Direct deposit eliminates the anxiety and security concerns associated with lost or stolen checks. Once the funds are transferred, they are immediately available, allowing for immediate access to earnings without the delay of traditional check-cashing procedures.

This instant availability is particularly beneficial in managing personal finances, paying bills on time, and avoiding potential late fees.

Another significant advantage of direct deposit is its contribution to financial management.

Many banks also offer the option to automatically divide your pay check into different accounts, facilitating a more straightforward approach to budgeting and saving for future goals.

How Direct Deposit Works

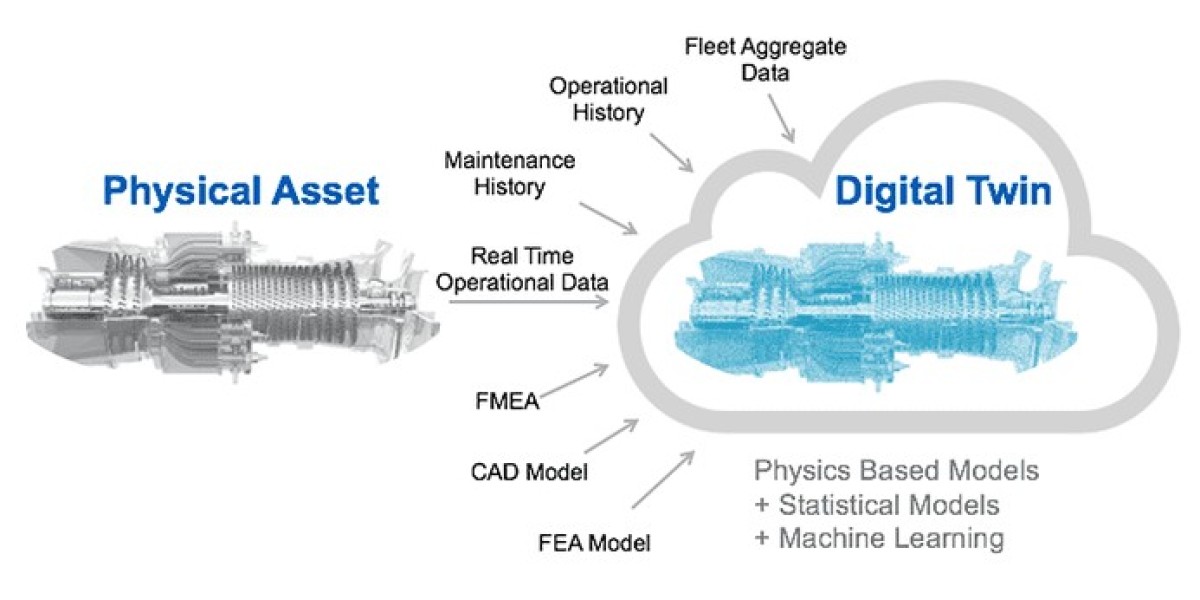

At its core, direct deposit utilizes an electronic network, known as the Automated Clearing House (ACH), to transfer funds from one bank account to another. This process begins with the employer initiating the payment through their bank, which then sends the funds through the ACH network to the employee's bank account.

This seamless transfer of funds is not only limited to pay checks but also extends to other forms of payments such as tax refunds, social security benefits, and more. The versatility and security of the ACH network make direct deposit a preferred method for various types of transactions, providing peace of mind with each transfer.

A noteworthy aspect of how direct deposit works is the predictability and consistency it offers. Since transactions are electronic, they can be scheduled in advance, ensuring that payments are made on time, every time. This reliability is invaluable for financial planning and eliminates the uncertainty associated with manual payment methods.

Steps to Set Up Direct Deposit

Setting up QuickBooks Direct Deposit Forms a straightforward process that requires a bit of preparation. The first step involves contacting your employer's payroll or human resources department to express your interest in enrolling in direct deposit.

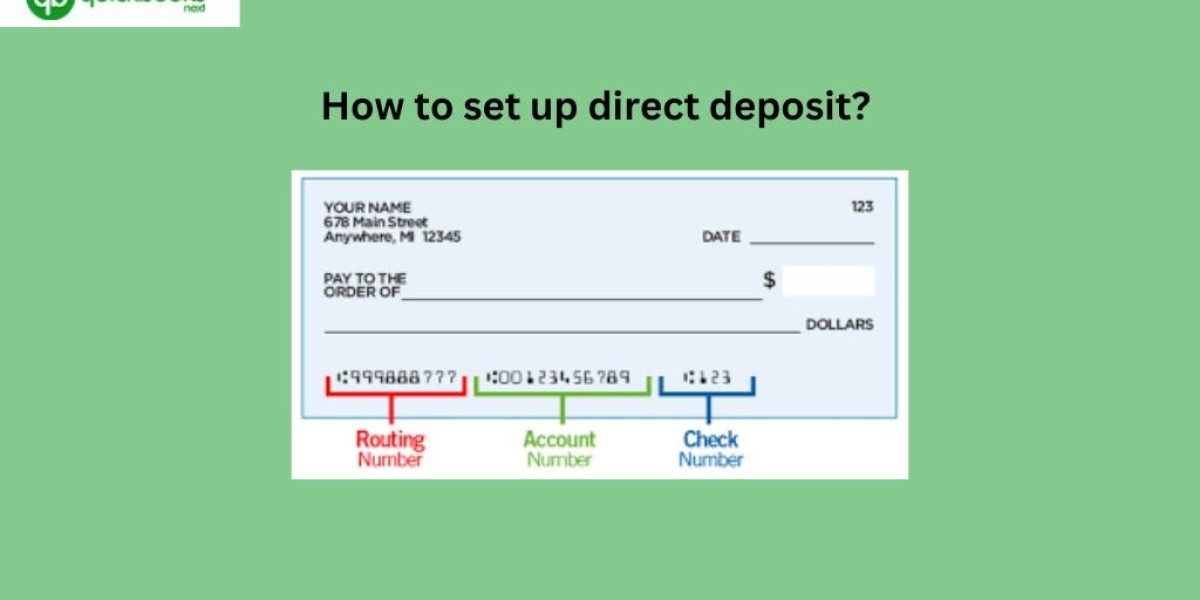

Upon receiving the enrolments form, you'll need to gather your bank account information, including the bank routing number and your account number. These details are crucial for accurately directing your pay check to your account. It's

Advisable to double-check this information to prevent any mishaps in the transfer process.

After completing the enrolment form with your bank account information, you'll typically need to attach a check or a bank statement. This serves as a verification step, ensuring that the account details provided are accurate and belong to you.

Required Information for Setting up Direct Deposit

The transition to direct deposit necessitates the provision of specific information to ensure a seamless and error-free setup. Primarily, you'll need to provide your bank's routing number, a nine-digit code that identifies your bank within the financial system.

Personal identification details, such as your full name and sometimes your address, are also necessary to match the direct deposit to your bank account accurately. Additionally, employers might request a social security number or employee ID to further ensure the correct association of the direct deposit setup.

It's worth mentioning the importance of accuracy when providing this information. Any errors in the bank routing or account numbers can lead to delays or misdirected payments, which can be a hassle to rectify.

Common Issues and Troubleshooting Tips

One common issue is a delay in the initial deposit. This often occurs due to the timing of the enrolment process; it may take a payroll cycle or two for the direct deposit to become active.

Another potential challenge is the deposit of funds into the wrong account, usually stemming from incorrect account information being provided. In such cases, it's crucial to notify your employer and bank immediately.

For individuals who change banks or accounts, updating your direct deposit information promptly is essential to avoid any disruption in receiving your pay check.

Direct Deposit vs. Other Payment Methods

When comparing direct deposit to other payment methods, such as paper checks or cash payments, the benefits of electronic transfer become even more apparent. Direct deposit offers a level of convenience and security unmatched by traditional methods.

There's no need to physically deposit a check or carry around a significant amount of cash on payday.

From an environmental perspective, direct deposit is a greener option, reducing the need for paper in the printing of checks.

Furthermore, direct deposit often provides faster access to funds. While a physical check may take days to clear, direct deposit transactions are typically available the morning of payday, allowing for immediate use.

Direct Deposit for Freelancers and Self-Employed Individuals

Direct deposit is not exclusively for employees in traditional work settings. Freelancers and self-employed individuals can also benefit from the convenience and security of receiving payments electronically.

This includes bank routing and account numbers, ensuring that payments are directed to the correct account. It's also beneficial to set clear terms regarding payment schedules to align expectations and ensure timely deposits.

Self-employed individuals may find that direct deposit facilitates a more organized approach to managing their finances. By having payments deposited directly into their bank account, it's easier to track income, manage taxes, and maintain financial records.

Direct Deposit for Businesses and Employers

From a business perspective, implementing direct deposit is a strategic move that can enhance operational efficiency and employee satisfaction. Offering direct deposit as a payment option can streamline the payroll process, reducing the time and costs associated with printing and distributing checks.

For employers, setting up a direct deposit system requires coordination with a banking institution and setting up the infrastructure to manage electronic payments. This may involve an initial investment in payroll software or services, but the long-term benefits in terms of efficiency and cost savings are significant.

Conclusion:

In this article, we've explored the key benefits of direct deposit, how the process works, and a step-by-step guide on signing up for direct deposit using QuickBooks. We've also addressed common issues and provided How Direct Deposit Works as well as.

For those considering direct deposit, the key is to ensure accuracy in the information provided and to communicate openly with employers or clients about the process. Addressing any issues promptly will ensure a smooth transition and continuous access to your funds.