Ever wondered what would happen if you faced a medical emergency while savoring the delights of Paris or exploring the ruins of Machu Picchu? Travel medical insurance is your unsung hero in such scenarios, a silent guardian that ensures peace of mind. Let's dive deep into understanding this crucial travel companion, ensuring you're as prepared for your journey as you are excited.

Decoding Travel Medical Insurance: What Does It Really Cover?

When you're gearing up for an adventure or a relaxing getaway, the last thing on your mind is probably insurance. However, knowing what your travel medical insurance covers is as essential as packing your passport. This isn't just another item on your checklist; it's a shield protecting you against unexpected medical costs.

The Basics: What's Covered?

Imagine this: you're hiking in the Swiss Alps, and you slip, twisting your ankle. Here's where your insurance steps in. Most plans cover:

- Emergency Medical Expenses: From that twisted ankle to more serious conditions, your plan has got you covered.

- Emergency Evacuation: If you need to be airlifted to a hospital, you won’t have to worry about the hefty cost.

- Repatriation: Should the worst happen, your remains can be returned home, easing the burden on your loved ones.

What's Not Covered: Reading the Fine Print

However, it's not a catch-all safety net. Most policies won’t cover:

- Pre-existing conditions, unless specified.

- Injuries from high-risk activities, unless you’ve opted for additional coverage.

- Travel for medical treatment or cosmetic surgery.

Knowing these details can save you from unexpected surprises during your travels.

Choosing the Right Travel Medical Insurance Plan

Now that you know what travel medical insurance entails, how do you pick the right one? It’s not a one-size-fits-all; your perfect plan depends on your travel style, destination, and personal health.

Factors to Consider

- Destination: Trekking in Nepal? You might want higher coverage limits.

- Duration of Trip: Longer trips might require more comprehensive plans.

- Personal Health: Consider any medical conditions you have.

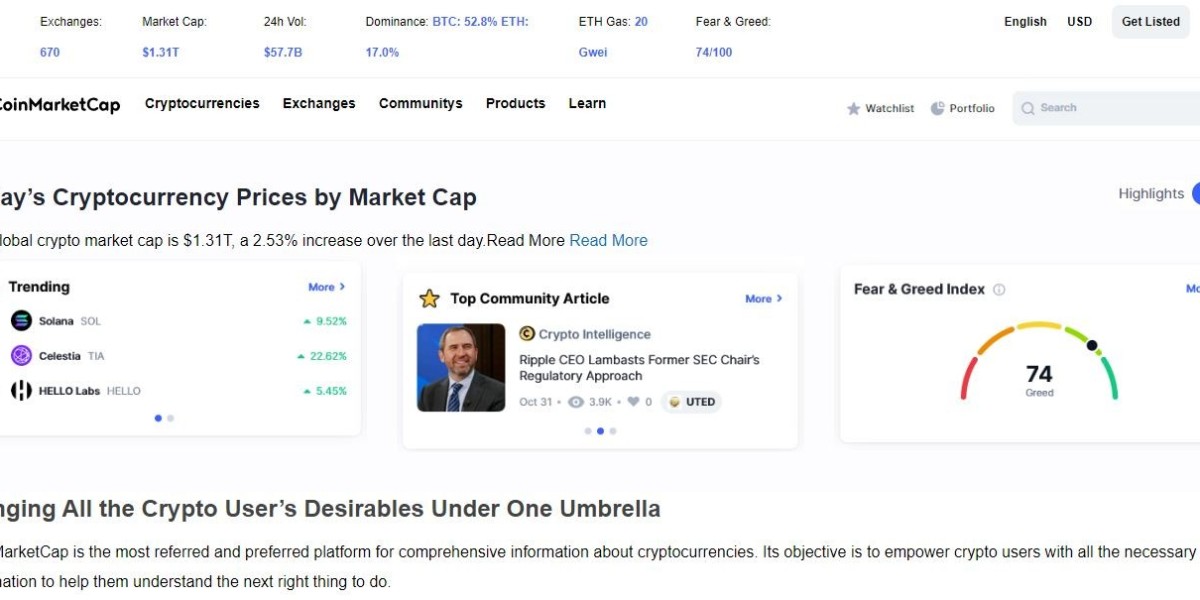

Tips for Comparison

- Read Reviews: What have others said about their experience with the insurer?

- Compare Plans: Don’t just look at the price. Compare what’s covered.

- Understand the Claim Process: Ensure it’s straightforward and hassle-free.

The Process of Claiming Your Travel Medical Insurance

You've chosen your plan, but how does claiming work? It’s simpler than you think.

Filing a Claim: The Steps

- Get Documentation: Keep all medical reports, bills, and receipts.

- Contact the Insurer: Do this as soon as possible.

- Submit Your Claim: Fill out the necessary forms and attach your documentation.

Effective Communication

Stay in touch with your insurance provider throughout the process. Clear and timely communication can speed up your claim.

Real-Life Scenarios: Why Travel Medical Insurance Matters

Let's look at some real-life examples:

- Case Study 1: John, skiing in Canada, broke his leg. His insurance covered the hospital bills and an emergency flight home.

- Case Study 2: Sarah, without insurance in Thailand, faced a huge bill for treating food poisoning.

These stories highlight the difference insurance can make.

Conclusion

Travel medical insurance is an essential aspect of travel planning. It's not just about being cautious; it's about being smart and prepared. Remember, it’s not just about the destination, it’s about ensuring a safe journey. And for the smart traveler, getting a travel insurance quote is the first step towards peace of mind.