Receiving a paycheck without any income tax withheld can be a puzzling and concerning situation for many employees.

This scenario can arise for various reasons, such as incorrect W-4 forms, incorrect employee status, trying to claim many exemptions, or employer error.

Understanding the underlying causes and taking the necessary steps to ensure proper tax withholding is crucial. In this article, we'll explore the common reasons for the issue and how to troubleshoot no income tax withheld from a paycheck.

Reasons For No Income Tax Being Withheld

There are several reasons why your employer may not be withholding income tax from your paycheck. Some of the most common scenarios include:

- Incorrect W-4 Form: If you've recently updated your W-4 form, your employer may have adjusted your withholding to the point where no income tax is being deducted.

- Claiming Too Many Exemptions: Claiming an excessive number of exemptions on your W-4 form can result in little to no income tax being withheld from your paycheck.

- Temporary or Part-Time Employment: Employers may not withhold income tax for temporary or part-time employees, especially if the income is below a certain threshold.

- Incorrect Classification of Employee Status: If your employer has misclassified your employment status, such as treating you as an independent contractor instead of an employee, no income tax could be withheld.

- Employer Error: In some cases, the issue may be due to a simple mistake or oversight in your employer's payroll department.

How to Troubleshoot The Issue of No Income Tax Being Withheld

Resolving the issue of no income tax being withheld from your paycheck requires a systematic approach. Here are the steps you can take to troubleshoot no income tax withheld from a paycheck:

Checking your tax forms and exemptions

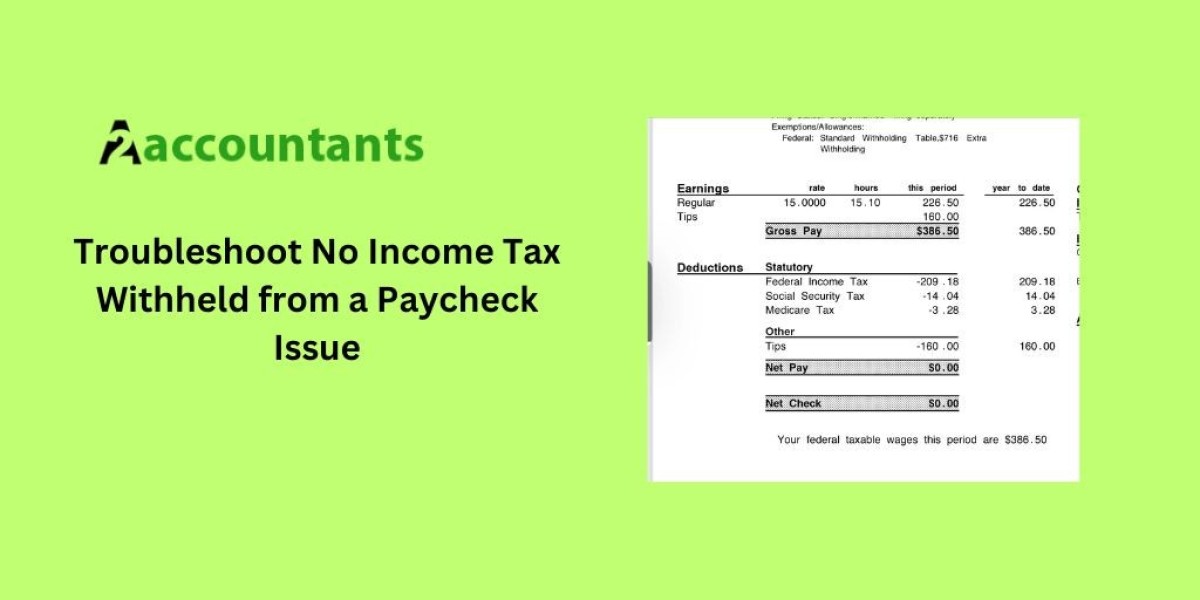

- Review your most recent pay stub or W-2 form to confirm that no income tax is being withheld.

- Examine your W-4 form and ensure the information you've provided is accurate and up-to-date.

- Verify the number of exemptions you've claimed on your W-4 form. If you've claimed an excessive number of exemptions, it could be the reason for the lack of income tax withholding.

Expert Recommendation:QuickBooks Payroll Not Calculating Taxes

Reviewing your W-4 form and updating it if necessary

- If you've discovered that the information on your W-4 form is outdated or incorrect, you'll need to update it.

- Carefully review the instructions on the W-4 form and make any necessary adjustments to your withholding allowances.

- Submit the updated W-4 form to your employer's payroll department, and monitor your next few paychecks to ensure the issue has been resolved.

Communicating with your employer about the issue

- If the above steps haven't resolved the problem, you should contact your employer's payroll department.

- Explain the situation and provide a copy of your most recent pay stub or W-2 form as evidence of the lack of income tax withholding.

- Work with your employer to identify the root cause of the issue and determine the appropriate course of action to ensure proper income tax withholding in the future.

Conclusion

Dealing with no income tax being withheld from your paycheck can be a frustrating and complex issue, but it's essential to address it promptly.

By following the steps outlined in this article, you can identify the underlying cause, update your tax forms, and communicate with your employer to troubleshoot no income tax withheld from a paycheck issue and ensure that the proper amount of income tax is being withheld from your paychecks.