IoT Banking Financial Services Market Overview:

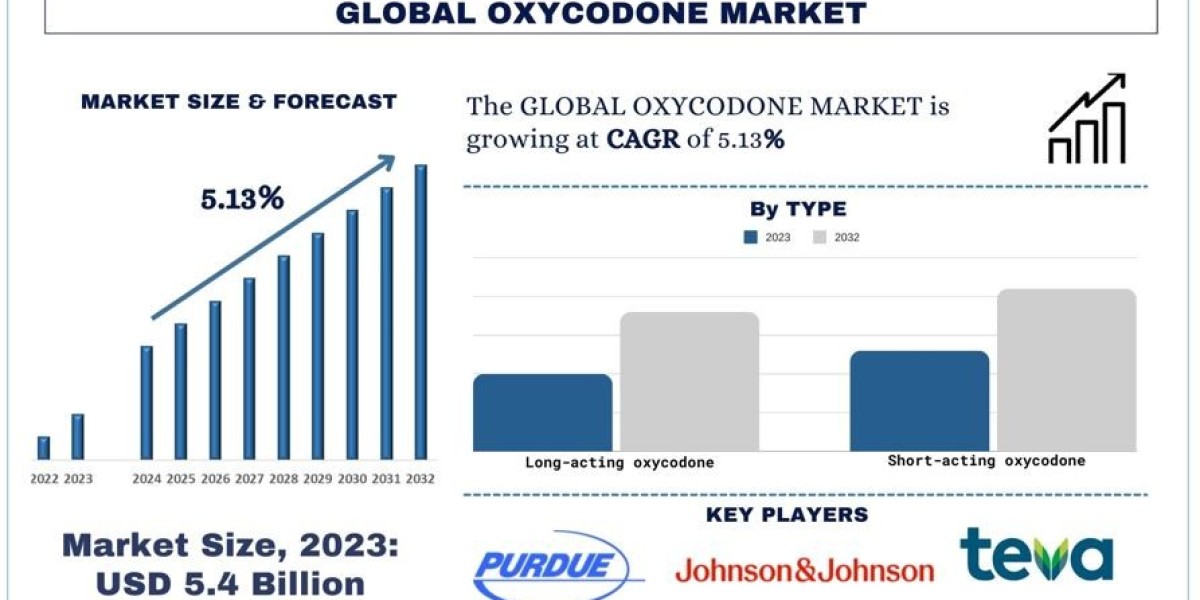

The Internet of Things (IoT) has emerged as a transformative force across various industries, and the banking and financial services sector is no exception. The integration of IoT technologies in banking and financial services is driving significant changes, enhancing operational efficiency, customer experience, and security. The IoT Banking Financial Services Market, which was valued at USD 25.47 billion in 2022, is set to experience substantial growth over the next decade. The market is projected to expand from USD 29.03 billion in 2023 to a staggering USD 94.23 billion by 2032, reflecting a compound annual growth rate (CAGR) of approximately 13.98% during the forecast period from 2024 to 2032.

Understanding IoT in Banking Financial Services

IoT in banking and financial services refers to the use of connected devices, sensors, and data analytics to gather and process real-time information. This technology enables banks and financial institutions to offer personalized services, enhance security measures, streamline operations, and provide innovative products to customers. From smart ATMs and wearable payment devices to connected branches and enhanced fraud detection systems, IoT is reshaping the landscape of financial services.

Request For Sample Report PDF - https://www.marketresearchfuture.com/sample_request/24183

Key Market Drivers

- Enhanced Customer Experience: One of the primary drivers of IoT adoption in banking is the ability to provide a more personalized and seamless customer experience. IoT devices enable banks to collect real-time data on customer behavior and preferences, allowing for tailored financial products and services. For example, IoT-enabled wearables can facilitate quick and secure payments, while smart branches can offer personalized services based on customer profiles.

- Operational Efficiency and Cost Reduction: IoT technologies help financial institutions optimize their operations by automating processes, reducing manual interventions, and improving resource management. For instance, IoT-enabled sensors can monitor ATM cash levels and predict maintenance needs, reducing downtime and operational costs. Additionally, connected devices in branches can streamline various functions, leading to more efficient branch operations.

- Enhanced Security and Fraud Detection: The integration of IoT in banking also enhances security measures. IoT devices, combined with advanced analytics, can detect unusual patterns in transactions and customer behavior, helping to identify potential fraud or security breaches in real-time. This proactive approach to security is crucial in an era where cyber threats are becoming increasingly sophisticated.

- Data-Driven Decision Making: IoT generates vast amounts of data that can be analyzed to gain insights into customer preferences, market trends, and operational performance. Banks can leverage this data to make informed decisions, optimize product offerings, and improve risk management practices. The ability to harness IoT data effectively will be a key differentiator for financial institutions in the competitive market.

Market Challenges

Despite the promising growth prospects, the IoT Banking Financial Services Market faces several challenges:

- Data Privacy and Security Concerns: The proliferation of connected devices in banking raises significant concerns about data privacy and security. Ensuring that customer data is protected from breaches and unauthorized access is a critical challenge that financial institutions must address to maintain customer trust.

- Integration Complexity: Integrating IoT technologies with existing banking systems can be complex and costly. Financial institutions must navigate challenges related to interoperability, legacy systems, and the need for new infrastructure to support IoT devices.

- Regulatory Compliance: The adoption of IoT in banking is subject to stringent regulatory requirements, particularly concerning data protection and cybersecurity. Financial institutions must ensure that their IoT implementations comply with all relevant regulations, which can add complexity and cost to the deployment process.

- High Initial Investment: Implementing IoT solutions requires significant upfront investment in technology, infrastructure, and training. While the long-term benefits of IoT adoption are substantial, the initial costs can be a barrier for some financial institutions, particularly smaller banks and credit unions.

Regional Analysis

The IoT Banking Financial Services Market is experiencing growth across various regions, each with unique drivers and challenges:

- North America: North America is a leading market for IoT in banking, driven by a high level of technological adoption, advanced infrastructure, and a strong focus on innovation. The U.S. and Canada are at the forefront of IoT implementations in financial services, with major banks investing heavily in IoT solutions to enhance customer experience and operational efficiency.

- Europe: Europe is another significant market for IoT in banking, with countries like the UK, Germany, and France leading the way. The region's strong regulatory framework, coupled with a focus on digital transformation, is driving the adoption of IoT technologies in financial services.

- Asia-Pacific: The Asia-Pacific region is expected to witness rapid growth in the IoT Banking Financial Services Market, driven by the increasing adoption of digital banking, a growing middle class, and rising demand for personalized financial services. Countries like China, India, and Japan are key players in this region.

- Latin America and Africa: These regions are also showing potential for growth in the IoT Banking Financial Services Market, although at a slower pace compared to North America, Europe, and Asia-Pacific. The adoption of IoT in banking is being driven by efforts to improve financial inclusion and expand access to banking services in underserved areas.

Future Outlook

The future of the IoT Banking Financial Services Market is bright, with strong growth expected over the next decade. As financial institutions continue to embrace digital transformation, IoT will play an increasingly important role in shaping the future of banking. The ability to leverage real-time data, enhance customer experiences, improve operational efficiency, and strengthen security measures will be critical for financial institutions looking to stay competitive in the evolving market.

To fully capitalize on the opportunities presented by IoT, banks and financial institutions must address the challenges related to data privacy, integration, and regulatory compliance. By doing so, they can unlock the full potential of IoT and drive innovation in the banking and financial services industry.

Conclusion

The IoT Banking Financial Services Market is on a trajectory of significant growth, with its value expected to more than triple by 2032. With a CAGR of 13.98% during the forecast period, the market is poised to revolutionize the banking sector, offering new opportunities for innovation, efficiency, and customer satisfaction. As the industry continues to evolve, IoT will be a key driver of change, enabling financial institutions to better serve their customers and navigate the complexities of the digital age.