Market Overview 2032

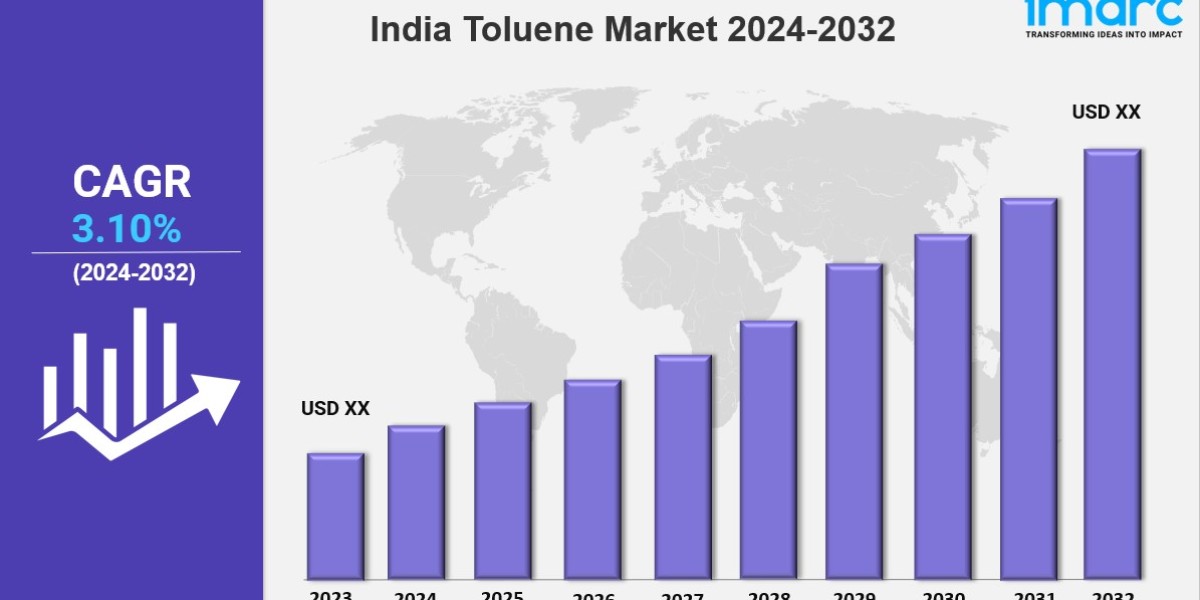

India toluene market size is projected to exhibit a growth rate (CAGR) of 3.10% during 2024-2032. The market is seeing steady growth, driven by increasing demand from industries such as paints, coatings, and chemicals. Its wide range of applications, along with growing industrialization, are key factors contributing to the sector’s expansion.

Key Market Highlights:

✔️ Steady market growth driven by increasing demand from chemical and industrial sectors

✔️ Rising usage in paints, coatings, adhesives, and pharmaceuticals

✔️ Expanding investments in refining capacity and sustainable production methods

Request for a sample copy of the report: https://www.imarcgroup.com/india-toluene-market/requestsample

India Toluene Market Trends and Driver:

The India toluene market is greatly impacted by the rising demand from the paint and coatings industry. Toluene is an essential solvent used in making paints, varnishes, and coatings. Its excellent solvency properties improve the flow and leveling of paint formulations. India's urban growth and fast-paced infrastructure development raise the demand for decorative and industrial coatings.

Government programs promoting construction, like affordable housing and smart city projects, will likely increase toluene use in this area. Additionally, the growing preference for eco-friendly and high-performance coatings pushes manufacturers to innovate. This development further increases the demand for toluene as a key ingredient. This trend will likely continue, strengthening the toluene market in India.

The growth of the automotive sector is a key factor in shaping the India toluene market. Toluene plays a vital role in making automotive paints, adhesives, and sealants. These materials are essential for vehicle production and upkeep. India's automotive industry is growing fast. Higher incomes and a shift toward personal vehicles are driving this growth. As a result, toluene demand is expected to increase.

The government's push for electric and hybrid vehicles creates new opportunities for toluene. Manufacturers seek advanced materials for lighter vehicle parts and eco-friendly coatings. The focus on sustainable solutions and the growing automotive aftermarket may boost the toluene market. As the automotive sector evolves, the demand for toluene will likely rise, creating a more dynamic market.

Regulatory changes are crucial in shaping the toluene market in India. The Indian government is putting more emphasis on environmental sustainability. It aims to cut down on volatile organic compounds (VOCs) in industrial processes. This has resulted in stricter rules about solvents like toluene, particularly in sectors like paints, coatings, and adhesives. These regulations seek to lower air pollution and encourage safer options. But they also pose challenges for manufacturers who rely on toluene.

As a result, the industry is moving toward low-VOC and non-toxic alternatives, which could impact toluene demand. This shift also opens doors for innovation and growth. Companies are adapting to these changes by investing in research and development. They aim to create compliant products while keeping performance standards high. The India toluene market is set for major changes in 2024, driven by key trends.

A major trend is the move toward sustainable solutions in many industries. As awareness of environmental issues rises, manufacturers face pressure to reduce their carbon footprint. They are adopting greener practices. This shift has led to more use of bio-based solvents and alternatives to traditional petrochemical-derived toluene. However, demand for toluene remains strong, especially where its unique properties are needed.

The consistent demand for toluene is increased by the expansion of India's chemical and pharmaceutical sectors. This requirement results from toluene's use as an intermediary and solvent in chemical reactions. The market will remain competitive if the expansion generates new ideas for toluene manufacturing. Growth in the automotive and construction industries would further help toluene demand. As we move into 2024, toluene will continue to play a significant role in India's industrial scene.

India Toluene Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Breakup by Production Process:

- Reformation Process

- Pygas Process

- Coke/Coal Process

- Styrene Process

Breakup by Application:

- Gasoline

- STDP/TPX

- Solvents

- Trans Alkylation (TA)

- Hydrodealkylation

- Toluene Diisocyanate (TDI)

- Toluene Disproportionation (TDP)

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145