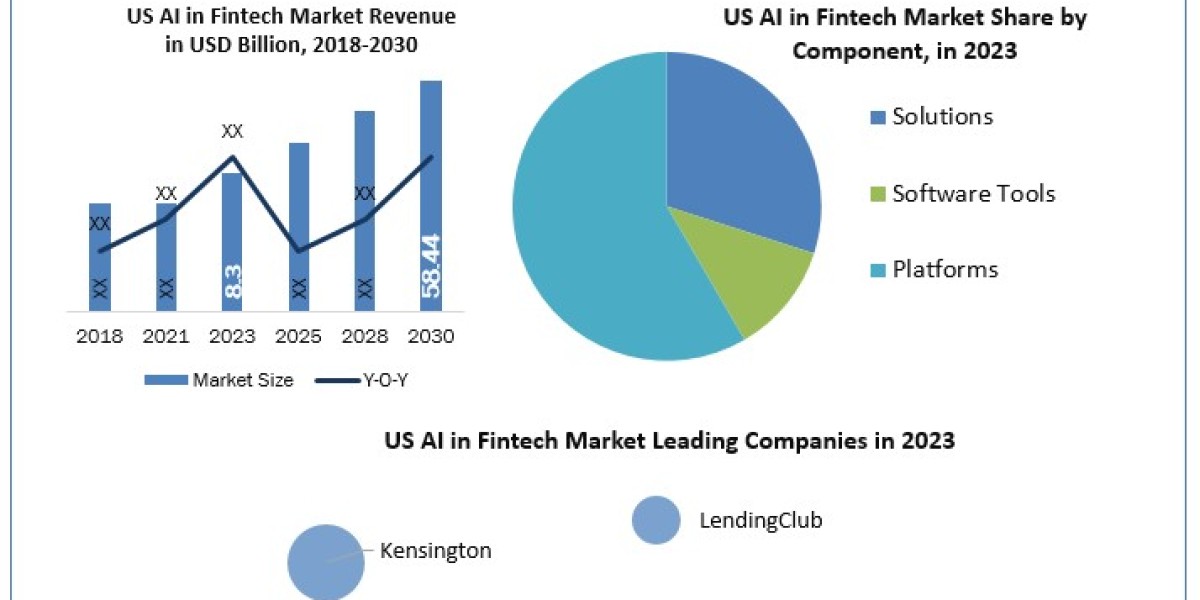

US AI in Fintech Market Demand was valued at USD 8.3 Billion in 2023 and the total US AI in Fintech revenue is expected to grow at a CAGR of 32.16% from 2024 to 2030, reaching nearly USD 58.44 Billion.

Market Estimation & Definition

The U.S. Artificial Intelligence (AI) in Fintech market is experiencing significant growth, driven by the integration of advanced technologies such as AI, blockchain, and big data to enhance financial products and services. In 2023, the market was valued at approximately USD 8.3 billion and is projected to reach nearly USD 58.44 billion by 2030, with a compound annual growth rate (CAGR) of 32.16% from 2024 to 2030. This expansion is attributed to the increasing adoption of AI-driven solutions for personalized financial planning, fraud detection, and operational efficiency within the financial sector.

Grab your free sample copy of this report today! https://www.stellarmr.com/report/req_sample/US-AI-in-Fintech-Market/1565

Market Growth Drivers & Opportunities

Several key factors are propelling the growth of AI in the U.S. fintech market:

Hyper-Personalization of Financial Services: AI enables fintech companies to analyze vast amounts of data, offering personalized financial products and services tailored to individual customer needs. This personalization enhances customer satisfaction and loyalty.

AI-Powered Financial Advisors: The rise of AI-driven financial advisors democratizes access to financial planning and investment strategies, providing users with personalized guidance and improving financial inclusion.

Operational Efficiency and Automation: AI automates routine tasks, reducing operational costs and increasing efficiency for financial institutions. This automation allows for the reallocation of resources to more strategic activities.

Enhanced Risk Management: AI's predictive analytics capabilities enable better risk assessment and fraud detection, safeguarding both institutions and customers.

Data-Driven Decision Making: AI processes large datasets to provide actionable insights, aiding in informed decision-making and strategic planning for fintech companies.

Segmentation Analysis

The U.S. AI in fintech market can be segmented based on several criteria:

By Deployment Mode:

- Cloud-Based Solutions: Offering scalability and flexibility, cloud-based AI solutions are increasingly adopted by fintech firms.

- On-Premises Solutions: Preferred by institutions requiring enhanced control over their AI infrastructure and data security.

By Application:

- Digital Payments: AI enhances transaction security and user experience in digital payment platforms.

- Automated Wealth Management: AI-driven tools provide personalized investment advice and portfolio management.

- Risk and Compliance Management: AI aids in real-time monitoring and compliance with regulatory standards.

- Chatbots and Virtual Assistants: Improving customer service through AI-powered conversational agents.

By End-User:

- Banks: Traditional banking institutions integrating AI to modernize services.

- Insurance Companies: Utilizing AI for claims processing and customer engagement.

- Investment Firms: Employing AI for market analysis and automated trading.

- Payment Processors: Enhancing fraud detection and transaction efficiency through AI.

To explore this subject matter further, please click on the link provided: https://www.stellarmr.com/report/US-AI-in-Fintech-Market/1565

Country-Level Analysis

United States: As a global leader in fintech innovation, the U.S. boasts a dynamic ecosystem of startups and established financial institutions. The country's technological infrastructure, coupled with a culture of innovation, fosters the rapid adoption of AI in financial services. Regulatory bodies are actively engaging with industry stakeholders to balance innovation with consumer protection.

Germany: Germany's fintech sector is experiencing growth, with AI being a significant contributor. The country's strong emphasis on data privacy and stringent regulatory environment influence the development and deployment of AI solutions in financial services. Collaborations between fintech firms and traditional banks are common, aiming to enhance service offerings through AI integration.

Competitive Analysis

The U.S. AI in fintech market is characterized by a mix of established technology giants and innovative startups:

IBM Corporation: Offers AI solutions like Watson, which are utilized by financial institutions for data analysis and customer service enhancement.

Microsoft Corporation: Provides Azure AI services, enabling fintech companies to develop and deploy AI applications efficiently.

Google LLC: Through its AI and machine learning platforms, Google supports fintech firms in creating advanced financial solutions.

NVIDIA Corporation: Supplies AI hardware and software platforms that power complex financial modeling and analytics.

Fintech Startups: Companies like Betterment and Wealthfront leverage AI to offer robo-advisory services, while Stripe utilizes AI for payment processing and fraud detection.

View Popular Topics Now :

Germany AI in FinTech Market https://www.stellarmr.com/report/Germany-AI-in-FinTech-Market/1567

US Digital Payment Market https://www.stellarmr.com/report/US-Digital-Payment-Market/1575

Conclusion

The integration of AI into the U.S. fintech sector is revolutionizing financial services, offering enhanced personalization, efficiency, and security. With a projected CAGR of 32.16% leading to a market size of $58.44 billion by 2030, the future of AI in fintech appears promising. Stakeholders are encouraged to embrace AI technologies to remain competitive and meet evolving customer expectations.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@Stellarmarketresearch.com

+91 20 6630 3320, +91 9607365656