The Forex market is the world's most active market. It is often regarded as the most liquid financial market that continues to grow in popularity among traders, primarily because of its 24/5 trading schedule and diverse trading instruments. However, navigating this market successfully demands more than just enthusiasm. It requires a strategic selection of currency pairs that combine liquidity and volatility.

In this comprehensive guide, we will undertake the most traded currency pairs in 2025 and discuss the factors that make them profitable.

Understanding Forex Currency Pairs

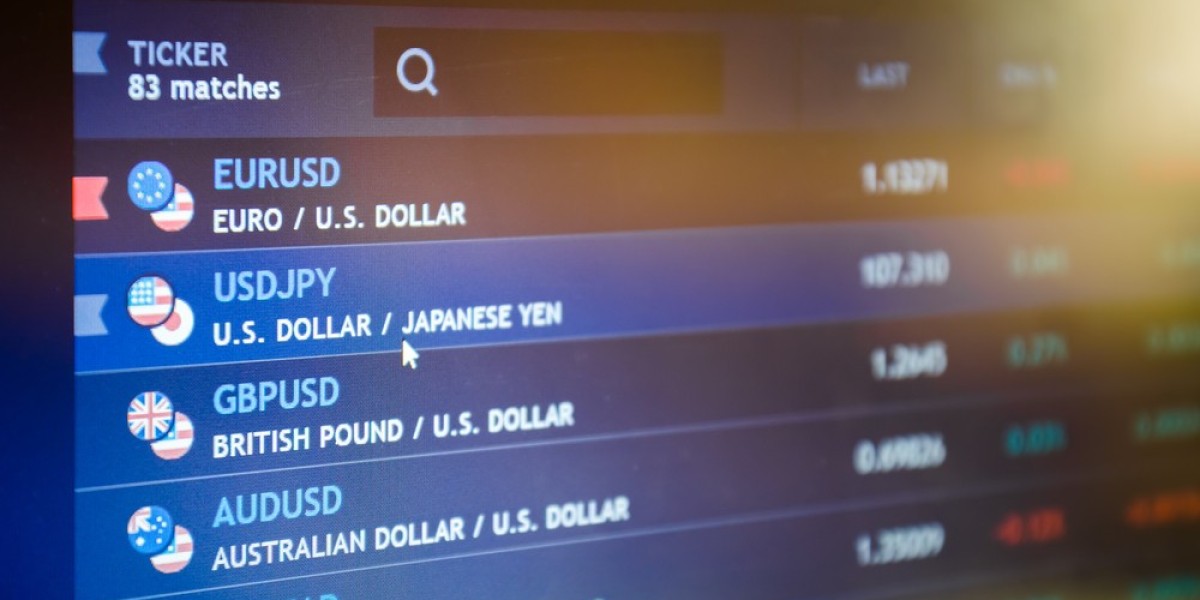

In Forex, currency pairs are divided into three categories, i.e. Major, Minor and Exotic Currency pairs. These are explained below-

- Major Currency Pairs: These are the currency pairs that include the combination of the US Dollar (USD) and other major currencies. They are traded the most and often have high liquidity and lower spreads.

- Minor Currency Pairs: These are the currency pairs that include currencies from strong economies but exclude the USD, such as EUR/GBP or AUD/NZD. They have decent liquidity but slightly higher spreads than major pairs.

- Exotic Currency Pairs: These include a combination of a major currency with a currency from an emerging or smaller economy, such as USD/TRY (US Dollar/Turkish Lira). These pairs can exhibit extreme volatility and less liquidity.

Top Forex pairs to trade in 2025

Since there are multiple currency pairs to trade, choosing the right one is essential to maximize profits. Selecting the best pair for online forex trading involves assessing your trading goals, risk tolerance, and market conditions. Additionally, using a trusted online forex trading platform can streamline your analysis and execution for better results. These are explained below-

- Liquidity: High liquidity pairs ensure smoother trades with lower transaction costs.

- Volatility: The currency pairs with higher volatility offer more opportunities for profit but also come with magnified risk.

- Market Trends: Analyse the economic and geopolitical trends that may impact the value of specific currencies.

- Trading Sessions: Certain pairs perform better during specific trading sessions like the London or New York sessions.

- Correlation with Other Assets: Some pairs correlate with commodities or stock indices, providing hedging opportunities.

Top Forex Pairs to Trade in 2025

Now that we are aware of the factors to consider while selecting the top Forex pairs, let’s dive into the best Forex pairs to trade in 2025 based on these considerations—

EUR/USD (Euro/US Dollar)

The EUR/USD remains one of the most traded currency pairs worldwide due to its high liquidity and tight spreads. The pair is highly influenced by the policies of the European Central Bank (ECB) and the US Federal Reserve.

Here is why to trade EUR/USD in 2025:

- Continued economic recovery in Europe post-pandemic.

- Influence of U.S. monetary policy adjustments.

- High trading volume ensures better technical analysis opportunities.

USD/JPY (US Dollar/Japanese Yen)

Because of consistent trading volumes and volatility, US Dollar/Japanese Yen remains a favourite choice of traders. It often attracts traders seeking stability amid global market fluctuations.

Here is why to trade USD/JPY in 2025:

- Japan’s unique monetary policies and low interest rates make this pair predictable.

- High liquidity ensures favourable trading conditions.

- Strong reaction to geopolitical events in Asia and the U.S.

GBP/USD (British Pound/US Dollar)

The GBP/USD also referred to as “Cable”, is highly reactive to economic data releases and political developments in the UK and the U.S.

Here is why to trade GBP/USD in 2025:

- Post-Brexit trade deals shaping the UK’s economy.

- Frequent price fluctuations create multiple trading opportunities.

- Strong market interest in the pound's performance against the dollar.

AUD/USD (Australian Dollar/US Dollar)

The AUD/USD is often called a commodity pair because of its correlation with raw material exports like iron ore and gold.

Here is why to trade AUD/USD in 2025:

- Australia’s robust commodity-driven economy.

- Global demand for natural resources influences this pair’s value.

- Ideal for traders who analyse commodity trends alongside Forex.

USD/CAD (US Dollar/Canadian Dollar)

The USD/CAD is another commodity-linked pair, with its value strongly influenced by crude oil prices.

Here is why to trade USD/CAD in 2025:

- Canada’s reliance on oil exports makes this pair sensitive to crude oil price fluctuations.

- Stable economic relations between Canada and the U.S. ensure consistency in trade patterns.

- Ideal for pairing Forex strategies with commodity insights.

Conclusion

To conclude, the Forex market will continue to offer numerous opportunities for traders to capitalize on volatility and liquidity in 2025.

The most traded currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, will remain to be reliable choices due to their stability and predictable trends. Meanwhile, pairs like AUD/USD and USD/CAD will attract traders with an eye on commodities. By understanding the dynamics of these pairs and aligning them with your trading strategies, you can navigate the Forex market effectively in 2025.