Data Broker Market Overview:

The Data Broker Market has evolved into a crucial component of the global data economy, driven by the increasing demand for data-driven insights across various industries. Data brokers act as intermediaries, collecting, aggregating, and selling consumer data to businesses and organizations. This market is characterized by its vast and diverse range of data types, including personal, financial, social media, and behavioral data. The growing importance of data in decision-making processes across sectors such as marketing, finance, healthcare, and retail has significantly contributed to the expansion of the data broker industry. The Data Broker Market size is projected to grow from USD 264.2 Billion in 2023 to USD 471.25 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.50% during the forecast period (2023 - 2032).

In recent years, the market has witnessed substantial growth due to the proliferation of digital devices and the increasing use of the internet, leading to the generation of massive amounts of data. The adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) has further enhanced the ability of data brokers to provide more accurate and actionable insights to their clients. However, the market's growth is also accompanied by increasing concerns over data privacy and security, leading to regulatory challenges that data brokers must navigate.

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/11676

Competitive Analysis:

The Data Broker Market is highly competitive, with numerous players ranging from large multinational corporations to small and medium-sized enterprises (SMEs). Key players in the market include,

- Acxiom LLC

- Experian plc

- CoreLogic

- Equifax

- Oracle Corporation

These companies have established themselves as leaders in the industry by leveraging their extensive data collection capabilities and advanced analytics tools.

Acxiom LLC, for instance, is known for its vast data assets and robust analytics platform that helps businesses make informed decisions. Experian plc is another major player, offering a wide range of data services, including credit data, marketing services, and decision analytics. CoreLogic Inc. specializes in property data and analytics, serving clients in real estate, mortgage, and insurance industries. Equifax Inc. is a leader in consumer credit reporting, while Oracle Corporation provides comprehensive data management solutions through its cloud-based platform.

In addition to these established players, the market is also witnessing the emergence of new entrants, particularly in niche segments such as social media data and location-based data. These new players are focusing on innovative data collection methods and personalized data offerings to differentiate themselves in the competitive landscape. The competition in the market is expected to intensify as companies continue to invest in technology and expand their data portfolios to meet the growing demand for data-driven insights.

Market Drivers:

Several factors are driving the growth of the Data Broker Market. One of the primary drivers is the increasing reliance on data-driven decision-making across various industries. Businesses are increasingly recognizing the value of data in gaining a competitive edge, improving customer engagement, and optimizing operations. As a result, there is a growing demand for high-quality, accurate, and comprehensive data, which data brokers are well-positioned to provide.

The rapid digitalization of industries and the widespread adoption of digital devices are also contributing to the growth of the market. The exponential increase in the volume of data generated by online activities, social media, e-commerce, and IoT devices has created a vast pool of data that data brokers can tap into. Furthermore, the advancements in AI and ML technologies are enabling data brokers to analyze and interpret this data more effectively, providing valuable insights to businesses.

Another significant driver is the increasing use of data for targeted marketing and personalized advertising. Companies are increasingly using consumer data to create personalized marketing campaigns that resonate with their target audience. Data brokers play a critical role in providing the necessary data to power these campaigns, driving demand for their services.

Market Restraints:

Despite the strong growth prospects, the Data Broker Market faces several challenges that could hinder its expansion. One of the most significant restraints is the growing concern over data privacy and security. Consumers are becoming increasingly aware of how their data is being collected, used, and sold by data brokers, leading to heightened concerns over privacy violations. This has resulted in stricter regulations and laws governing data collection and usage, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States.

Compliance with these regulations presents a challenge for data brokers, as they must ensure that their data collection and processing practices adhere to legal requirements. Failure to comply with these regulations can result in hefty fines and damage to a company's reputation. Moreover, the increasing awareness of data privacy issues among consumers could lead to a decline in the willingness of individuals to share their data, reducing the availability of data for brokers.

Another challenge facing the market is the potential for data quality issues. The accuracy and reliability of the data provided by brokers are crucial for businesses relying on this data for decision-making. However, data brokers often collect data from multiple sources, which can result in inconsistencies, inaccuracies, and outdated information. Ensuring data quality and accuracy is essential for maintaining the trust of clients and the overall credibility of the industry.

Segment Analysis:

The Data Broker Market can be segmented based on data type, end-user industry, and geography. By data type, the market is divided into personal data, financial data, social media data, and others. Personal data, which includes information such as names, addresses, and contact details, is one of the largest segments, driven by its widespread use in marketing and customer profiling. Financial data is also a significant segment, particularly in the banking and insurance industries, where it is used for credit scoring, fraud detection, and risk assessment.

In terms of end-user industries, the market serves a wide range of sectors, including marketing and advertising, finance, healthcare, retail, and government. The marketing and advertising industry is one of the largest consumers of data broker services, using data for targeted marketing, customer segmentation, and campaign optimization. The finance industry also relies heavily on data brokers for credit reporting, risk management, and compliance with regulatory requirements. The healthcare sector is increasingly using data brokers to gain insights into patient behavior, improve healthcare outcomes, and enhance operational efficiency.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/data-broker-market-11676

Regional Analysis:

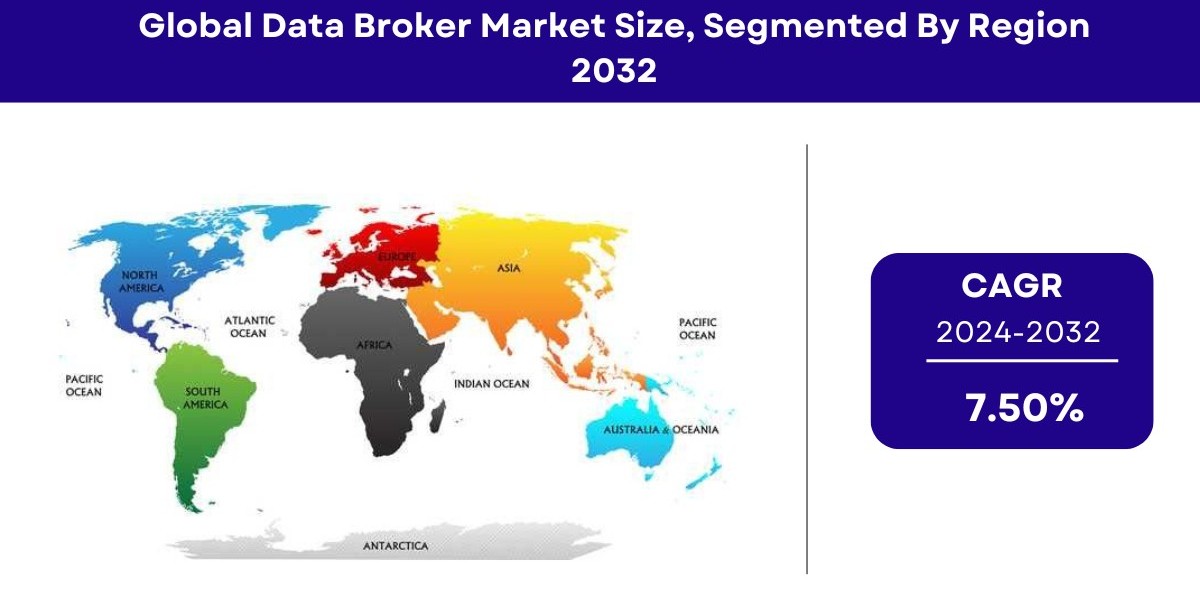

Geographically, the Data Broker Market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is the largest market for data brokers, driven by the high demand for data-driven insights across various industries and the presence of major market players in the region. The United States, in particular, is a key market, with a well-established data economy and a strong emphasis on digital marketing and personalized advertising.

Europe is another significant market, with the demand for data broker services driven by the growing adoption of digital technologies and the increasing use of data in business decision-making. However, the market in Europe is also heavily influenced by stringent data privacy regulations, such as GDPR, which impose strict requirements on data collection, processing, and usage.

The Asia-Pacific region is expected to witness the fastest growth in the Data Broker Market, driven by the rapid digitalization of economies, the increasing adoption of smartphones and internet services, and the growing awareness of the value of data-driven insights. Countries such as China, India, and Japan are emerging as key markets in the region, with a strong focus on e-commerce, digital marketing, and financial services.

In the Rest of the World, the market is also experiencing growth, particularly in Latin America and the Middle East and Africa, where the adoption of digital technologies is increasing, and businesses are increasingly recognizing the value of data in driving growth and competitiveness.

The Data Broker Market is poised for significant growth, driven by the increasing demand for data-driven insights across various industries. However, the market also faces challenges, particularly in the areas of data privacy and security, which must be addressed to ensure sustainable growth. As businesses continue to recognize the value of data, the role of data brokers in the global data economy will only become more critical, providing ample opportunities for innovation and expansion in the industry.

Top Trending Reports:

Cognitive Computing Technology Market

Pharma Knowledge Management Software Market

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com