Report Overview

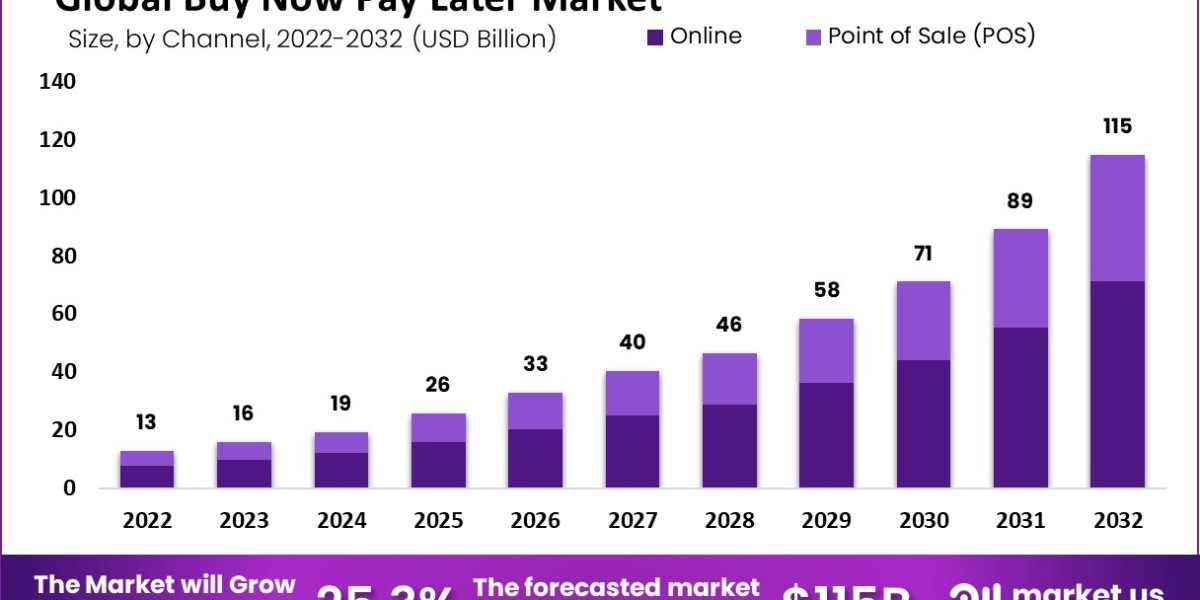

In 2022, the global Buy Now Pay Later market was valued at US$ 13 Billion. Between 2023 and 2032, this market is estimated to register a CAGR of 25.3%.

The buy now pay later option helps consumers purchase online or in-store without making complete payments. Factors like digitization, increasing merchant adoption, and repeat usage by younger consumers are surging the market. Younger consumers benefit from paying for stationery products for buying high-cost products like laptops, smartphones, smart TV, etc. BNPL services offer a fixed payment schedule, a simplified checkout process, zero interest, and fast approval options to customers looking to make purchases.

Read more: https://market.us/report/buy-now-pay-later-market/

Key Takeaways:

Convenience at Your Fingertips: BNPL services offer shoppers the freedom to buy products immediately without the burden of paying the full price upfront. This flexibility attracts many customers who might not have been able to make these purchases otherwise.

Interest-Free Options: Many BNPL providers offer interest-free installment plans, making it an affordable choice for budget-conscious shoppers. This can be a great alternative to traditional credit cards, which often come with high-interest rates.

Easy Application Process: Signing up for a BNPL service is typically quick and straightforward, requiring minimal documentation. This accessibility has contributed to its widespread adoption.

Diverse Merchant Partnerships: BNPL services have partnered with numerous online and offline retailers, allowing customers to use this payment method for a wide range of products and services.

Consumer Protection: BNPL providers often offer consumer protection features, such as refunds and dispute resolution, giving shoppers peace of mind when making purchases.

Market Trend:

The BNPL market has witnessed significant growth in recent years, and this trend is expected to continue. Here are some noteworthy market trends:

Expanding Market Reach: BNPL services are no longer limited to online shopping. They are now being integrated into physical stores, enabling customers to use BNPL for in-store purchases as well.

Global Expansion: BNPL providers are expanding their services to new markets around the world. This globalization is making BNPL accessible to a broader range of consumers.

Partnerships and Acquisitions: To stay competitive, BNPL companies are forming strategic partnerships and making acquisitions. This not only helps them expand their customer base but also enhances the range of products and services they can offer.

Regulatory Scrutiny: As the BNPL market grows, regulators are paying closer attention to ensure consumer protection and financial stability. This may lead to new regulations in the future to safeguard consumers.