The POS payment market has witnessed significant growth in recent years, driven by the increasing adoption of electronic payments and the evolution of consumer preferences. As technology advances, businesses are shifting towards seamless, contactless, and mobile-friendly payment systems. With the rise of e-commerce, mobile wallets, and digital payment solutions, the POS payment market is poised for continued growth. This article explores the key drivers of the POS payment market's potential and highlights the opportunities that lie ahead.

Technological Advancements Driving Market Growth

The POS payment market has experienced a surge in demand due to advancements in technology. Traditional payment methods are gradually being replaced by advanced POS systems that offer more secure, efficient, and convenient transactions. With the increasing use of smartphones and smart devices, mobile payment solutions such as Apple Pay, Google Wallet, and Samsung Pay are gaining momentum. These solutions allow customers to make payments using their phones, eliminating the need for physical cards. The integration of near-field communication (NFC) technology has made contactless payments more accessible, boosting adoption among both consumers and businesses.

Moreover, the development of cloud-based POS systems has revolutionized the market. Cloud-based POS systems offer real-time reporting, remote management, and enhanced scalability, making them an attractive option for businesses of all sizes. This shift towards cloud-based solutions has also lowered the barriers to entry for small and medium-sized enterprises (SMEs), allowing them to leverage advanced payment technology without significant upfront investment.

Changing Consumer Preferences and Payment Habits

The shift in consumer behavior plays a crucial role in driving the growth of the POS payment market. Consumers are increasingly looking for faster, more secure, and convenient payment methods. With the rise of e-commerce, consumers expect businesses to provide seamless payment experiences, whether they are shopping online or in-store. The ability to make contactless payments and use mobile wallets aligns with the growing demand for convenience and speed.

Additionally, the growing concern over data security and privacy has prompted businesses to adopt more secure payment solutions. EMV (Europay, MasterCard, and Visa) chip technology, which enhances the security of card-based payments, has been widely adopted across the industry. The implementation of tokenization, end-to-end encryption, and biometric authentication further strengthens security, assuring customers that their payment information is protected.

Global Expansion and Market Opportunities

The POS payment market is not limited to developed regions such as North America and Europe. Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for POS payment providers. The increasing smartphone penetration, rising disposable incomes, and expanding middle class in these regions are contributing to the rapid adoption of digital payment solutions.

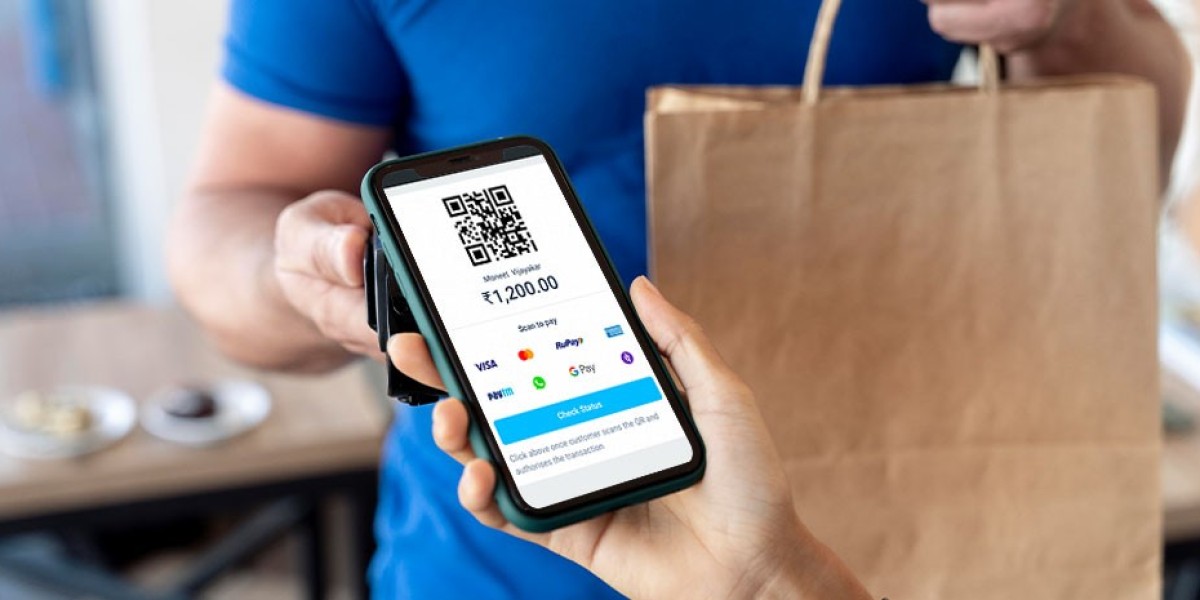

In countries like India and China, mobile wallets and QR code-based payments are gaining traction. The government's push for digitalization, coupled with the adoption of financial inclusion initiatives, is creating a conducive environment for the growth of POS payments. As more consumers in these regions embrace cashless transactions, the demand for POS payment systems is expected to rise.

Furthermore, the global trend toward contactless payments is driving POS payment providers to innovate and offer new features. In regions with high volumes of tourism, POS systems that support multiple currencies and languages are in high demand. By offering solutions tailored to different markets, POS payment providers can tap into a diverse customer base and expand their reach globally.

Regulatory Support and Challenges

Governments and regulatory bodies are playing a vital role in shaping the future of the POS payment market. Regulatory initiatives aimed at improving payment security and promoting digital payment adoption are driving the market forward. For example, the European Union's PSD2 (Revised Payment Services Directive) has facilitated open banking and increased competition in the payments industry. Similarly, the implementation of the Payment Card Industry Data Security Standard (PCI DSS) ensures that payment providers comply with stringent security protocols.

However, despite the positive regulatory environment, the POS payment market faces certain challenges. One of the major hurdles is the lack of infrastructure in some regions, particularly in developing countries. The installation of POS terminals, integration with payment processors, and training of merchants are essential for ensuring widespread adoption. Additionally, businesses must be prepared to handle the costs associated with upgrading their payment systems to keep up with technological advancements.

Conclusion

The POS payment market holds immense potential, driven by technological innovation, changing consumer preferences, and the global shift toward cashless transactions. As businesses and consumers embrace digital payments, the demand for advanced POS systems will continue to rise. While challenges such as infrastructure gaps remain, the opportunities for growth in emerging markets and the increasing need for secure payment solutions present a promising future for the industry. POS payment providers must stay agile and innovative to capitalize on this growing market and meet the evolving needs of both businesses and consumers.