South Korea Reinsurance Market Overview

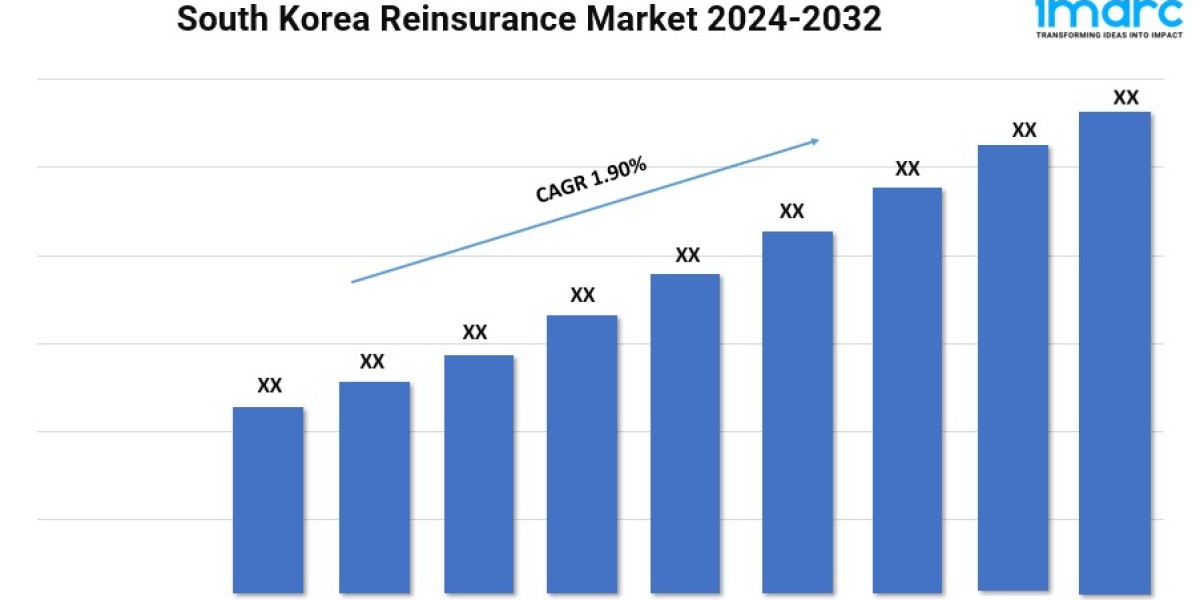

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 1.90% (2024-2032)

The South Korea reinsurance market is expanding rapidly, owing to several interconnected factors. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 1.90% from 2024 to 2032.

Download sample copy of the Report: https://www.imarcgroup.com/south-korea-reinsurance-market/requestsample

South Korea Reinsurance Industry Trends and Drivers:

The South Korea reinsurance market is growing due to various reasons. The complexity and severity of risks borne by primary insurers are on the rise. The instances of natural disasters and the level of their impact have increased over the years, not only because of climate change but also because of the growing interconnection of the global economy. This has caused primary insurers to buy reinsurance coverage to reduce their risk of suffering catastrophic losses and to improve their capital position. However, the other factor that is contributing to the development This has of has led the been to reinsurance spurred rising market on insurance in by premiums the an for Korean aging life region population and is and health the by insurance. development people’s In increasing addition, the concern the Korean for demand insurance for market health, non-life itself. insurance products such as property, casualty, and marine insurance have been growing due to economic development and urbanization, which has also increased the need for reinsurance to manage these increased risks. The regulatory environment in South Korea is also significant. The government targets the solvency and risk management of the insurance sector and recommends that companies engaged in the business adopt good risk management practices, including the use of reinsurance. This regulatory environment, together with the growing concern about financial stability, has forced primary insurers to purchase reinsurance to protect their capital and comply with the regulations.

In addition, the increase in alternative capital sources such as Insurance-Linked Securities (ILS) is also increasing the capacity of the reinsurance market. ILS products like catastrophe bonds and collateralized reinsurance provide traditional reinsurance companies with additional sources of capital, enhance market liquidity, and offer new risk transfer solutions. Finally, the focus on environmental, social, and governance (ESG) factors is influencing the reinsurance market. As companies and regulators move to sustainable risk management practices, there is growing demand for reinsurance solutions that address ESG risks. These include reinsurance products that cover climate-related risks like floods, droughts, and wildfires, as well as those that address social and governance issues. Therefore, the South Korea reinsurance market will continue to expand due to many factors including increasing complexity of risks, expansion of the primary insurance market, technological advances, and rising concerns about sustainability and ESG factors. As insurance companies face the challenges of a changing world, the function of reinsurance in the management of risk and the sustainability of the insurance sector will become more important.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging South Korea reinsurance market trends.

Download sample copy of the Report: Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-proportional Reinsurance

Mode Insights:

- Online

- Offline

Distribution Channel Insights:

- Direct Writing

- Broker

Application Insights:

- Property and Casualty Reinsurance

- Life and Health Reinsurance

- Disease Insurance

- Medical Insurance

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145