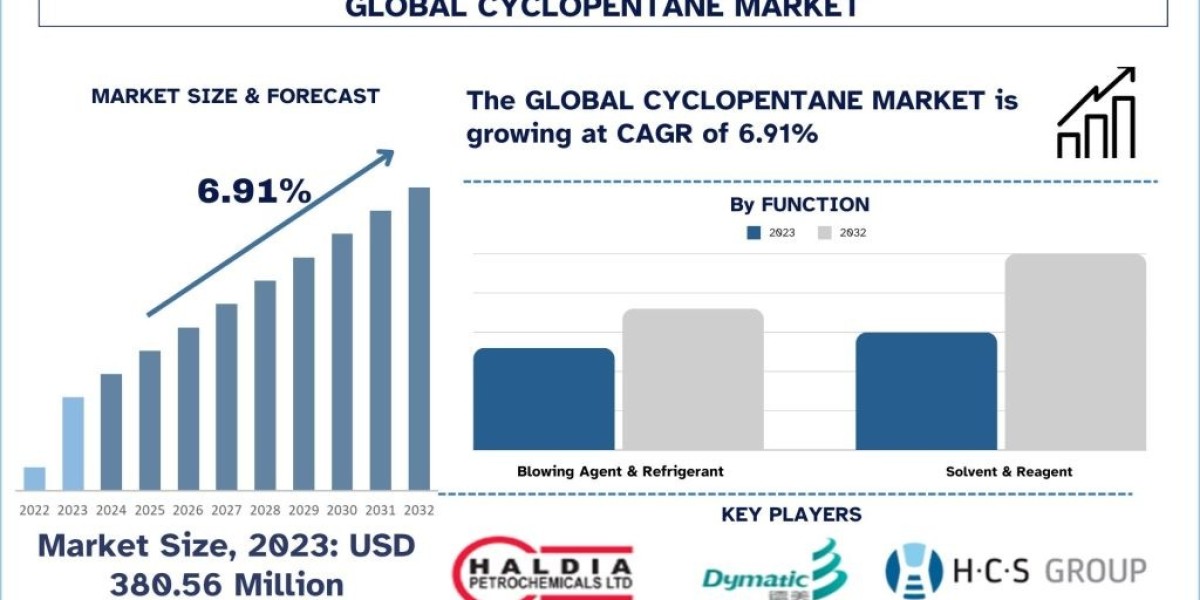

According to a new report by Univdatos Market Insights, the Global Cyclopentane Market is expected to reach USD 695.35 million in 2032, growing at a CAGR of 6.91%. The market is experiencing significant growth driven by increasing insulation, refrigeration, and electrical demand, coupled with stringent environmental regulations promoting eco-friendly blowing agents.

Market Dynamics

The cyclopentane market continues to grow due to several factors. Firstly, the global push for energy efficiency, particularly in household appliances, has led to increased demand for cyclopentane as a blowing agent in polyurethane foam insulation. For instance, in May 2024, Whirlpool Corporation reported a 12% increase in sales of its energy-efficient refrigerator line using cyclopentane-based insulation.

Moreover, the phase-out of hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs) under the Montreal Protocol and subsequent amendments has accelerated the adoption of cyclopentane as an environmentally friendly alternative. In February 2024, the European Union implemented stricter regulations on fluorinated greenhouse gases, further boosting cyclopentane demand in the region.

The construction industry's recovery post-COVID-19 pandemic has also contributed to increased cyclopentane usage in insulation materials. For instance, in 2024, according to the report published by the United States Census Bureau, the construction spending during May 2024 was estimated at a seasonally adjusted annual rate of USD 2,139.8 billion, 0.1 percent (±1.0 percent) below the revised April estimate of USD 2,142.1 billion. The May figure is 6.4 percent (±1.6 percent) above the May 2023 estimate of USD 2,011.8 billion. During the first five months of this year, construction spending amounted to USD 836.3 billion, 8.8 percent (±1.2 percent) above the USD 768.6 billion for the same period in 2023.

Additionally, technological advancements in cyclopentane production have improved efficiency and reduced costs. In August 2023, BASF SE announced a new catalytic process for cyclopentane production, which reduced energy consumption by 30% and decreased carbon emissions by 25% compared to conventional methods.

Sector Specific Growth

Refrigeration and Air Conditioning: The refrigeration and air conditioning sector remains the largest consumer of cyclopentane, driven by stringent energy efficiency standards and the shift towards eco-friendly refrigerants. For instance, in June 2024, according to Daikin, the company is focused on increasing its localization level, leveraging the PLI scheme for the air conditioning sector. The company plans to enhance local manufacturing of PCB circuits to achieve this goal. The company expects to manufacture 2 million units in India this fiscal year and has plans to scout for more export opportunities by making India a manufacturing hub. The company has sold seven lakh residential air conditioners (RAC) units in the first three months of the year, helped by a blistering summer this season, and expects over 50 percent growth. Therefore, this will increase the demand for cyclopentane-based insulation materials in the coming years.

Construction and Insulation: The construction and insulation segment has been a significant driver of cyclopentane demand, particularly in developing economies. The growing emphasis on green building practices has further boosted cyclopentane adoption. In January 2024, the Indian Green Building Council reported a 20% increase in green building certifications, with many projects utilizing cyclopentane-based insulation materials.

Electrical and Electronics: The electrical and electronics industry is emerging as a promising growth area for cyclopentane, particularly in producing circuit breakers and switchgear. In February 2024, Huntsman Building Solutions (HBS), the global leader in high-performance, energy-efficient, and resilient building envelope solutions, announced the launch of its all-new Icynene Series spray polyurethane foam insulation product line. The collection of spray foam systems offers the highest performance available in the industry today and includes key product certifications.

Request Free Sample Pages with Graphs and Figures Here https://univdatos.com/get-a-free-sample-form-php/?product_id=63784

Sustainability Drives Innovation in Cyclopentane Production and Application

The market is witnessing rapid technological developments and significant efforts from industry leaders in researching sustainable production methods. In October 2023, a consortium of European chemical companies unveiled a breakthrough in bio-based cyclopentane production, utilizing renewable feedstocks derived from agricultural waste. This innovation is expected to reduce the carbon footprint of cyclopentane production by up to 70% compared to conventional methods. The trend towards circular economic practices is also influencing the cyclopentane market. In September 2023, a major European appliance manufacturer launched a pilot program for recovering and purifying cyclopentane from end-of-life refrigerators, aiming to reduce virgin material consumption and minimize waste.

Conclusion:

With increasing environmental concerns, stringent regulations, and the growing demand for energy-efficient products, the cyclopentane market is poised for substantial growth in the coming years. The industry's focus on sustainable production methods, innovative applications, and circular economy practices is expected to drive further expansion and geographic diversification of the market.

As the global economy continues to prioritize sustainability and energy efficiency, cyclopentane is likely to remain a critical component in various industries, particularly in insulation, refrigeration, and electrical applications. The future of the industry will largely depend on its ability to adapt to evolving regulatory landscapes, consumer preferences, and technological advancements in green chemistry and manufacturing processes.

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website -www.univdatos.com