guide for employees, illustrating how to fill out each section correctly. By seeing a completed example, employees can better understand what is expected of them, reducing the chances of errors. Make sure that the template is clear and easy to follow, minimizing confusion.

Frequently Asked Questions About Intuit QuickBooks Payroll Direct Deposit Form

As you navigate the process of filling out the Intuit QuickBooks Payroll Direct Deposit Form, you may encounter questions or uncertainties. It’s always beneficial to have a FAQ section to address common concerns. One frequently asked question is, “How long does it take for direct deposit to start?” Generally, it can take one or two payroll cycles for the direct deposit to become effective, depending on your payroll schedule and banking processes.

Another common inquiry is, “What should I do if I change my bank account?” Employees should notify their employer as soon as possible to update their direct deposit information. It’s advisable to fill out a new direct deposit form to ensure that all necessary changes are made. This will prevent any lapses in payment or errors in deposits during the transition.

Resources and Support for Further Assistance

If you still have questions or need additional help with the Intuit QuickBooks Payroll Direct Deposit Form, there are numerous resources available. Intuit QuickBooks itself provides extensive documentation and support for users. You can visit their official website for guides, FAQs, and customer service options tailored to assist users with payroll issues.

Consider reaching out to local payroll professionals or HR consultants who can offer personalized assistance. They can provide insights based on their experience and help you navigate any complexities that arise during the payroll process. Networking with other small business owners can yield valuable tips and advice based on their experiences with direct deposit and payroll management.

Benefits of Using Intuit QuickBooks Payroll Direct Deposit Form

The advantages of using the Intuit QuickBooks Payroll Direct Deposit Form extend far beyond mere convenience. One of the most significant benefits is the speed with which employees receive their pay. Direct deposit allows funds to be available in employees’ accounts on payday without any delays caused by manual check processing. This immediate access to wages can greatly enhance employee satisfaction and morale, as they can plan their finances with greater certainty.

With a streamlined payroll process, employers can allocate less time to administrative tasks associated with paper checks. This efficiency frees up valuable hours that can be invested in other crucial areas of the business, such as employee training or strategic planning, ultimately contributing to growth.

Conclusion and Final Thoughts

The Intuit QuickBooks Payroll Direct Deposit Form is a vital skill for anyone involved in payroll management. By understanding the components of the form, following a step-by-step guide, and avoiding common pitfalls, you can create an efficient and effective direct deposit system for your business. The benefits of direct deposit—such as increased efficiency, security, and employee satisfaction—make it a worthy investment for any organization.

As you embark on this process, remember to utilize available resources for assistance and support. Whether it’s through Intuit QuickBooks documentation, professional consultants, or online communities, you don’t have to navigate this journey alone. With the right tools and knowledge, you’ll be well-equipped to implement a direct deposit system that meets the needs of both your business and your employees.