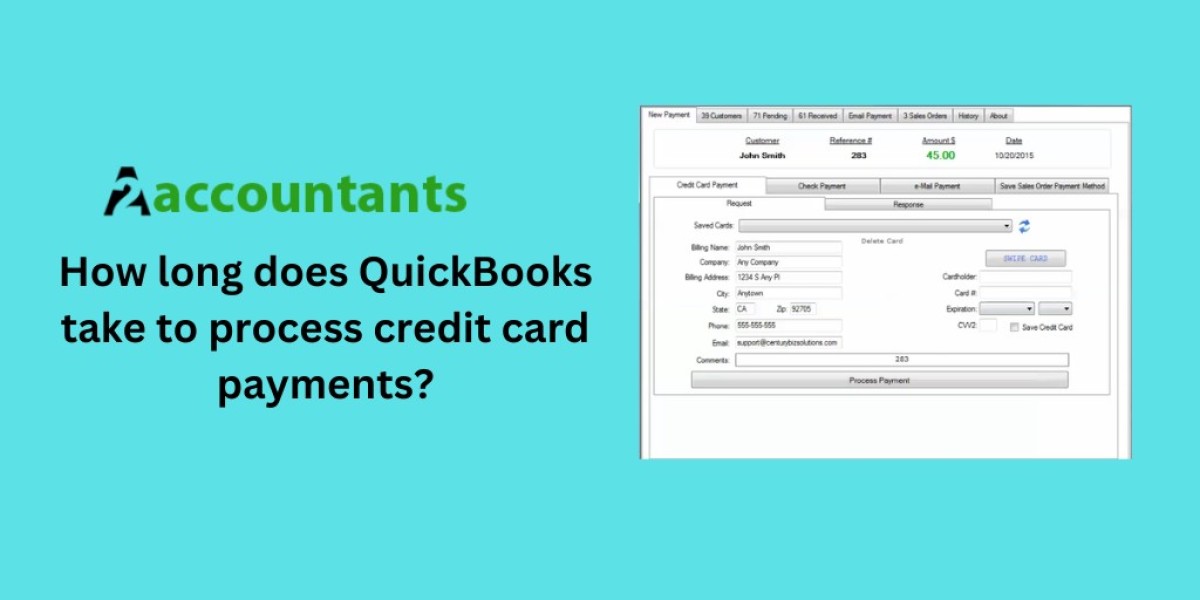

Are you a small business owner using QuickBooks to manage your finances? You might be wondering how long it takes for QuickBooks to process credit card payments.

Well, the good news is that QuickBooks processes credit card payments quickly and efficiently, allowing you to receive funds in a timely manner.

How credit card processing works with QuickBooks

QuickBooks offers an integrated payment processing feature that allows you to seamlessly accept credit card payments from your customers. This feature eliminates the need for manual entry or third-party payment processors, streamlining the payment process.

When a customer makes a credit card payment, QuickBooks securely transmits the payment information to the payment gateway for processing.

The payment gateway then communicates with the customer's credit card network to verify the transaction and process the payment.

Once the payment is approved, QuickBooks updates your financial records automatically, reflecting the payment received. This seamless integration ensures that credit card payments are processed efficiently, reducing the time and effort required to manage your finances.

Factors that affect the processing time for credit card payments

The processing time for credit card payments in QuickBooks can vary depending on several factors. One of the main factors is the payment gateway you use.

Different payment gateways have different processing speeds, so it's essential to choose a reliable and efficient one. QuickBooks offers compatibility with various payment gateways, allowing you to select the one that suits your business needs.

Another factor that can affect processing time is the speed of your internet connection. A slow internet connection may cause delays in the transmission of payment information to the payment gateway, resulting in longer processing times.

To ensure optimal processing speed, it's recommended to have a stable and high-speed internet connection.

Additionally, the complexity of the transaction can also impact the processing time. For example, if a transaction requires additional verification or involves a large amount, it may take slightly longer to process.

However, in most cases, QuickBooks processes credit card payments within a matter of seconds, ensuring a smooth payment experience for both you and your customers.

Understanding QuickBooks processing times for credit card payments

QuickBooks is designed to provide efficient and timely processing of credit card payments. The software is optimized to handle payment transactions quickly, allowing you to receive funds promptly.

With QuickBooks, you can track and manage your credit card payments in real-time, providing you with accurate and up-to-date financial information.

The processing time for credit card payments in QuickBooks is typically instantaneous. As soon as the payment is authorized by the payment gateway, QuickBooks updates your financial records, reflecting the payment received.

This real-time processing ensures that you can easily monitor your cash flow and make informed financial decisions.

Moreover, QuickBooks offers a user-friendly interface that simplifies the payment process. You can easily generate invoices, set up recurring payments, and send payment reminders to your customers.

This convenience, coupled with the fast processing times, allows you to focus on running your business efficiently while ensuring timely payments from your customers.

Highly recommended: QuickBooks Credit Card Processing Not Working

Tips to expedite the processing time for credit card payments in QuickBooks

While QuickBooks already processes credit card payments quickly, there are several tips you can follow to further expedite the processing time:

Choose a reliable payment gateway:

Selecting a reputable payment gateway that offers fast processing speeds can significantly reduce the time it takes to process credit card payments in QuickBooks. Research and compare different payment gateways to find the one that best suits your business needs.

Ensure a stable internet connection:

A stable and high-speed internet connection is crucial for seamless payment processing. Make sure your internet connection is reliable to minimize any potential delays in transmitting payment information to the payment gateway.

Optimize your QuickBooks settings:

Adjusting certain settings in QuickBooks can improve processing speed. For example, you can enable the option to automatically process credit card payments as soon as they are received, eliminating the need for manual intervention.

Regularly update QuickBooks:

Keeping your QuickBooks software up to date ensures that you have access to the latest features and improvements, including faster credit card payment processing. Check for updates regularly and install them promptly.

By following these tips, you can maximize the efficiency of credit card payment processing in QuickBooks, allowing you to receive funds quickly and manage your finances more effectively.

Common issues and troubleshooting for credit card payment processing in QuickBooks

While QuickBooks is known for its efficient credit card payment processing, there can be occasional issues that may arise. Here are some common issues and troubleshooting steps:

Payment declines:

If a credit card payment is declined, it's essential to identify the reason for the decline. It could be due to insufficient funds, an expired card, or a temporary issue with the payment gateway. In such cases, contacting the customer or the payment gateway's support team can help resolve the issue.

Slow processing times:

If you experience unusually slow processing times, it's worth checking your internet connection speed. A slow connection can cause delays in transmitting payment information to the payment gateway.

Additionally, ensure that your QuickBooks software is up to date and that you have selected a reliable payment gateway.

Payment discrepancies:

Occasionally, there may be discrepancies between the payment recorded in QuickBooks and the actual amount received. This can happen due to transaction fees or other factors.

To resolve this, compare the payment details in QuickBooks with the information provided by the payment gateway or contact their support for clarification.

Integration issues:

If you encounter difficulties integrating your payment gateway with QuickBooks, it's recommended to consult the payment gateway's documentation or support resources. They can provide guidance on the integration process and help troubleshoot any issues that may arise.

By addressing these common issues and following the troubleshooting steps, you can ensure a smooth credit card payment processing experience in QuickBooks.

Comparing QuickBooks processing times to other payment processors

QuickBooks' credit card payment processing times are known for their efficiency and speed. However, it's essential to compare them to other payment processors to understand how QuickBooks stacks up.

Different payment processors may have varying processing times based on their infrastructure and capabilities.

When comparing QuickBooks to other payment processors, it's important to consider factors such as reliability, integration options, and customer support as well.

While QuickBooks offers seamless integration with its payment processing feature, other processors may have more specialized features or cater to specific industries.

Additionally, the processing times of other payment processors may vary depending on the payment gateway chosen and the internet connection speed.

It's crucial to research and compare different payment processors to determine the one that best suits your business needs in terms of processing times and other relevant factors.

Steps to optimize QuickBooks for faster credit card payment processing

To optimize QuickBooks for faster credit card payment processing, follow these steps:

Update QuickBooks:

Ensure that you are using the latest version of QuickBooks to leverage any performance improvements and bug fixes introduced in updates.

Choose a fast payment gateway:

Select a payment gateway that is known for its fast processing times. Research different options and compare their speed and reliability before making a decision.

Optimize your internet connection:

Ensure that you have a stable and high-speed internet connection to minimize any delays in transmitting payment information to the payment gateway. Consider upgrading your internet plan if necessary.

Enable automatic payment processing:

Configure QuickBooks to automatically process credit card payments as soon as they are received. This eliminates the need for manual intervention and speeds up the overall processing time.

Regularly reconcile your payments:

Regularly reconcile your credit card payments in QuickBooks to ensure accuracy and identify any discrepancies promptly. This helps maintain the integrity of your financial records and avoids potential issues down the line.

By following these steps, you can optimize QuickBooks for faster credit card payment processing, saving you time and ensuring a smoother financial management experience.

Security considerations for credit card payments in QuickBooks

When processing credit card payments in QuickBooks, it's crucial to prioritize security to protect both your business and your customers' sensitive information.

QuickBooks has implemented robust security measures to safeguard payment transactions, but it's essential to take additional precautions as well.

Here are some security considerations for credit card payments in QuickBooks:

Use secure payment gateways:

Choose payment gateways that prioritize data security and comply with industry standards, such as Payment Card Industry Data Security Standard (PCI DSS).

Enable encryption:

Ensure that your QuickBooks software is configured to use encryption when transmitting payment information. Encryption adds an extra layer of protection, making it harder for unauthorized parties to access sensitive data.

Implement strong access controls:

Limit access to QuickBooks and credit card payment processing features to authorized individuals only. Use strong passwords, two-factor authentication, and regularly review user access privileges.

Regularly update and patch software:

Keep your QuickBooks software up to date with the latest security patches and updates. These updates often include security enhancements that protect against known vulnerabilities.

Educate your staff:

Train your employees on best practices for handling credit card payments, including how to identify and report suspicious activity. This helps create a security-conscious culture within your organization.

By following these security considerations, you can minimize the risk of data breaches and protect your business and customers' sensitive information.

Conclusion:

QuickBooks provides small business owners with a reliable and efficient solution for credit card payment processing. With its integrated payment processing feature, you can seamlessly accept credit card payments from your customers and receive funds quickly.

Understanding the factors that affect processing times, optimizing your settings, and following security best practices can further enhance the efficiency of credit card payment processing in QuickBooks.

By leveraging QuickBooks' capabilities and taking the necessary steps to expedite payment processing, you can streamline your financial management and focus on growing your business.