Mexico Fintech Market Overview

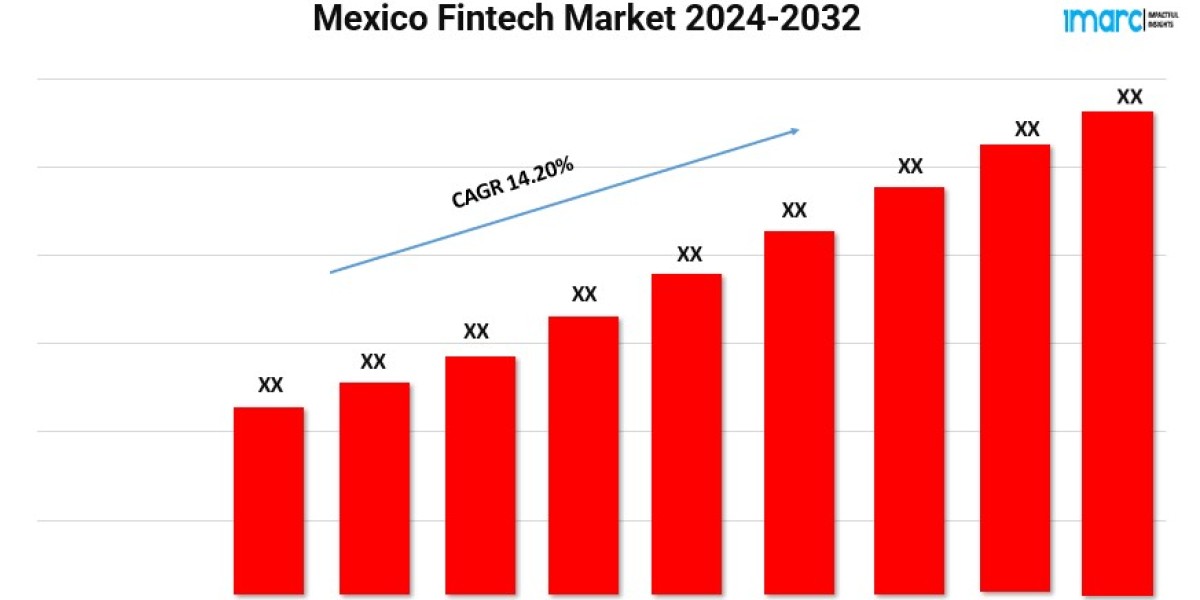

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 14.20% (2024-2032)

Individuals and businesses in Mexico are shifting towards digital transactions, which is driving the demand for financial technology (fintech) solutions that facilitate seamless and secure payments. According to the latest report by IMARC Group, The Mexico fintech market size is projected to exhibit a growth rate (CAGR) of 14.20% during 2024-2032.

Mexico Fintech Industry Trends and Drivers:

The growing utilization of digital financial services along with the escalating focus on financial inclusion are the factors responsible for the growth of the Mexico fintech market. Additionally, fintech companies are filling the gap by offering mobile banking, digital wallets, peer-to-peer lending, and payment platforms that cater to previously underserved segments with a large unbanked population and rising smartphone usage. Besides this, the push by government authorities to improve financial literacy and promote cashless transactions is further supporting the adoption of these services. Moreover, fintech innovations such as blockchain technology and artificial intelligence are enhancing efficiency and security, enabling companies to provide personalized financial solutions at lower costs, which is attracting both consumers and businesses alike.

The rise of neobanks and challenger banks that offer fully digital financial services, appealing particularly to younger, tech-savvy consumers, is augmenting the Mexico fintech market. These institutions provide a user-friendly alternative to traditional banks with faster account setup, reduced fees, and enhanced digital experiences. The growing e-commerce sector in Mexico is also propelling demand for fintech solutions, particularly in online payments and buy-now-pay-later options, allowing consumers greater flexibility. Furthermore, the fintech sector is benefiting from increased venture capital investments, with startups receiving substantial funding to innovate and scale their operations. Regulatory developments, such as fintech law, are also playing a vital role in providing a clearer legal framework, which boosts investor confidence and helps ensure market stability. As digital finance becomes more deeply integrated into everyday life, the Mexico fintech market is expected to drive in the coming years.

Grab a sample PDF of this report: https://www.imarcgroup.com/mexico-fintech-market/requestsample

Mexico Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145