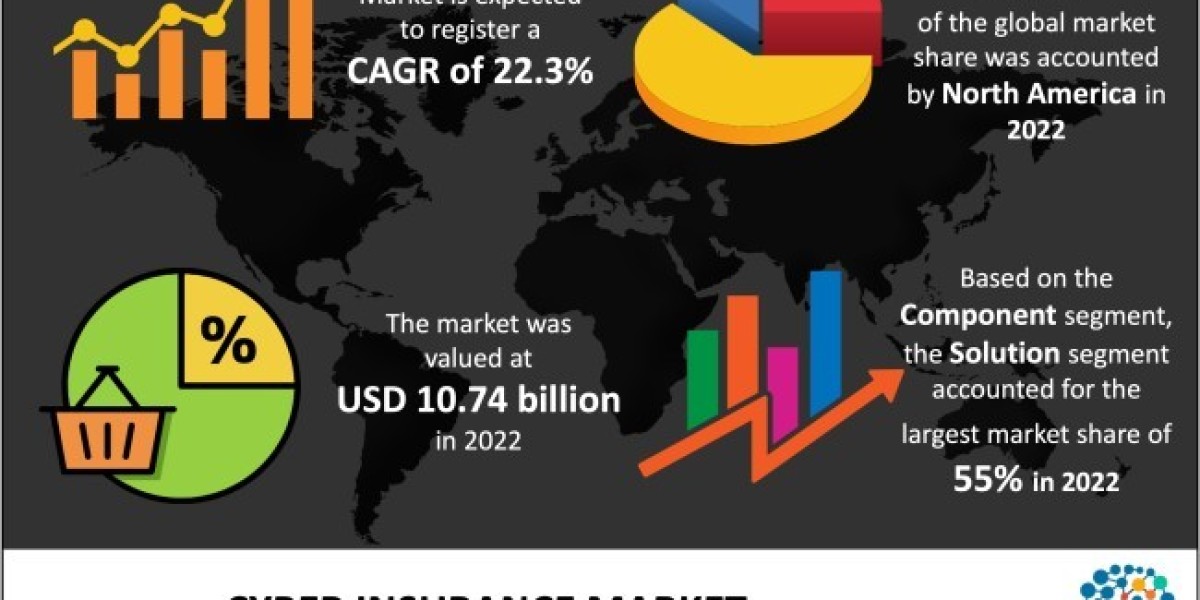

The Global Cyber Insurance Market is expected to rise with an impressive CAGR 22.3% and generate the highest revenue by 2032

Global Cyber Insurance Market Analysis report published with extensive market research, growth analysis, and forecast by 2032. This report is highly predictive as it holds the overall market analysis of topmost companies into the Cyber Insurance industry. With the classified market research based on various growing regions, this report provides leading players portfolio along with sales, growth, market share and so on. This report provides information about Types, Application, Revenue, Growth Rate, Gross margin, with role of top players in market. Report Provides Market Share, CAGR, Production, Consumption, Revenue, Gross Margin, Cost and Market Influencing factors of the Cyber Insurance industry in global regions.

Get sample copy of Cyber Insurance Market report @ https://www.thebrainyinsights.com/enquiry/sample-request/13736

Cyber Insurance Market offers an in-depth summary of the current as well as futuristic growth aspects of the overall market with respect to the ever-growing opportunities available in the specific industry. It also showcases significant research about the key drivers that are responsible for improving the market. Furthermore, the Cyber Insurance industry report covers key drivers, probable growth opportunities, size, CAGR, and other compelling details. The worldwide Cyber Insurance Market report especially concentrating on distinct verticals of businesses including assessment of competitive landscape, market trends, region-wise outlook, differentiable business perspectives, and fundamental operating procedures.

Top Leading Key Players are: Chubb, Travelers Indemnity Company, American International Group, Inc., AXA XL, Beazley Group, CNA Financial Corporation, AXIS Capital Holdings Limited, BCS Financial Corporation, Zurich Insurance, The Hanover Insurance, Inc., Arthur J. Gallagher & Co.

Read complete report with TOC at: https://www.thebrainyinsights.com/report/cyber-insurance-market-13736

Cyber Insurance Market report sheds light on the industry characteristics, progress and size, country and geographical breakdowns, market shares, segmentation, strategies, trends and competitive background of the global Cyber Insurance industry. The research report also outlines the driver as well as restraining factors that are adding and hampering the development of the Cyber Insurance Market correspondingly. In addition, the research study also delivers the market historical as well as estimate market size on the basis of the geographical analysis. Furthermore, the market research report provides the comprehensive information about the key emerged regions as well as major developing markets on the basis of regional growth of the market.

Global Cyber Insurance Market is segmented based by type, application and region.

Based on Type, the market has been segmented into:

by Component:

- Solution

- Services

by Insurance Type:

- Standalone

- Packaged

Based on application, the market has been segmented into:

In addition, the research report offers a Quantitative analysis of the current market. Therefore, market size estimation is provided through base year 2020 to 2025 to showcase the financial calibre of the market. The research report on global Cyber Insurance Market ensures users to remain competitive in the market. Also report helps to identify the new innovations and developments by existing key players to increase the growth of the global Cyber Insurance Market. Study report covers all the geographical regions where competitive landscape exists by the players such as North America, Europe, Latin America, Asia-Pacific and Middle East Africa. Thus, report helps to identify the key growth countries and regions.

Furthermore, Cyber Insurance readers will get a clear perspective on the most affecting driving and restraining forces in the Cyber Insurance Market and its impact on the global market. The report predicts the future outlook for market that will help the readers in making appropriate decisions on which market segments to focus in the upcoming years accordingly. In conclusion, the report provides a fast outlook on the market covering aspects such as deals, partnerships, product launches of all key players for 2023 to 2032. It then sheds lights on the competitive landscape by elaborating on the current mergers and acquisitions (M&A), venture funding and product developments that took place in the Cyber Insurance Market.

Highlights of the Report:

- Identification and in-depth assessment of growth opportunities in key segments and regions

- Company profiles of top players of the Global Cyber Insurance Market are determined

- Intensive research on innovation and other trends of the global market

- Reliable industry value chain and supply chain analysis

- In-depth analysis of important growth drivers, restraints, challenges, and growth prospects

- Accurate market size and CAGR forecasts for the period 2023-2032

Enquire for customization in Report @ https://www.thebrainyinsights.com/enquiry/request-customization/13736

About The Brainy Insights:

The Brainy Insights is a market research company, aimed at providing actionable insights through data analytics to companies to improve their business acumen. We have a robust forecasting and estimation model to meet the clients' objectives of high-quality output within a short span of time. We provide both customized (clients' specific) and syndicate reports. Our repository of syndicate reports is diverse across all the categories and sub-categories across domains. Our customized solutions are tailored to meet the clients' requirement whether they are looking to expand or planning to launch a new product in the global market.

Media Contact

Avinash D

Organization: The Brainy Insights

Phone: +1-315-215-1633

Email: sales@thebrainyinsights.com

Web: www.thebrainyinsights.com