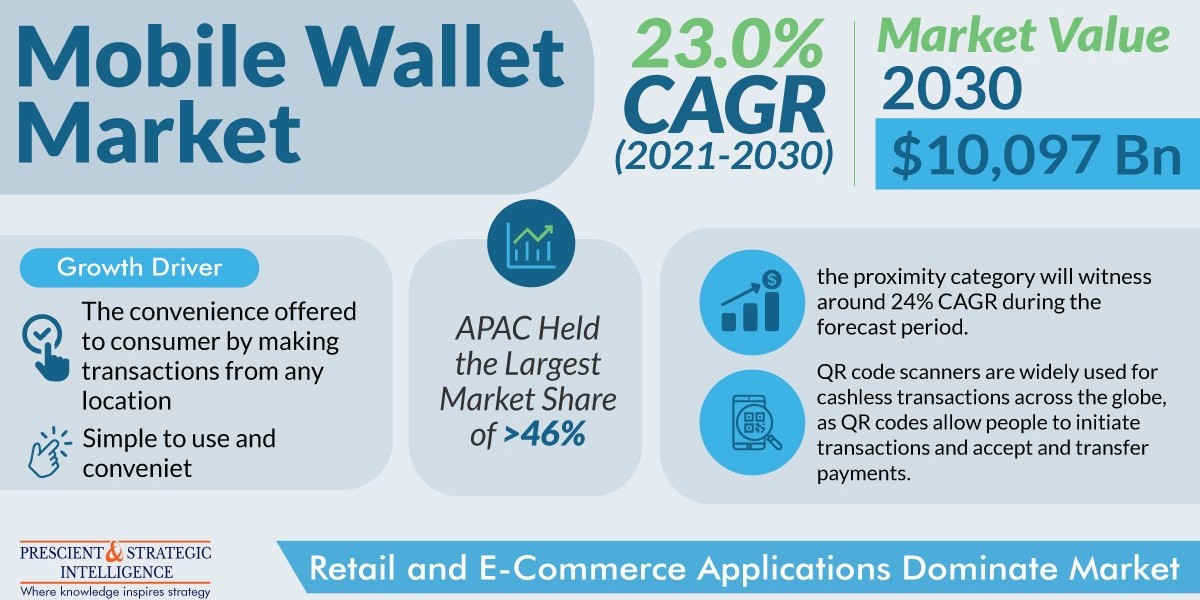

The total value of the mobile wallet market was USD 1,568 billion in 2021, and it will rise at a growth rate of above 23% in the near future, to reach USD 10,097 billion by 2030, according to P&S Intelligence.

This can be credited to the ease provided to customers by this technology to do transactions from any place at any time. It enables consumers to manage their payment accounts with no trouble, with rapid funds transfer.

Through the utilization of mobile-proximity payment and near-field communication, the mobile wallet technology provides ease, thus, the proximity category will experience approximately 24% CAGR in the coming few years. This technology delivers personalized services for online shopping and payment requirements.

NFC-empowered devices make it simpler for customers to do purchases at the nearest point of sale (POS), without the need to carry money or wait in a line for a long-time. Hence, clientele's ease in handling and accessing their payment accounts makes an opportunity for the industry to develop.

QR code scanners are extensively utilized for cashless transactions throughout the world, as QR codes permit individuals to do transactions and accept and transfer money. This real-time channel enables the exchange of essential data in seconds, which is why it grips an industry share of approximately 47%.

In 2021, the retail and e-commerce category held the largest revenue share, at approximately 33%. This can be credited to the rising adoption of mobile wallets among vendors and online platforms. Vendors are concentrating on contactless payment systems in order to get customer buying activity data in real-time.

Asia-Pacific dominates the mobile wallet market, majorly due to the growing adoption of smartphones and the internet. Moreover, with the rising 5G penetration across the region, the connectivity and speed of the internet are enhancing.

APAC is leading the market, mainly because of the rising acceptance of smart mobiles and the internet. Furthermore, with the increasing 5G dispersion throughout the globe, the connectivity and speediness of the internet are advanced.

The ability of mobile wallets to store account info for doing the transaction is supporting them to gain popularity, as they make it simple to maintain payments, take part in faithfulness programs, track transactions, and enjoy other benefits. Moreover, carrying ATM cards and other monetary documents is no longer needed.

The operators can keep an eye on their payment history by utilizing transaction-associated credentials, like debit card credentials and bank account data, as well as non-payment-associated info, like specifics of loyalty cards and promotional tickets.

Hence, the ease provided to customers by this technology to do transactions from any place at any time, are the factor contributing to the growth of the mobile wallet market.