In the quickly evolving world of cryptocurrencies, the creation and launch of new tokens have become commonplace. Crypto enthusiasts, developers, and entrepreneurs are eager to ride the digital currency wave and create their own crypto token development company. However, amidst the excitement, it's crucial to acknowledge the inherent risks associated with crypto token development. In this blog post, we will delve into these risks and learn from the experiences of industry experts who have navigated these treacherous waters.

Understanding the Crypto Token Development Landscape

Before we explore the risks, let's establish a foundation for crypto token development. Cryptocurrencies are decentralized digital assets, and tokens are a fundamental component of many blockchain ecosystems. Tokens can represent various assets, including utility, security, and non-fungible tokens (NFTs). To create a successful token, developers must navigate complex technical, legal, and financial landscapes.

Risk 1: Security Vulnerabilities

One of the first risks in crypto token development is security vulnerabilities. Smart contracts, which underpin many tokens, can contain coding errors that may lead to vulnerabilities. These vulnerabilities can be exploited by malicious actors, resulting in significant financial losses.Industry experts stress the importance of exact security audits and testing during the development process. Collaborating with cybersecurity professionals and conducting thorough code reviews can help mitigate this risk.

Risk 2: Regulatory Compliance

Navigating the ever-evolving regulatory landscape is another challenge in crypto token development. Different jurisdictions have varying rules and regulations, and non-compliance can lead to legal consequences.Experts emphasize the need for a comprehensive understanding of local and international regulations. Engaging legal counsel well-versed in cryptocurrency laws can help ensure that your token complies with all necessary requirements.

Risk 3: Market Volatility

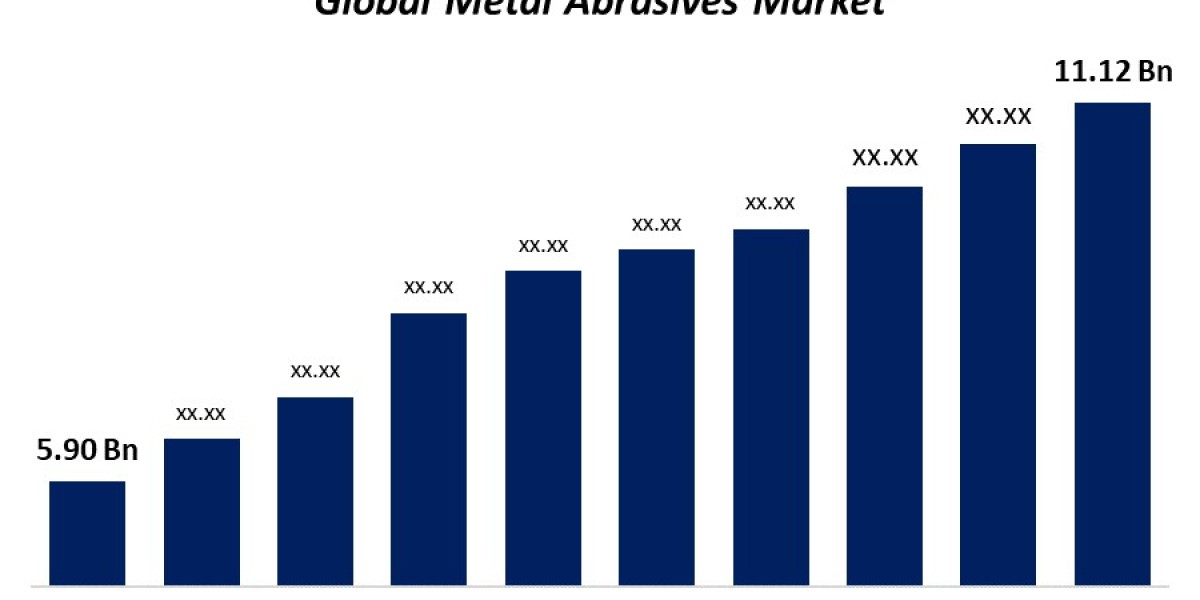

The cryptocurrency market is known for its extreme volatility. Token prices can skyrocket or plummet in a matter of minutes, posing a significant risk to token holders and developers.To mitigate this risk, experts advise prudent financial planning and risk management. Creating a clear tokenomics model and establishing mechanisms to stabilize token prices can provide a safety net against market turbulence.

Risk 4: Lack of Adoption

In the highly competitive world of crypto, not all tokens gain broad adoption. Many promising projects fail to gain traction due to lack of interest, competition, or inadequate marketing efforts.Experts recommend a comprehensive marketing strategy that includes community engagement, partnerships, and a clear value proposition. Building a loyal user base and fostering a vibrant ecosystem around your token can increase its chances of success.

Risk 5 : Team and Governance Issues

A strong and capable team is essential for the success of any crypto project. However, internal conflicts, leadership issues, or a lack of transparency can pose significant risks.Experts stress the importance of assembling a skilled and dedicated team and establishing clear governance structures. Transparency and open communication within the team can help prevent internal issues from derailing the project.

Conclusion: Learning from Experts

In the world of crypto token development, avoiding risks is paramount to success. By learning from the experiences of industry experts, we can better prepare ourselves to navigate the complex and ever-changing landscape of cryptocurrency. From prioritizing security and compliance to mastering tokenomics and marketing, these lessons from the experts can guide us toward creating and launching tokens that stand the test of time.

In following posts, we will delve deeper into each of these risks, providing actionable insights and real-world examples to help you on your crypto token development journey. Stay tuned for more valuable information from the experts in the field.