India Two-Wheeler Market Overview

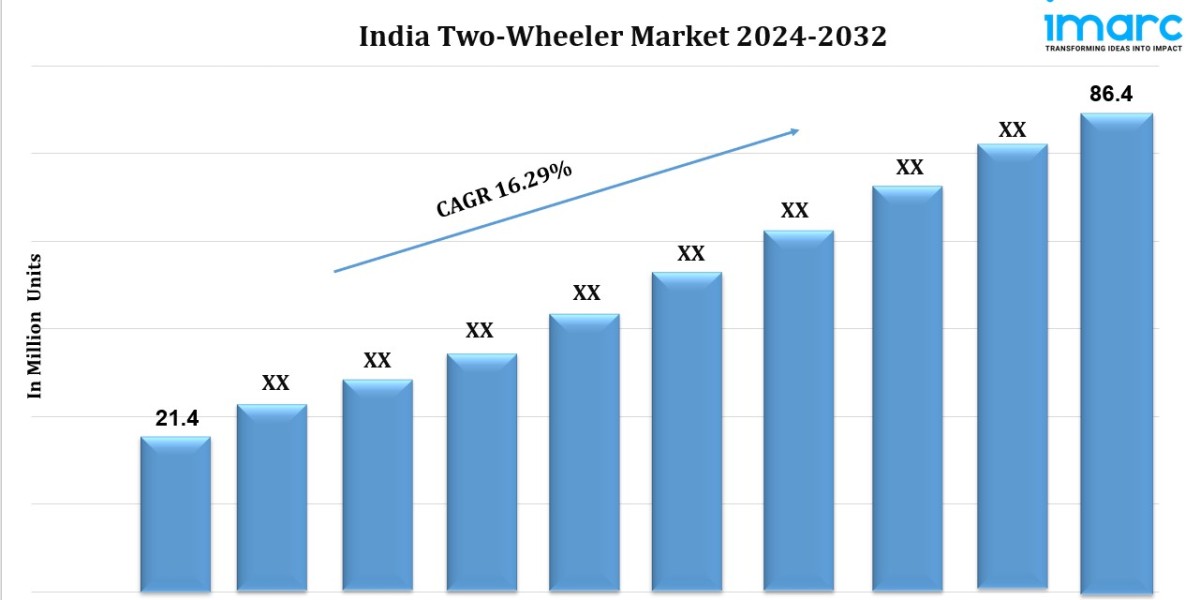

Base Year: 2024

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 16.29% (2024-2032)

Market Size in 2023: 21.4 Million Units

Market Size in 2032: 86.4 Million Units

The India two-wheeler market is expanding quickly due to factors like urbanization, affordability, increased demand, and the growing popularity of electric automobiles. According to the latest report by IMARC Group, the market size reached 21.4 Million Units in 2023. Looking forward, IMARC Group expects the market to reach 86.4 Million Units by 2032, exhibiting a growth rate (CAGR) of 16.29% during 2024-2032.

India Two-Wheeler Market Trends and Drivers:

The India two-wheeler market is undergoing significant transformation, driven by changing consumer behavior and industry dynamics. A key trend is the growing preference for electric two-wheelers, fueled by increased environmental awareness and the demand for sustainable transportation. By 2024, electric vehicles are expected to account for a larger share of sales, supported by higher production and better consumer education on the benefits of electric vehicles.

Technological advancements, such as connectivity, navigation systems, and smart safety features, are becoming more common, attracting tech-savvy consumers. Online sales and digital platforms are also making it easier for people to purchase two-wheelers. Stricter safety regulations are pushing manufacturers to meet higher standards, ensuring that products align with consumer expectations. As the market evolves, increased competition and innovation will offer consumers a wider range of choices and better-quality products.

Urbanization in India is playing a significant role in shaping the two-wheeler market. As more people move to cities for better job opportunities and living conditions, the demand for personal transportation has risen. Two-wheelers are increasingly the preferred option due to their affordability, ease of handling in traffic, and lower running costs compared to cars. Improved urban infrastructure, such as bike lanes and parking facilities, makes owning a two-wheeler even more appealing. This trend is expected to continue as urban populations grow, driving higher demand for two-wheelers as a practical transportation solution.

The shift toward electric vehicles in the India two-wheeler market is largely driven by environmental concerns and government support. Rising fuel prices and the need to reduce carbon emissions are prompting consumers to consider electric models. Government subsidies and improved charging infrastructure are accelerating this transition. In 2024, electric two-wheeler sales are projected to surge, with more models featuring advanced battery technology. This trend aligns with global sustainability goals and appeals to eco-conscious consumers.

As India's economy grows, middle-class incomes are rising, leading to increased demand for premium, feature-rich two-wheelers. Consumers are willing to invest in models that offer advanced technology, safety, and comfort. Social media and digital marketing are also influencing this trend, with younger consumers gravitating toward brands that align with their lifestyle aspirations. Additionally, personalized two-wheelers reflecting individual tastes are gaining popularity, sparking further innovation and competition in the market, which will result in a more diverse range of options for consumers.

Request for a sample copy of this report: https://www.imarcgroup.com/india-two-wheeler-market/requestsample

India Two-Wheeler Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

- Scooters

- Mopeds

- Motorcycle

- Electric Two-Wheeler

Breakup by Technology:

- ICE

- Electric

Breakup by Transmission:

- Manual

- Automatic

Breakup by Engine Capacity:

- <100cc

- 100-125cc

- 126-180cc

- 181-250cc

- 251-500cc

- 501-800cc

- 801-1600cc

- >1600cc

Breakup by Fuel Type:

- Gasoline

- Petrol

- Diesel

- LPG/CNG

- Battery

Breakup by End User:

- Personal

- Commercial

Breakup by Distribution Channel:

- Offline Channels

- Online Channels

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=3991&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145