Non-Alcoholic Beer Market -Overview

The demand for non-alcoholic beverages is predicted to rise owing to a surge in health awareness in the end-user base theough the forecast period. Reports created by MRFR detail the developments of the industry that can be expected in the market through the forecast period. The non-alcoholic beverages market size is projected to gain a CAGR of 8.28% and accomplish a market value of USD 9.26 Bn by the conclusion of 2027.

The rise in ailments connected to increased consumption of alcoholic beverages is estimated to guide the non-alcoholic beer market companies' growth in the forthcoming period. Moreover, increased spending on marketing and publicity is estimated to ensure a better market penetration rate for the non-alcoholic beer products in the impending period.

Segmental Analysis

The segmental investigation of the non-alcoholic beer market has been conducted based on category, distribution channel, product type, and region. On the basis of distribution channels, the non-alcoholic beer industry is split into store-based and non-store-based. The non-alcoholic beer market is segmented into 0.5% alcohol by volume and alcohol-free based on the product type. Based on category, the non-alcoholic beer market is split into flavored and plain. The regions studied in the non-alcoholic beer market are North America, Europe, APAC, and other vital regional markets.

Detailed Regional Analysis

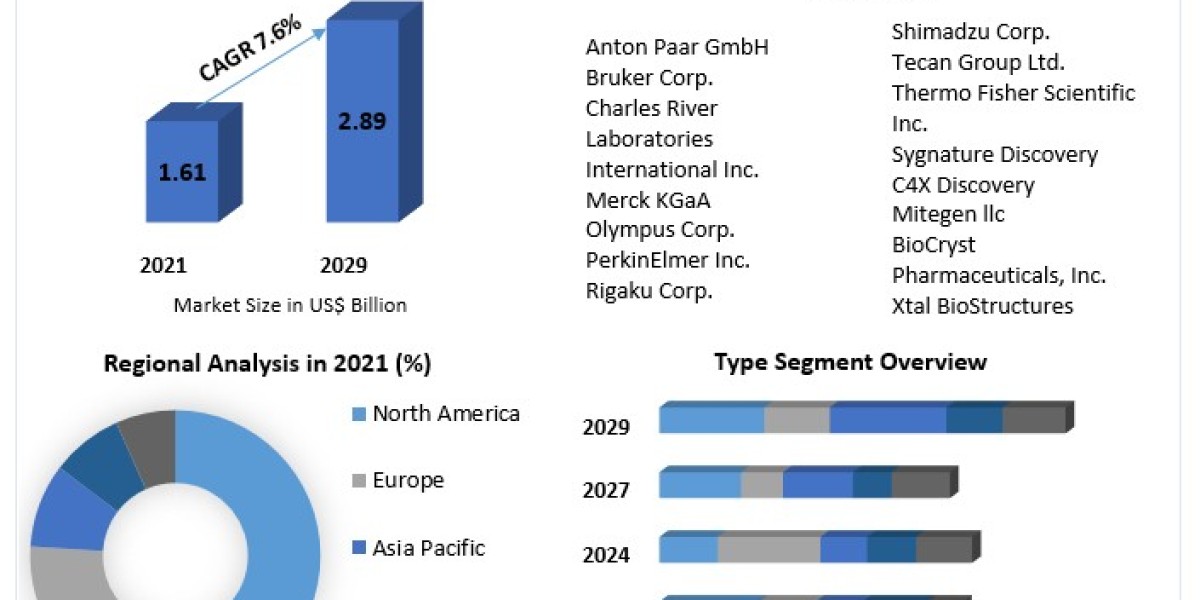

The regional outlook of the non-alcoholic beer market analysis includes North America, Europe, APAC and other vital regional markets. The North American non-alcoholic beer market is the dominating market with a 36.70% share of the worldwide market. The swelling cases of heart diseases, a mounting number of the employed population, and stern government laws on alcohol drinking are anticipated to be key motivating forces for the regional non-alcoholic beer market to advance throughout the forecast period. The European region's non-alcoholic beer market is projected to grow at the quickest rate in the non-alcoholic beer industry owing to the mounting trend of 'clean living' and increased drinking of specialty beers with minimal alcohol content are majorly swaying the regional market development. Furthermore, the systematized retail sector incidence in nations such as the U.K. and Germany is further driving the regional non-alcoholic beer market's advance.

Competitive Analysis

The progress in the distribution of vaccines is estimated to fasten the market's development as optimistic sentiment returns to the market. The majority stake contenders are assessed to take an enhanced amount of risk to achieve their overall targets by aligning the resources needed to accomplish this goal. The return in demand stability is estimated to herald a positive development phase in the global market in the forecast period. The positive influence of macro market reforms is predicted to ripple favorably throughout the global market in the forecast period. The challenges of business stability and diminished cash flows due to the pandemic are estimated to be rectified gradually in the coming years. The market is estimated to be powered by the developments visible in the global market that are being instated to create a swift return to normalcy. The focus on sustained growth in the market is likely to reveal promising development options in the forecast period. Foreign portfolio investors are predicted to play a vital role in expanding the business interest of new businesses innovating the market's product range.

The strategic players summarized in non-alcoholic beer are Anheuser-Busch InBev SA (Belgium), Erdinger Weibbrau (Germany), Bernard Brewery (Czech Republic), Big Drop Brewing Co. (U.K.), Heineken N.V. (Netherland), Krombacher Brauerei (Germany), and Suntory Beer (Japan) among many others.

Industry Update

Jan 2021 Athletic Brewing Co, a Connecticut-based company that produces only non-alcoholic (N.A.) beer, has revealed an impressive list of high-profile supporters. It comprises of pro football stars, bicycling legend Lance Armstrong, as well as Tom's Shoes LLC founder Blake Mycoskie. The celebrity backers have financed Athletic for as long as three years. Their participation in the band hadn't formerly been declared. The NA beer group has seen major growth throughout the pandemic, even though news early on that alcohol drinking had jumped. Athletic's retailing grew about 500% in 2020, associated with the preceding year, from USD 2.5 million to about USD 15 million in revenue.

Feb 2021 Drop Bear Beer Co's strategy to build an alcohol-free brewery has taken an important leap forward with a £1.5m financings by one of Wales' most successful businesspersons. The participation of Henry Engelhardt, founder of Admiral Group and humanitarian, has carried the entire investment solicited for the brewery to £1.8m. It will aid the company in beginning the second U.K. – and first Welsh alcohol-free brewery. When all phases of the scheme have been finished, the brewery will be as big as 20,000 sq ft.

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.