The offshore pipeline market is a critical segment within the global energy and infrastructure industry, facilitating the transportation of oil, gas, and other resources across vast oceanic distances. The market is characterized by substantial investments, technological advancements, and an evolving competitive landscape. As offshore projects become more complex, companies are vying for market share by enhancing capabilities and embracing sustainability initiatives. This article explores the competitive landscape, highlighting key players and their strategies to maintain dominance.

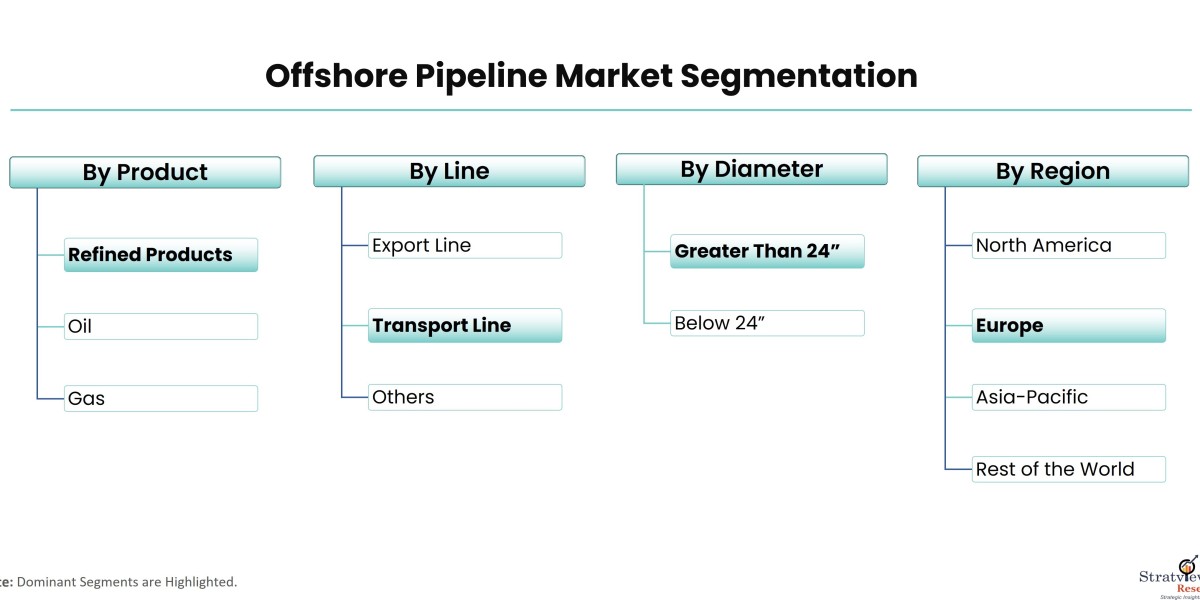

According to Stratview Research, the offshore pipeline market was estimated at USD 14.5 billion in 2022 and is likely to grow at a CAGR of 4.72% during 2023-2028 to reach USD 19.17 billion in 2028.

Key Players in the Offshore Pipeline Market

- Saipem S.p.A.

- A global leader in offshore pipeline construction, Saipem offers integrated services that span from project design to installation and maintenance. Known for its advanced engineering capabilities, Saipem has been involved in some of the most challenging and high-profile offshore pipeline projects.

- Subsea 7 S.A.

- Subsea 7 provides offshore pipeline installation and subsea construction services. The company has a strong presence in deepwater pipeline projects and is renowned for its technological expertise in underwater pipeline construction.

- McDermott International, Inc.

- McDermott is a significant player in the offshore pipeline industry, specializing in engineering, procurement, construction, and installation (EPCI) services. The company has been involved in numerous projects related to deepwater oil and gas development.

- Tenaris S.A.

- As a leading manufacturer of seamless steel pipes, Tenaris is a vital player in the offshore pipeline market. The company provides pipes and related services for offshore oil and gas exploration, particularly in harsh environments.

- Oceaneering International, Inc.

- Oceaneering focuses on offshore engineering services, including pipeline installation and inspection. The company is known for its subsea robotics, remotely operated vehicles (ROVs), and other advanced technologies, enhancing the safety and efficiency of offshore pipeline operations.

- KBR, Inc.

- KBR is a global leader in providing engineering and construction solutions, including offshore pipeline installation. With a focus on innovation and safety, the company continues to expand its footprint in the offshore energy sector.

Market Share and Competitive Dynamics

The offshore pipeline market is highly competitive, with a few key players dominating the market share. Companies with a strong technological base, such as Saipem and Subsea 7, hold substantial shares, particularly in deepwater and ultra-deepwater projects. The rise in energy demand and offshore oil and gas exploration is contributing to increased competition among these firms.

The market is also witnessing a trend toward consolidation, with companies pursuing strategic mergers and acquisitions to strengthen their technological capabilities and expand their geographic reach. In addition, firms are increasingly focusing on adopting environmentally sustainable practices to meet regulatory requirements and the growing emphasis on green energy solutions.

Conclusion

The offshore pipeline market remains competitive, with key players focusing on technological innovations, strategic collaborations, and sustainability to maintain their leadership positions. As demand for offshore energy solutions grows, companies in this sector will continue to adapt, positioning themselves for long-term success in an increasingly complex global market.