Commodity Trade Finance Market Overview:

The commodity trade finance market, a crucial segment within the broader financial services sector, plays a vital role in facilitating global trade by providing the necessary funding to businesses engaged in the production, export, and import of commodities. In 2022, the global commodity trade finance market was valued at approximately USD 5.04 billion. The market is poised for gradual growth, with projections indicating an increase from USD 5.23 billion in 2023 to around USD 7.35 billion by 2032, reflecting a compound annual growth rate (CAGR) of approximately 3.85% during the forecast period from 2024 to 2032.

Understanding Commodity Trade Finance

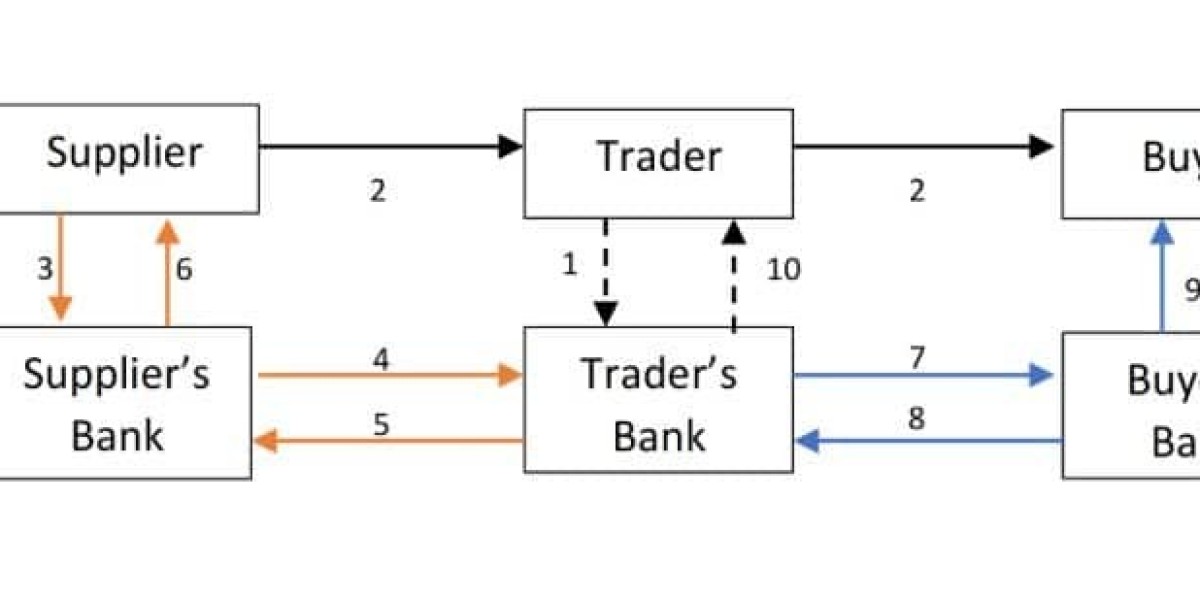

Commodity trade finance involves the provision of financial products and services that enable traders, producers, and processors to manage the risks associated with commodity transactions. These financial services include letters of credit, trade credit insurance, structured commodity finance, and supply chain finance. The sector supports the trading of various commodities such as oil, gas, metals, agricultural products, and more, ensuring that participants in these markets have the liquidity and risk management tools needed to operate effectively.

Request For Sample Report PDF - https://www.marketresearchfuture.com/sample_request/24345

Key Drivers of Market Growth

Several factors are contributing to the steady growth of the commodity trade finance market:

Globalization of Trade: The continued expansion of international trade, driven by globalization and the increasing interdependence of economies, is a significant driver of the commodity trade finance market. As companies engage in cross-border transactions involving commodities, the demand for trade finance solutions that can mitigate risks and ensure smooth operations increases.

Rising Commodity Prices: Fluctuations in global commodity prices have a direct impact on the demand for trade finance. When commodity prices rise, traders and producers often require additional financing to manage their working capital needs. The recent volatility in commodity prices, influenced by factors such as geopolitical tensions, supply chain disruptions, and environmental concerns, has underscored the importance of robust trade finance mechanisms.

Technological Advancements: The adoption of digital technologies and blockchain in trade finance is transforming the industry by enhancing transparency, reducing transaction times, and minimizing fraud. These technological advancements are making commodity trade finance more efficient and accessible, thereby driving market growth. Additionally, the integration of data analytics and artificial intelligence (AI) is helping financial institutions better assess risks and optimize financing solutions for their clients.

Increasing Focus on Sustainability: As global attention shifts towards sustainability, there is growing demand for financing solutions that support environmentally and socially responsible commodity trading. Financial institutions are increasingly offering green trade finance products that incentivize sustainable practices within the commodity supply chain. This trend is expected to contribute to the growth of the commodity trade finance market, particularly in sectors such as agriculture and renewable energy.

Challenges in the Commodity Trade Finance Market

Despite the positive growth outlook, the commodity trade finance market faces several challenges:

Geopolitical Risks and Trade Disruptions: Geopolitical tensions, trade wars, and economic sanctions can disrupt global trade flows and increase the risks associated with commodity transactions. These risks can make financial institutions more cautious in extending trade finance, potentially limiting market growth.

Regulatory and Compliance Requirements: The commodity trade finance industry is subject to complex regulatory and compliance requirements, which can vary significantly across different regions. Compliance with anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, and sanctions screening can be costly and time-consuming for financial institutions, potentially hindering market expansion.

Credit Risk: The commodity trade finance market is inherently exposed to credit risk, particularly in emerging markets where economic and political instability can impact the ability of borrowers to repay loans. Financial institutions must carefully assess and manage these risks to avoid significant losses, which can impact their willingness to finance certain transactions.

Future Outlook

The commodity trade finance market is expected to experience steady growth, driven by several key trends:

Expansion of Trade in Emerging Markets: As emerging markets continue to grow and industrialize, they are likely to play a more significant role in global commodity trade. This will create new opportunities for trade finance, particularly in regions such as Asia, Africa, and Latin America, where demand for raw materials and agricultural products is increasing.

Integration of Digital Platforms: The future of commodity trade finance is increasingly digital. The adoption of digital platforms and blockchain technology is expected to accelerate, enabling faster, more secure, and more transparent transactions. These technologies will likely reduce operational costs and open up new opportunities for market participants, particularly small and medium-sized enterprises (SMEs) that have traditionally faced challenges in accessing trade finance.

Sustainability-Linked Finance: The demand for sustainability-linked finance solutions is expected to grow as companies and investors prioritize environmental, social, and governance (ESG) criteria. Financial institutions that offer trade finance products aligned with sustainability goals are likely to see increased demand from companies looking to enhance their ESG credentials.

Enhanced Risk Management Solutions: As the commodity trade finance market evolves, financial institutions are expected to develop more sophisticated risk management solutions that leverage data analytics, AI, and other advanced technologies. These solutions will help mitigate risks associated with volatile commodity prices, geopolitical tensions, and credit exposure, making trade finance more resilient and attractive to market participants.

Conclusion

The commodity trade finance market is set for steady growth, driven by globalization, technological advancements, rising commodity prices, and an increasing focus on sustainability. While challenges such as geopolitical risks, regulatory complexities, and credit risks persist, the market's future looks promising. As trade finance continues to evolve with the integration of digital technologies and sustainability-linked products, the demand for these services is expected to rise, ensuring sustained growth in the commodity trade finance market through 2032.