The oil storage market is a crucial element of the global energy infrastructure, playing a pivotal role in balancing supply and demand, ensuring energy security, and stabilizing prices. Understanding the dynamics of supply, demand, and strategic reserves is essential to comprehending how this market operates and adapts to changing conditions.

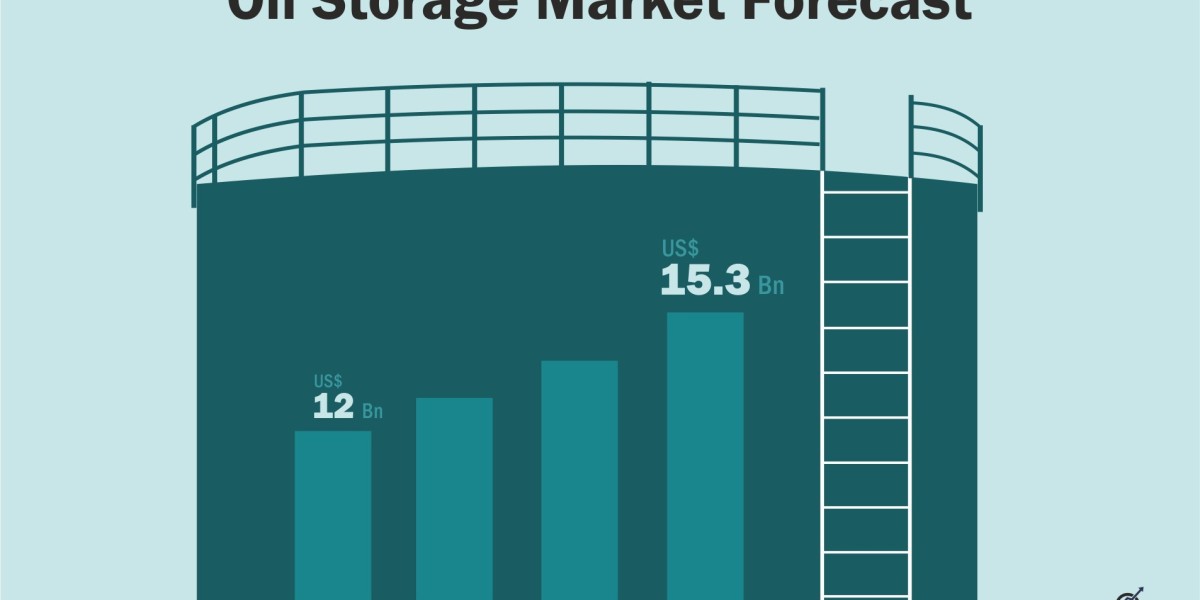

According to Stratview Research, the oil storage market was estimated at USD 12.0 billion in 2021 and is likely to grow at a CAGR of 4.2% during 2022-2027 to reach USD 15.3 billion in 2027.

Supply Dynamics

The supply side of the oil storage market is influenced by production levels, geopolitical events, and technological advancements. Major oil-producing countries, such as Saudi Arabia, Russia, and the United States, significantly impact global supply. When these nations increase production, the market can become oversupplied, leading to lower prices and increased demand for storage capacity. Conversely, disruptions in production due to geopolitical tensions, natural disasters, or technical issues can create supply shortages, driving up prices and reducing the need for storage.

Technological advancements in oil extraction and production, such as hydraulic fracturing (fracking) and deep-water drilling, have also increased the global supply of oil. These technologies enable the extraction of previously inaccessible reserves, contributing to higher production levels and greater variability in supply.

Demand Dynamics

The demand for oil is driven by various factors, including economic growth, industrial activity, and seasonal variations. During periods of economic expansion, industries and transportation sectors consume more oil, increasing demand. Conversely, during economic downturns, demand for oil decreases as industrial activity slows down and consumer spending declines.

Seasonal factors also play a role in demand dynamics. For example, colder winter months typically see increased demand for heating oil, while summer months often experience higher gasoline consumption due to travel and vacation activities. These seasonal demand fluctuations necessitate strategic storage solutions to ensure a steady supply throughout the year.

Strategic Reserves

Strategic petroleum reserves (SPRs) are critical to the stability and security of the oil market. Governments maintain SPRs to mitigate the impact of supply disruptions and ensure a continuous energy supply during emergencies. The United States, for instance, holds one of the largest strategic reserves, capable of supplying the country with oil for several months in the event of a major disruption.

The existence and management of SPRs influence the oil storage market significantly. When governments release oil from their reserves to counteract supply shortages, it can stabilize prices and ensure market continuity. Conversely, the accumulation of strategic reserves can increase demand for storage facilities and drive up storage costs.

Market Adaptation and Trends

The oil storage market continually adapts to changing supply and demand dynamics. In recent years, there has been a trend towards the construction of more flexible and technologically advanced storage facilities. These facilities are designed to handle different types of crude oil and refined products, providing greater adaptability to market fluctuations.

Additionally, the rise of renewable energy sources and the global push towards reducing carbon emissions are influencing long-term demand for oil. While oil remains a critical energy source, the shift towards greener alternatives is expected to impact demand and storage needs over the coming decades.

Conclusion

The dynamics of the oil storage market are shaped by a complex interplay of supply, demand, and strategic reserves. Understanding these factors is essential for stakeholders to navigate the market effectively and make informed decisions. As the global energy landscape continues to evolve, the oil storage market will play a vital role in ensuring energy security and stability, adapting to new challenges and opportunities along the way.