An LLC, or Limited Liability Company, is a business structure that offers a blend of partnership-like tax benefits and corporate liability protection. This means that your personal assets are generally shielded from business debts and liabilities, providing a crucial layer of financial security.

Why Form an LLC?

- Liability Protection: The primary advantage of an LLC is its ability to shield your personal assets from business debts and lawsuits. This means that if your business faces a lawsuit or incurs significant debt, your personal property (like your home, car, and savings) is generally protected.

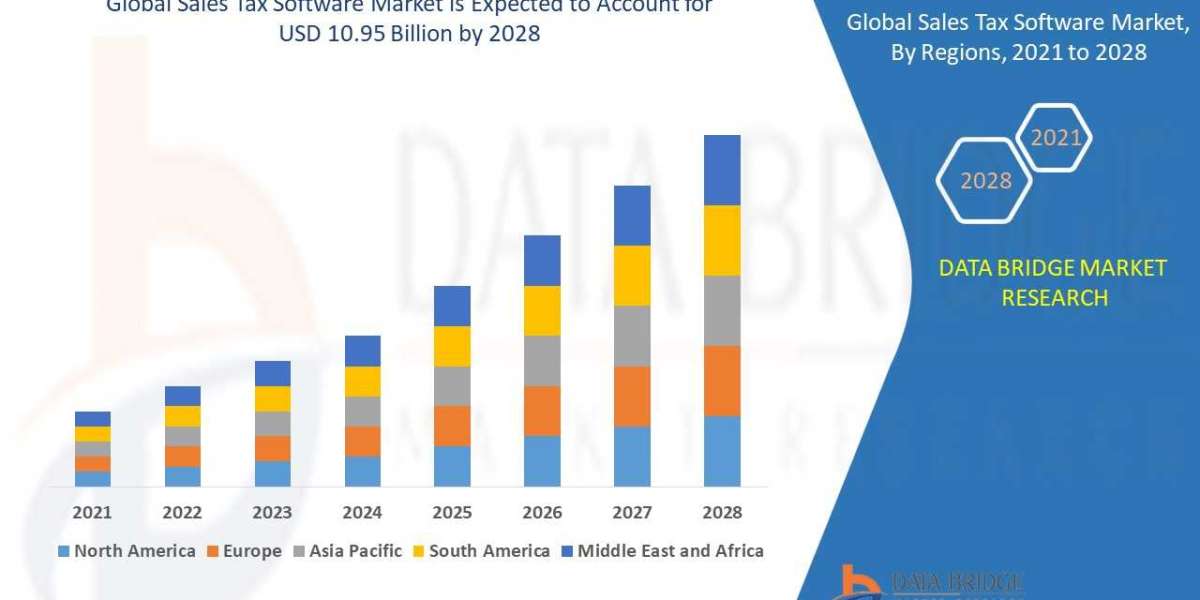

- Tax Flexibility: LLCs offer flexibility in how they are taxed. By default, an LLC is taxed as a pass-through entity, meaning the business itself doesn't pay taxes. Instead, profits and losses "pass through" to the owners (members) and are reported on their personal tax returns. This can result in significant tax savings.

- Simplified Management: LLCs generally have simpler management structures compared to corporations. They can be managed by the members themselves, offering greater flexibility and control.

- Credibility and Professionalism: Forming an LLC can enhance your business's credibility and professionalism. It signals to customers, suppliers, and investors that your business is a legitimate and established entity.

Steps to Form an LLC

- Choose a State: You'll need to choose the state where you'll register your LLC. This is typically the state where your business will primarily operate.

- Choose a Unique Business Name: Select a name that is not already in use and complies with your state's naming requirements.

- Appoint a Registered Agent: A registered agent is a designated individual or entity that receives legal documents on behalf of your LLC.

- Draft an Operating Agreement: An operating agreement is an internal document that outlines the rules and procedures for managing your LLC. While not always legally required, it's highly recommended.

- File Articles of Organization: This document is the official application to form your LLC. It typically includes information such as the LLC's name, registered agent, and the names of the members.

- Obtain an Employer Identification Number (EIN): If your LLC will have employees, you'll need to obtain an EIN from the IRS.

- Comply with State and Local Regulations: Depending on your location and industry, you may need to obtain additional licenses or permits.

Tips for a Smooth LLC Formation

- Consult with a Business Attorney: An attorney can provide valuable guidance throughout the LLC formation process, ensuring you comply with all legal requirements and addressing any unique circumstances.

- Consider Professional Help: You can also use online LLC formation services, which can simplify the process and provide guidance at an affordable cost.

- Keep Accurate Records: Maintain meticulous records of all LLC-related activities, including financial transactions, meetings, and any changes to the business structure.

Conclusion

Forming an LLC can provide significant benefits for your business, including liability protection, tax advantages, and enhanced credibility. By carefully following the steps outlined above and seeking professional guidance when needed, you can successfully establish your LLC and set a strong foundation for your business's future growth.