The automotive adhesives market has emerged as a crucial segment in the automotive industry, playing a vital role in modern vehicle design and manufacturing. As automakers increasingly prioritize lightweight materials, improved safety, and enhanced performance, the demand for advanced adhesive solutions is growing. This article provides an in-depth analysis of the automotive adhesives market, focusing on its size, share, and competitive landscape.

Market Size and Growth

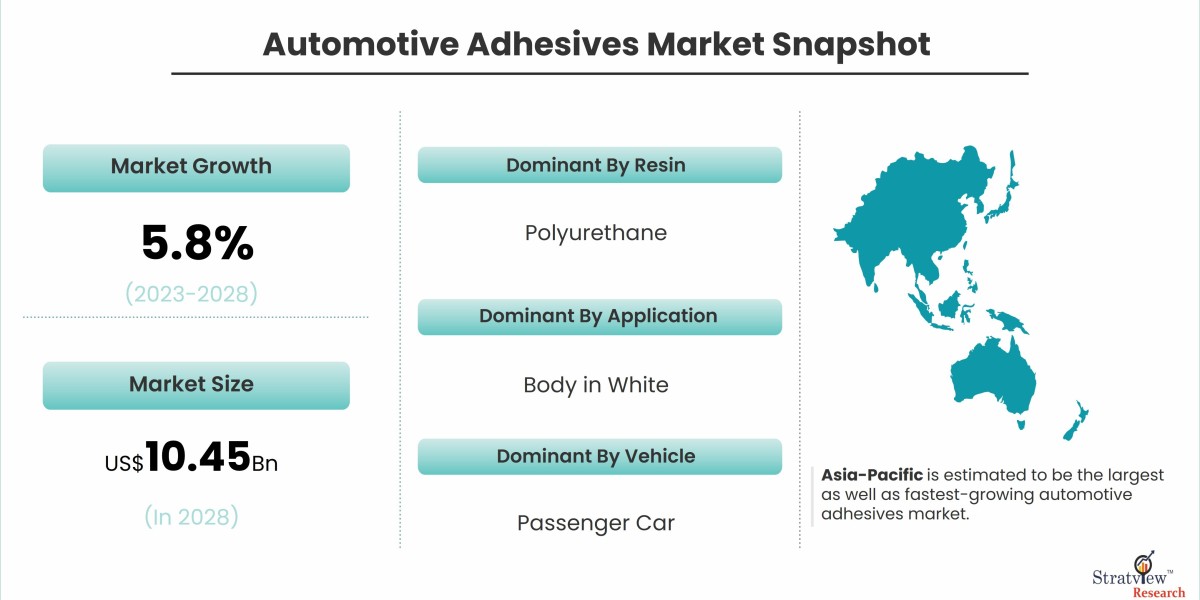

According to Stratview Research, the automotive adhesives market was estimated at USD 7.43 billion in 2022 and is likely to grow at a CAGR of 5.8% during 2023-2028 to reach USD 10.45 billion in 2028.

The rising demand for lightweight vehicles, especially in response to stringent emission regulations and fuel efficiency standards, is a significant factor propelling the market. Adhesives provide robust bonding capabilities while reducing the overall weight of vehicles, contributing to better fuel economy and lower emissions. Furthermore, the shift toward electric vehicles (EVs) and the integration of innovative materials like composites and aluminum in vehicle manufacturing further boost the market for automotive adhesives.

Market Share and Segmentation

The automotive adhesives market can be segmented by resin type, application, vehicle type, and region:

- Resin Type: Epoxy, polyurethane, acrylic, silicone, and others. Among these, the polyurethane segment held the largest share of the market in 2022 and is expected to remain dominant during the forecast period. The wide use of polyurethanes in the automotive adhesives market, owing to their excellent properties, such as high elongation and stronger bonding, is driving the growth of this segment.

- Application: Body-in-white, paint shop, powertrain, and assembly. The body in white segment dominated the market in 2022 and is expected to remain dominant during the forecast period. Epoxy and polyurethanes are the most used products in the body in the white application.

- Vehicle Type: Passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). The passenger car segment held the largest share of the market in 2022 and is expected to remain dominant during the forecast period. Increasing production of electric vehicles is expected to drive the growth of this segment during the forecast period.

- Region: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is estimated to be the largest as well as fastest-growing automotive adhesives market during the forecast period, with China, Japan, India, and Australia being the major countries with lucrative growth opportunities. The growth of the market is driven by the growth of various end-use industries, such as body in white, paint shop, assembly, and powertrain, which is generating huge demand for automotive adhesives and the presence of a large number of automotive adhesive manufacturers in the Asia-Pacific region.

Competitive Landscape

The automotive adhesives market is highly competitive, with several major players dominating the landscape. Key companies include:

- Arkema Group

- DuPont

- Huntsman Corporation

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Sika AG

- The 3M Company.

These companies are actively engaged in research and development to innovate adhesive formulations that offer enhanced performance, sustainability, and cost-efficiency. Strategic collaborations, mergers and acquisitions, and expansion into emerging markets are common strategies employed by these players to strengthen their market positions.

Conclusion

The automotive adhesives market is poised for substantial growth, driven by technological advancements, regulatory pressures for lightweight vehicles, and the rise of electric vehicles. With key players focusing on innovation and expansion, the market is set to witness increased competition and dynamic changes in the coming years. As the industry continues to evolve, automotive adhesives will play an essential role in shaping the future of vehicle manufacturing and design.