Health and medical insurance is a type of financial product that covers the cost of medical treatment and procedures. It involves paying periodic payments of premiums to an insurance provider, which protects you financially from expensive medical bills. Preventive care, prescription drugs, hospital stays, surgeries, and doctor visits are usually covered under this coverage. The coverage, deductibles, co-pays, and out-of-pocket maximums of different policies differ. The goal of health insurance is to lower the financial burden of medical expenses and increase affordability for both individuals and families. Additionally, it encourages accessibility to essential medical treatments, enhancing the general health and wellbeing of the populace. Through the distribution of the risk of medical costs among numerous policyholders, health insurance contributes to the guarantee that people in need can obtain necessary health treatments.

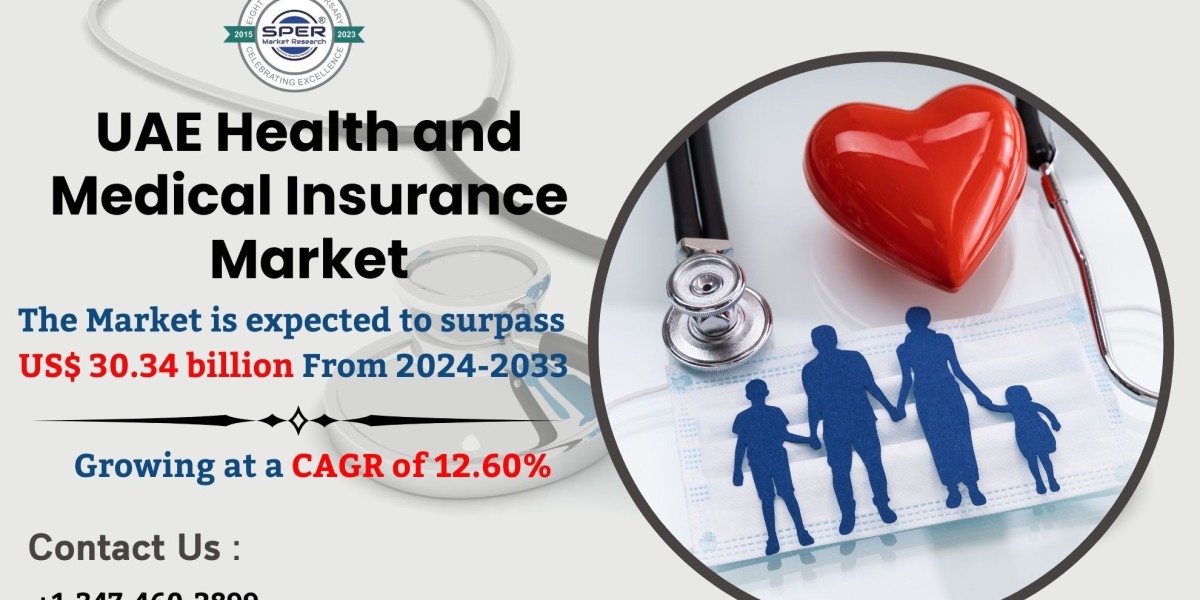

According to SPER Market Research, 'UAE Health and Medical Insurance Market Size- By Provider, By Product Type, By Distribution Channel- Regional Outlook, Competitive Strategies and Segment Forecast to 2033' states that the UAE Health and Medical Insurance market is estimated to reach USD 30.34 billion by 2033 with a CAGR of 12.60%.

Several factors are driving the expansion of medical and health insurance in the United Arab Emirates. Firstly, there is a greater need for complete health coverage due to the growing population and growing health consciousness. The UAE government's obligatory health insurance laws, like those in Dubai and Abu Dhabi, have greatly increased the number of people who have insurance. In addition, people and companies are looking for insurance options to help with cost mitigation as a result of the growing cost of healthcare services. The rise of the health insurance market has been facilitated by technological advancements such as ehealth and digital platforms, which have improved accessibility and efficiency.

Request for Sample Copy of Report for More Detailed Market Insight - https://www.sperresearch.com/report-store/uae-health-and-medical-insurance-market.aspx?sample=1

The market saturation in the UAE for health and medical insurance, the high costs of technology updates and compliance, and regulatory complexity are just a few of the difficulties the industry faces. The margins of insurers are under pressure due to new policies and higher VAT rates. A great deal of insurers competes fiercely with one another, which further fragments the market and puts pressure on prices. The complexity is increased by the requirement for discipline and openness in the regulatory framework as well as the differences in healthcare systems throughout the emirates. The continued need to adjust to afterwards market conditions, which have increased awareness and demand for comprehensive insurance coverage, contributes to these problems.

The COVID-19 epidemic has had a major effect on UAE health and medical insurance. The crisis highlighted flaws in coverage and the need for more extensive policies by exposing weaknesses in the current insurance design. The surge in COVID-19 associated therapies resulted in greater claims for insurers, which changed policy terms and raised prices. The pandemic forced regulatory agencies to take action in order to improve coverage for pandemic-related costs and guarantee policy holders increased financial security. Furthermore, the crisis boosted E- health and digital health solution adoption, forcing insurers to innovate and modify their offerings. COVID-19 highlighted the necessity of strong health insurance programs that can effectively handle such public health emergencies.

Dubai dominates the health and medical insurance business. Because there are many foreign enterprises based in the city and an extensive expat community, there is a considerable need for comprehensive health insurance coverage. Some of the key players are - Abu Dhabi National Insurance Company, Aetna International, AXA Gulf Insurance, Bupa Arabia for Cooperative Insurance, Daman Insurance.

UAE Health and Medical Insurance Market Segmentation:

By Provider:

- Private Health Insurance

- Public/Social Health Insurance

By Product Type:

- Individual Health Insurance

- Group Health Insurance

- Personal Accident

By Distribution Channel:

- Agents

- Banks

- Brokers

- Online Sales

By Region:

- Abu Dhabi

- Dubai

- Sharjah

- Rest of UAE

For More Information, refer to below link –

Dubai Health and Medical Insurance Market Share

Related Report –

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant – U.S.A.

SPER Market Research

+1-347-460-2899