Key Market Insights

- With over 195 candidates under development, mRNA therapeutics and mRNA Vaccines Market currently represents one of the fastest growing drug classes in the pharmaceutical market

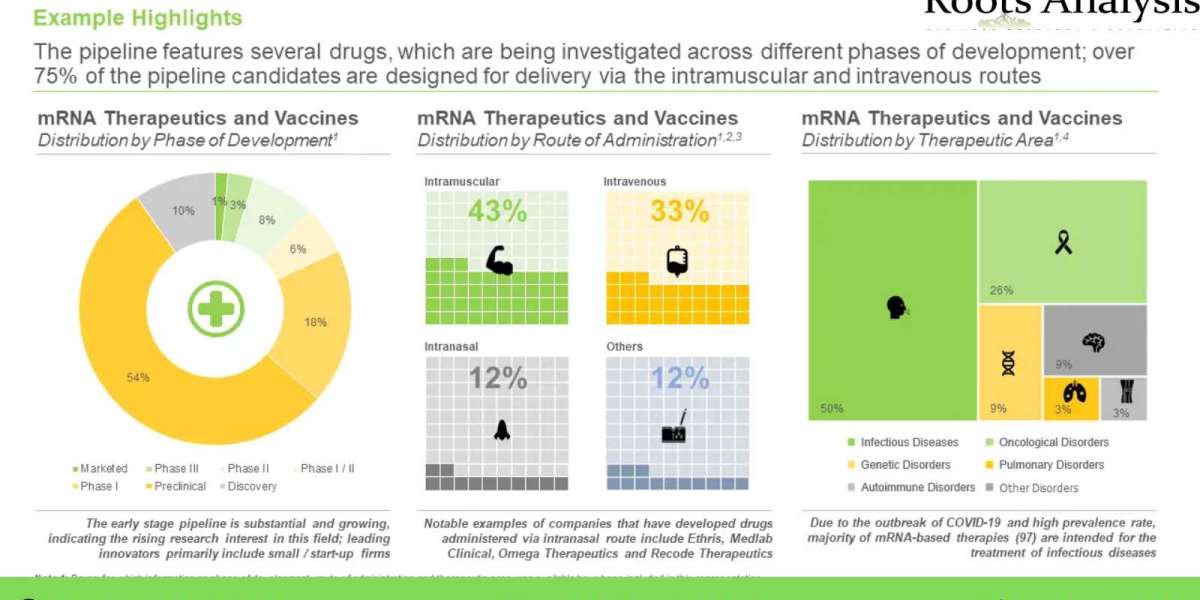

- The pipeline features several drugs, which are being investigated across different phases of development; over 75% of the pipeline candidates are designed for delivery via the intramuscular and intravenous routes

- Stakeholders are actively upgrading their existing capabilities to further enhance their respective product pipeline and comply to the evolving industry benchmarks

- Presently, around 17 start-ups are driving innovation in this domain; various RD initiatives have been undertaken by these players over the last few years

- More than 345,000 patients have been recruited / enrolled in clinical trials registered for this novel class of therapies, across different geographies

- Over 430 patents related to mRNA therapeutics and vaccines have recently been filed / granted by industry and non-industry stakeholders, indicating the widening intellectual capital in this domain

- The growing interest is evident from the rise in partnership activity, since 2021; clinical trial agreements has emerged as the most common type of partnership model adopted by drug developers

- Several investors, having realized the opportunity within this upcoming segment, have invested over USD 11 billion across various funding rounds in the past nine years

- Big pharma players have undertaken several initiatives, ranging from proprietary product development to strategic investments, to tap the lucrative opportunity in this rapidly growing market

- The market’s evolution is likely to be driven by the rising need for novel drug candidates; we expect the future opportunity to be well distributed across various routes of administration, therapeutic areas and key regions

To get a sample copy of the latest market report, visit

https://www.rootsanalysis.com/reports/mrna-therapeutics-and-vaccines-market/request-sample.html

Table of Contents

PREFACE

1.1. Scope of the Report

1.2. Market Segmentation

1.3. Research Methodology

1.4. Key Questions Answered

1.5. Chapter Outlines

- EXECUTIVE SUMMARY

- INTRODUCTION

3.1. Chapter Overview

3.2. mRNA Therapeutics

3.2.1. Advantages of mRNA Therapeutics

3.2.2. Key Applications of mRNA Therapeutics

3.3. mRNA Vaccines

3.3.1. Advantages of mRNA Vaccines

3.3.2. Key Applications of mRNA Vaccines

3.4. mRNA Delivery Routes

3.5. mRNA Delivery Strategies

3.6. Key Challenges Associated with mRNA Therapeutics and Vaccines

3.7. Future Perspectives

- MARKET OVERVIEW

4.1. Chapter Overview

4.2. mRNA Therapeutics and Vaccines: Overall Market Overview

4.2.1. Analysis by Phase of Development

4.2.2. Analysis by Type of Drug Candidate

4.2.3. Analysis by Therapeutic Area

4.2.4. Analysis by Phase of Development and Therapeutic Area

4.2.5. Analysis by Type of Delivery System Used

4.2.6. Analysis by Type of Molecule Encoded

4.2.7. Analysis by Route of Administration

4.2.8. Analysis by Therapeutic Area and Route of Administration

4.2.9. Analysis by Phase of Development, Therapeutic Area and Route of Administration (Grid Representation)

- COMPETITIVE LANDSCAPE

5.1. mRNA Therapeutics and Vaccines: List of Developers

5.1.1. Analysis by Year of Establishment

5.1.2. Analysis by Company Size

5.1.3. Analysis by Location of Headquarters

5.1.4. Key Players: Analysis by Number of Drug Candidates

5.1.5. Key Players: Analysis by Number of Drug Candidates and Phase of Development

5.1.6. Key Players: Analysis by Number of Drug Candidates and Therapeutic Area

5.1.7. Analysis by Year of Establishment, Company Size and Location of Headquarters (Heat Map Representation)

5.1.8. mRNA Therapeutics and Vaccines: Analysis by Phase of Development and Location of Headquarters (Regional Landscape)

- COMPANY COMPETITIVENESS ANALYSIS

6.1. Chapter Overview

6.2. Key Assumptions and Parameters

6.3. Methodology

6.4. mRNA Therapeutics and Vaccines Developers: Company Competitive Analysis

6.5. mRNA Therapeutics and Vaccines Developers based in North America

6.6. mRNA Therapeutics and Vaccines Developers based in Europe

6.7. mRNA Therapeutics and Vaccines Developers based in Asia-Pacific and Rest of the World

- DRUG PROFILES

7.1. Chapter Overview

7.2. BNT162b2 (BioNTech / Pfizer)

7.2.1. Drug Overview

7.3. GEMCOVAC-19 (Gennova)

7.3.1. Drug Overview

7.4. mRNA-1273 (Moderna)

7.4.1. Drug Overview

7.5. LUNAR-COV19 (Arcturus Therapeutics)

7.5.1. Drug Overview

7.6. CVnCOV (CureVac)

7.6.1. Drug Overview

7.7. mRNA-1010 (Moderna)

7.7.1. Drug Overview

7.8. mRNA-1345 (Moderna)

7.8.1. Drug Overview

7.9. mRNA-1647 (Moderna)

7.9.1. Drug Overview

7.10. ARCoV (Walvax)

7.10.1. Drug Overview

- BIG PHARMA INITIATIVES

8.1. Chapter Overview

8.2. Scope and Methodology

8.3. mRNA Related Initiatives of Big Pharmaceutical Players

8.3.1. Analysis by Portfolio Diversity

8.3.2. Analysis by Phase of Development

8.3.3. Analysis by Target Therapeutic Areas

8.4. Benchmark Analysis of Big Pharmaceutical Players

8.4.1. Spider Web Analysis: Amgen

8.4.2. Spider Web Analysis: AstraZeneca

8.4.3. Spider Web Analysis: Bayer

8.4.4. Spider Web Analysis: BioNTech

8.4.5. Spider Web Analysis: Eli Lilly

8.4.6. Spider Web Analysis: Gilead Sciences

8.4.7. Spider Web Analysis: GlaxoSmithKline

8.4.8. Spider Web Analysis: Merck

8.4.9. Spider Web Analysis: Moderna

8.4.10. Spider Web Analysis: Novartis

8.4.11. Spider Web Analysis: Novo Nordisk

8.4.12. Spider Web Analysis: Pfizer

8.4.13. Spider Web Analysis: Roche

8.4.14. Spider Web Analysis: Sanofi

8.4.15. Spider Web Analysis: Takeda

- START-UP HEALTH INDEXING

9.1. Chapter Overview

9.2. Start-ups focused on mRNA Therapeutics and Vaccines

9.2.1. Analysis by Location of Headquarters

9.3. Benchmarking of Start-ups

9.4. Startup-Health Indexing

9.4.1. Analysis by Supplier Strength

9.4.2. Analysis by Pipeline Maturity

9.4.3. Analysis by Pipeline Strength

9.4.4. Analysis by Financial Investments

9.4.5. Analysis by Partnership Activity

9.4.6. Start-ups Health Indexing: Roots Analysis Perspective

- CLINICAL TRIAL ANALYSIS

10.1. Chapter Overview

10.2. Scope and Methodology

10.3. mRNA Therapeutics and Vaccines: Clinical Trial Analysis

10.3.1. Analysis by Trial Registration Year

10.3.2. Analysis by Trial Status

10.3.3. Analysis by Trial Phase

10.3.4. Analysis by Trial Registration Year and Trial Status

10.3.5. Analysis by Trial Registration Year and Trial Phase

10.3.6. Analysis by Trial Status and Trial Phase

10.3.7. Analysis of Enrolled Patient Population by Trial Registration Year

10.3.8. Analysis by Study Design

10.3.9. Analysis by Type of Sponsor / Collaborator

10.3.10. Most Active Players: Analysis by Number of Registered Trials

10.3.11. Analysis by Therapeutic Area

10.3.12. Analysis by Number of Registered Trials and Geography

10.3.13. Analysis by Number of Registered Trials, Trial Status and Geography

10.3.14. Analysis of Enrolled Patient Population by Geography

- PARTNERSHIPS AND COLLABORATIONS

11.1. Chapter Overview

11.2. Partnership Models

11.3. mRNA Therapeutics and Vaccines: Partnerships and Collaborations

11.3.1. Analysis by Year of Partnership

11.3.2. Analysis by Type of Partnership

11.3.3. Analysis by Year and Type of Partnership

11.3.4. Analysis by Therapeutic Area

11.3.5. Analysis by Type of Partnership and Therapeutic Area

11.3.6. Most Active Players: Analysis by Number of Partnerships

11.3.7. Regional Analysis

11.3.7.1. Intercontinental and Intracontinental Agreements

11.3.7.2. Local and International Agreements

- FUNDING AND INVESTMENT ANALYSIS

12.1. Chapter Overview

12.2. Types of Funding

12.3. mRNA Therapeutics and Vaccines: Funding and Investment

12.3.1. Analysis by Cumulative Year-wise Trend of Funding Instances

12.3.2. Analysis by Cumulative Year-wise Trend of Amount Invested

12.3.3. Analysis by Type of Funding

12.3.4. Analysis by Year and Type of Funding

12.3.5. Analysis of Number of Funding Instances and Amount Invested by Therapeutic Area

12.3.6. Analysis of Number of Funding Instances and Amount Invested by Geography (Continent-wise)

12.3.7. Regional Analysis of Number of Funding Instances (Country-wise)

12.3.8. Most Active Players: Analysis by Number of Funding Instances

12.3.9. Most Active Players: Analysis by Total Amount Raised

12.3.10 .Most Active Investors: Analysis by Number of Funding Instances

12.3.11. Analysis of Amount Invested by Year and Type of Funding (Grid Representation)

- PATENT ANALYSIS

13.1. Chapter Overview

13.2. Scope and Methodology

13.3. mRNA Therapeutics and Vaccines: Patent Analysis

13.3.1. Analysis by Type of Patent

13.3.2. Analysis by Patent Publication Year

13.3.3. Analysis of Granted Patents by Publication Year

13.3.4. Analysis of Filed Patents by Publication Year

13.3.5. Analysis of Year-wise Filed Patent Applications and Granted Patents

13.3.6. Analysis by Publication Year and Type of Applicant

13.3.7. Analysis by Patent Issuing Authority

13.3.8. Analysis by Patent Age

13.3.9. Analysis by CPC Symbols

13.3.10. Leading Players: Analysis by Number of Patents

13.3.11. Leading Inventors: Analysis by Number of Patents

13.4. mRNA Therapeutics and Vaccines: Patent Benchmarking Analysis

13.4.1. Analysis by Patent Characteristics

13.5. mRNA Therapeutics and Vaccines: Patent Valuation Analysis

- MARKET FORECAST AND OPPORTUNITY ANALYSIS

14.1. Chapter Overview

14.2. Key Assumptions and Methodology

14.3. Global mRNA Therapeutics and Vaccines Market, 2022-2035

14.3.1. mRNA Therapeutics and Vaccines Market: Analysis by Route of Administration, 2022, 2030, 2035

14.3.2. mRNA Therapeutics and Vaccines Market: Analysis by Therapeutic Area, 2022, 2030, 2035

14.3.3. mRNA Therapeutics and Vaccines Market: Analysis by Geography, 2022, 2030, 2035

14.3.3.1. mRNA Therapeutics and Vaccines Market in North America, 2022-2035

14.3.3.2. mRNA Therapeutics and Vaccines Market in Europe, 2022-2035

14.3.3.3. mRNA Therapeutics and Vaccines Market in Asia-Pacific, 2022-2035

14.3.3.4. mRNA Therapeutics and Vaccines Market in Latin America, 2022-2035

14.3.3.5. mRNA Therapeutics and Vaccines Market in Middle East and North Africa, 2022-2035

14.4. mRNA Therapeutics and Vaccines Market: Value Creation Analysis

14.5. mRNA Therapeutics and Vaccines Market: Product-wise Sales Forecasts

14.5.1. COMIRNATY

14.5.1.1. Target Patient Population

14.5.1.2. Sales Forecast

14.5.1.3. Net Present Value

14.5.1.4. Value Creation Analysis

14.5.2. Spikevax

14.5.2.1. Target Patient Population

14.5.2.2. Sales Forecast

14.5.2.3. Net Present Value

14.5.2.4. Value Creation Analysis

14.5.3. GEMCOVAC-19

14.5.3.1. Target Patient Population

14.5.3.2. Sales Forecast

14.5.3.3. Net Present Value

14.5.3.4. Value Creation Analysis

14.5.4. ARCoV

14.5.4.1. Target Patient Population

14.5.4.2. Sales Forecast

14.5.4.3. Net Present Value

14.5.4.4. Value Creation Analysis

14.5.5. CVnCoV

14.5.5.1. Target Patient Population

14.5.5.2. Sales Forecast

14.5.5.3. Net Present Value

14.5.5.4. Value Creation Analysis

14.5.6. ARCT-154

14.5.6.1. Target Patient Population

14.5.6.2. Sales Forecast

14.5.6.3. Net Present Value

14.5.6.4. Value Creation Analysis

14.5.7. mRNA-1647

14.5.7.1. Target Patient Population

14.5.7.2. Sales Forecast

14.5.7.3. Net Present Value

14.5.7.4. Value Creation Analysis

14.5.8. mRNA-1345

14.5.8.1. Target Patient Population

14.5.8.2. Sales Forecast

14.5.8.3. Net Present Value

14.5.8.4. Value Creation Analysis

14.5.9. mRNA-1010

14.5.9.1. Target Patient Population

14.5.9.2. Sales Forecast

14.5.9.3. Net Present Value

14.5.9.4. Value Creation Analysis

- CONCLUSION

- EXECUTIVE INSIGHTS

16.1. Chapter Overview

16.2. eTheRNA Immunotherapies

16.2.1. Company Snapshot

16.2.2. Interview Transcript: David Ricketts (Director, Business Development)

- APPENDIX I: TABULATED DATA

- APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link

https://www.rootsanalysis.com/reports/mrna-therapeutics-and-vaccines-market.html

You may also be interested in the following titles:

Oral Proteins and Peptides Market

Single-Use Upstream Bioprocessing Technology / Equipment Market

You may also like to learn what our experts are sharing in Roots educational series:

Cell Therapy – The Revolutionary Therapeutic Modality: All Set To Obliterate Oncological Disorders |

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Contact:

Ben Johnson

+1 (415) 800 3415