Understanding the intricacies of Malaysia's business tax system is imperative for entrepreneurs and corporations alike. From corporate taxes to compliance, this comprehensive guide offers insights into navigating business tax Malaysia landscape effectively.

Introduction: Embarking on business ventures in Malaysia requires a solid understanding of the country's tax regulations. This guide aims to provide clarity on various tax aspects, enabling businesses to make informed decisions and maintain compliance.

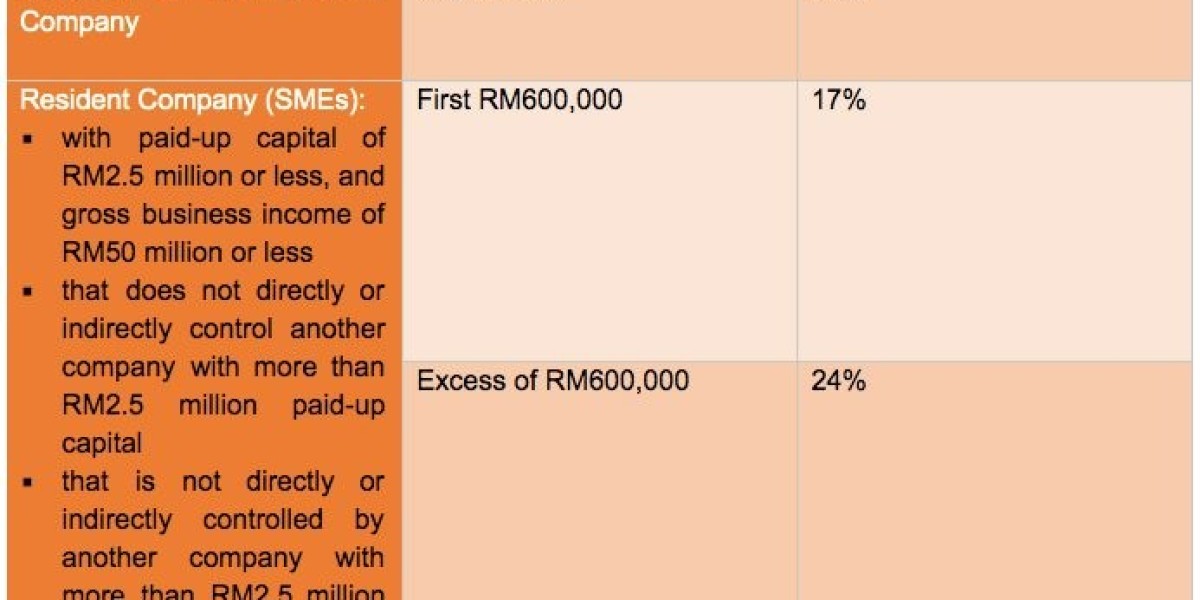

Corporate Income Tax Overview: Resident companies in Malaysia are subjected to a flat corporate income tax rate of 24%, while non-residents face similar rates based on their income source. Exploring deductions and tax planning strategies is crucial for optimizing tax liabilities.

Transition from GST to SST: The transition from the Goods and Services Tax (GST) to the Sales and Services Tax (SST) introduced changes in tax reporting and compliance. Businesses must adapt to these changes to ensure seamless operations and compliance with regulatory requirements.

Withholding Tax and Stamp Duty: Withholding tax rates vary based on the nature of payments made to non-residents, while stamp duty applies to legal instruments such as agreements and property transactions. Understanding these obligations is essential for avoiding financial implications.

Leveraging Tax Incentives and Reliefs: Malaysia offers various tax incentives and reliefs to encourage investment and economic growth. Exploring opportunities such as pioneer status and industry-specific incentives can optimize tax positions and foster business growth.

Compliance and Reporting Requirements: Businesses must meet compliance standards, including timely tax filing and record-keeping, to avoid penalties. Adhering to regulatory requirements ensures smooth operations and maintains the trust of stakeholders.

Conclusion: Navigating Malaysia's business tax terrain requires diligence and awareness of regulatory changes. By understanding tax obligations, leveraging incentives, and prioritizing compliance, businesses can navigate the complexities of taxation and thrive in Malaysia's vibrant business environment.