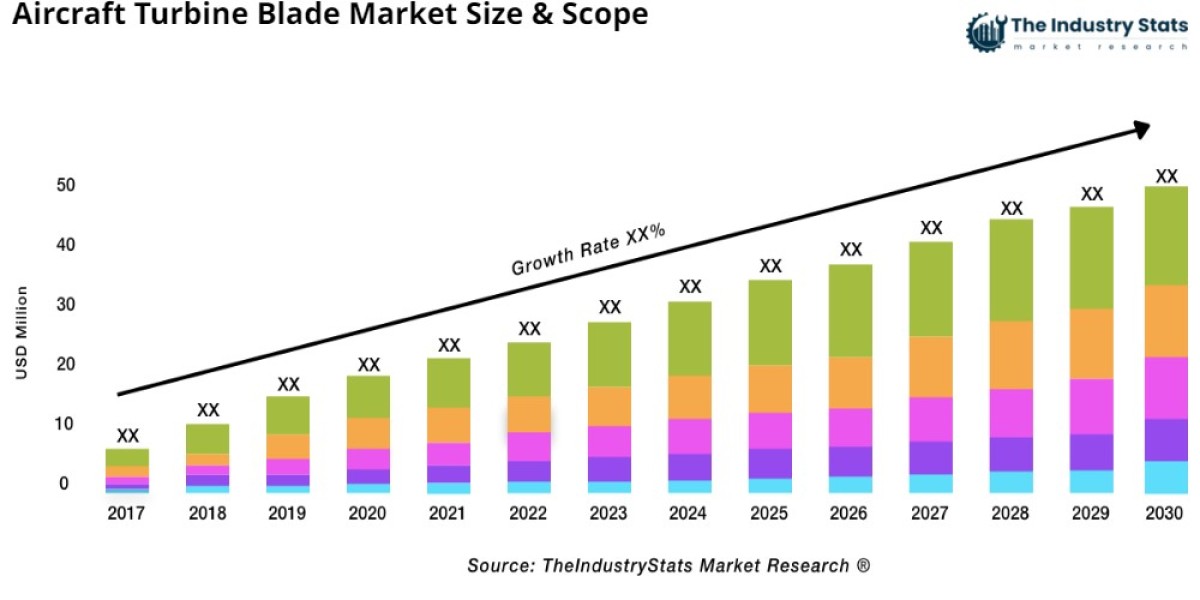

The global aircraft turbine blade market was valued at USD 23.8 billion in 2023 and is projected to reach USD 46 billion by 2032, registering a CAGR of 7.60% from 2024 to 2032. The increasing demand for efficient and durable turbine blades in commercial and military aircraft, along with advancements in turbine technology, are the key drivers propelling market growth.

Key Market Drivers

Growing Demand for Aircraft Engines: As the global aviation industry expands, there is a rising need for high-performance aircraft engines, which are essential for fuel efficiency and sustainability. Aircraft turbine blades are crucial components that significantly impact engine performance. The increasing number of commercial and military aircraft worldwide is driving the demand for turbine blades.

Technological Advancements in Turbine Blade Materials: The development of advanced materials, including titanium, nickel alloys, and composites, is revolutionizing the turbine blade market. These materials provide enhanced strength, corrosion resistance, and thermal efficiency, crucial for high-performance engines. As turbine blades evolve, manufacturers are investing in new technologies to increase the lifespan and efficiency of these components.

Rising Military and Defense Spending: Military aircraft also play a significant role in driving the demand for turbine blades. With increased defense spending globally, countries are upgrading their fleets, resulting in a higher demand for military-grade turbine blades. The ongoing development of advanced fighter jets and other military aircraft further supports market growth.

Market Segmentation

The aircraft turbine blade market is segmented by product type, application, sales channel, and region:

By Product Type:

- Titanium Blades: Known for their high strength and lightweight properties, titanium blades are commonly used in commercial and military aircraft engines.

- Nickel Alloy Blades: These blades offer superior resistance to high temperatures, making them ideal for turbine engines exposed to extreme conditions.

- Composite Blades: Made from advanced composite materials, these blades provide enhanced durability and reduced weight, contributing to overall engine performance.

- Others: This category includes alternative materials used in specialized applications.

By Application:

- Commercial Aircraft: The largest segment, driven by the growing number of passenger aircraft globally, with increasing demand for fuel-efficient, high-performance engines.

- Military Aircraft: Military applications are also a significant driver, as defense forces modernize their fleets with cutting-edge turbine technology.

By Sales Channel:

- Direct Channel: Manufacturers directly supply turbine blades to aircraft engine makers and OEMs (Original Equipment Manufacturers).

- Distribution Channel: Turbine blades are also sold through distributors, ensuring broad availability across markets.

By Region:

- North America: Home to leading aerospace companies and a large base of commercial and military aircraft manufacturers, North America dominates the market.

- Europe: Europe is a key player, with several well-established aerospace companies and a high demand for turbine blades for both commercial and military aircraft.

- Asia-Pacific: The Asia-Pacific region is witnessing significant growth, fueled by the increasing aviation industry in countries like China, India, and Japan.

- South America: Growth in the aerospace industry in countries like Brazil is expected to increase demand for turbine blades.

- Middle East & Africa: The Middle East is investing heavily in modernizing its aviation fleets, boosting demand for turbine blades in both commercial and military aircraft.

Detail ToC & Scope of Research: https://theindustrystats.com/report/aircraft-turbine-blade-market/22539/

Leading Market Players

The aircraft turbine blade market features a mix of established industry giants and emerging players. Some of the key companies leading the market include:

- RTX Corporation

- MTU Aero Engines

- Rolls-Royce

- Farinia Group

- IHI

- Doncasters

- AeroEdge

- PowerJet Engineering

These companies are focusing on enhancing turbine blade technologies, expanding their product portfolios, and forming strategic alliances to strengthen their position in the market.

The aircraft turbine blade market is set for significant growth as technological advancements and increasing demand for high-efficiency aircraft engines fuel its expansion. The market is expected to reach USD 46 billion by 2032, driven by the need for advanced turbine blades in both commercial and military aircraft.

Key players like RTX Corporation, MTU Aero Engines, and Rolls-Royce are leading the way in innovation and market development, contributing to the market’s rapid evolution. As the aviation industry continues to grow and evolve, the aircraft turbine blade market will play a crucial role in powering the future of global aviation.