United States Regtech Market Overview

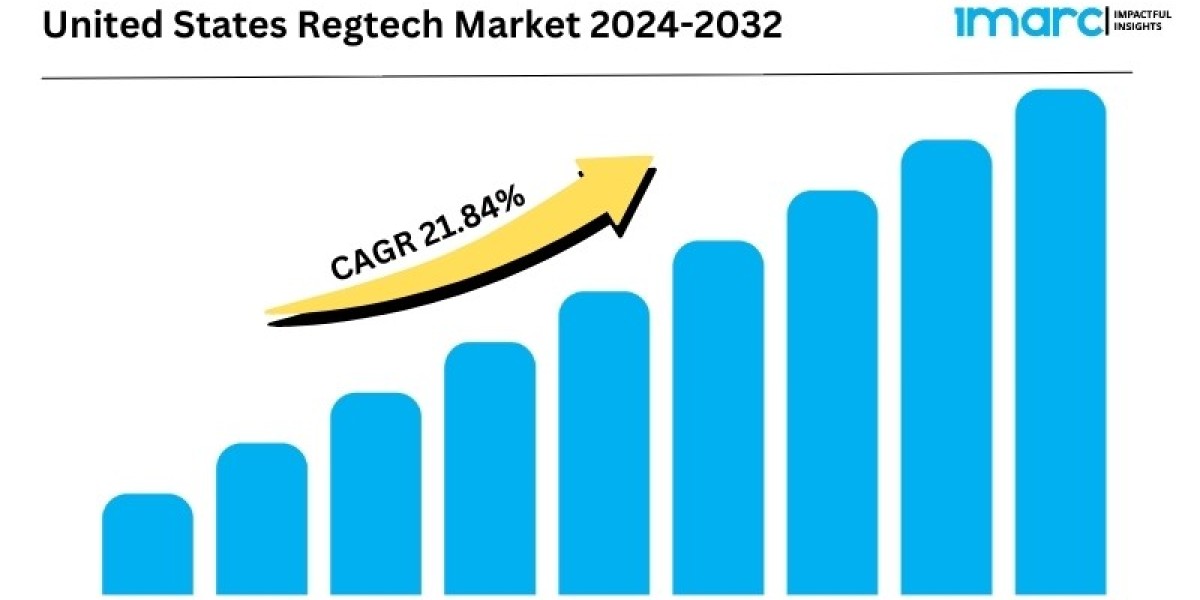

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 21.84% (2025-2033)

According to the latest report by IMARC Group, the regtech industry in the U.S. is projected to grow at a CAGR of 21.84% from 2024 to 2032. The market is experiencing robust growth, driven by increasing regulatory complexities and the need for efficient compliance solutions. Advancements in technology are fostering innovation, enabling businesses to streamline operations and mitigate risks effectively. As demand for automated regulatory tools rises, the market is poised for continued expansion and development.

United States Regtech Industry Trends and Drivers:

The United States RegTech market is rapidly evolving as businesses across various industries embrace technological advancements to navigate complex regulatory landscapes. Regulatory Technology, or RegTech, leverages cutting-edge solutions to streamline compliance, mitigate risks, and manage regulatory reporting, among other functions. The market is experiencing impressive growth, driven by the rising threat of cybercrime, increasing regulatory scrutiny, and a growing demand for automation in compliance processes. RegTech solutions are becoming increasingly integral to organizations, particularly within the financial services industry, where the need for efficient, scalable, and robust compliance systems is critical.

A key driver of the United States RegTech market’s expansion is the increasing complexity of regulatory requirements. As businesses face ever-tightening regulations, particularly in sectors like banking, insurance, and fintech, the demand for automated compliance solutions has surged. RegTech platforms provide tools that help organizations efficiently navigate these challenges, significantly reducing the reliance on manual intervention. This shift to automated solutions not only ensures compliance but also reduces the chances of human error, thus minimizing regulatory and reputational risks. The financial sector, particularly banks and fintech companies, have been at the forefront of adopting these solutions, recognizing the urgent need to mitigate financial crimes like fraud and money laundering, which have become more sophisticated and harder to detect manually.

The rising sophistication of cyber threats is another critical factor driving the market’s growth. As businesses and financial institutions continue to digitalize operations, the potential for cyberattacks has grown exponentially. Regulatory bodies are increasingly focused on enforcing strict cybersecurity protocols to protect sensitive customer data. RegTech solutions, particularly those in anti-money laundering (AML) and fraud management, are essential in addressing these concerns. They offer real-time transaction monitoring, identity verification, and fraud detection, which can help organizations identify and mitigate potential security threats before they escalate. Moreover, the advent of artificial intelligence and machine learning is revolutionizing the RegTech sector by enabling predictive analytics, which further enhances the ability to detect anomalies and prevent financial crimes.

In addition to the demand from the financial services sector, other industries such as energy, utilities, and the public sector are increasingly adopting RegTech solutions to comply with both local and global regulations. As organizations expand their operations globally, the complexity of adhering to diverse regulations becomes even more challenging. Cloud-based RegTech solutions, which provide scalability, flexibility, and cost-efficiency, are helping organizations manage these complexities with ease. By deploying cloud-based tools, companies can ensure that their compliance solutions are always up-to-date, reducing the risk of non-compliance due to outdated or incomplete information.

As the United States RegTech market continues to grow, it is also diversifying in terms of applications and deployment models. From anti-money laundering (AML) solutions to regulatory reporting, risk management, and identity verification, RegTech platforms address a wide range of compliance and regulatory challenges. The increasing adoption of cloud-based RegTech platforms is a significant trend, as they provide businesses with the flexibility to scale their compliance operations without incurring high upfront infrastructure costs. However, on-premises solutions still hold relevance for large enterprises that require more control over their data and infrastructure. The adaptability of RegTech solutions to different enterprise sizes—whether large enterprises or small and medium-sized enterprises (SMEs)—further fuels the market's growth.

Moreover, the continued integration of RegTech with other technologies such as blockchain, artificial intelligence (AI), and machine learning is opening new avenues for market growth. These technologies are enhancing the capabilities of RegTech solutions, enabling organizations to leverage advanced tools for fraud detection, risk assessment, and real-time regulatory reporting. As businesses seek to stay ahead of the curve, the demand for these innovative, AI-driven RegTech solutions is expected to grow, especially in highly regulated sectors like banking, insurance, and fintech.

Key drivers of the United States RegTech market include:

- Regulatory Pressure: Increasing regulatory scrutiny across industries drives the need for automated compliance solutions.

- Cybersecurity Threats: The growing threat of cybercrime pushes organizations to adopt advanced fraud detection and AML solutions.

- Technological Advancements: Integration of AI, machine learning, and blockchain enhances the capabilities of RegTech platforms.

- Cloud Adoption: Cloud-based solutions provide scalability, cost-efficiency, and flexibility for businesses of all sizes.

As the market continues to mature, we can expect further consolidation and specialization within the RegTech space. Companies are likely to increasingly focus on niche solutions tailored to specific industry needs, creating more opportunities for innovation and customization. In the years to come, we are likely to see greater cross-industry collaboration as organizations seek integrated solutions that span compliance, risk management, and cybersecurity.

Looking ahead, the United States RegTech market is poised for continued growth, driven by the ever-expanding need for regulatory compliance and the ongoing digital transformation of businesses. Whether it's in the financial services industry, healthcare, or public sector, RegTech solutions are rapidly becoming an indispensable tool for organizations seeking to navigate the increasingly complex regulatory environment. As the market evolves, businesses will need to stay agile, adopting the latest technologies to ensure they remain compliant and resilient in the face of evolving regulatory and cyber risks.

In conclusion, the United States RegTech market is experiencing robust growth and transformation, driven by technological advancements, increasing regulatory pressures, and rising cybersecurity threats. With businesses in every sector adopting RegTech solutions to streamline compliance and risk management, the future of this market is bright, with innovation and efficiency set to shape the next generation of regulatory technology.

For more in-depth insights and comprehensive details: https://www.imarcgroup.com/united-states-regtech-market/requestsample

United States Regtech Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

- Solution

- Services

Deployment Mode Insights:

- Cloud-based

- On-premises

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Application Insights:

- Anti-Money Laundering (AML) and Fraud Management

- Regulatory Intelligence

- Risk and Compliance Management

- Regulatory Reporting

- Identity Management

End User Insights:

- Banks

- Insurance Companies

- FinTech Firms

- IT and Telecom

- Public Sector

- Energy and Utilities

- Others

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=20047&flag=F

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145