QuickBooks company files can become cluttered and disorganised, leading to various issues that can impact your business operations. Some of the most common problems you might encounter include duplicate entries, outdated information, incorrect transactions, and an overall lack of organisation.

Duplicate entries, such as multiple customer or vendor records, can create confusion and make it challenging to reconcile your accounts accurately. Outdated information, like inactive customers or vendors, can also clutter your file and make it harder to navigate.

Incorrect transactions, whether due to human error or system glitches, can skew your financial reports and lead to inaccurate decision-making.

Additionally, an unorganised QuickBooks company file can make it difficult to find the information you need quickly, leading to wasted time and potential mistakes.

Steps to clean up QuickBooks company files

The Company File NeedsTo Be Updated file doesn't have to be a daunting task. Here are the steps you can take to clean up your QuickBooks company file:

Verifying and rebuilding QuickBooks Company files

The first step in cleaning up your QuickBooks company file is to verify its integrity and, if necessary, rebuild it. This process helps ensure that your file is free from any underlying issues that could be causing problems.

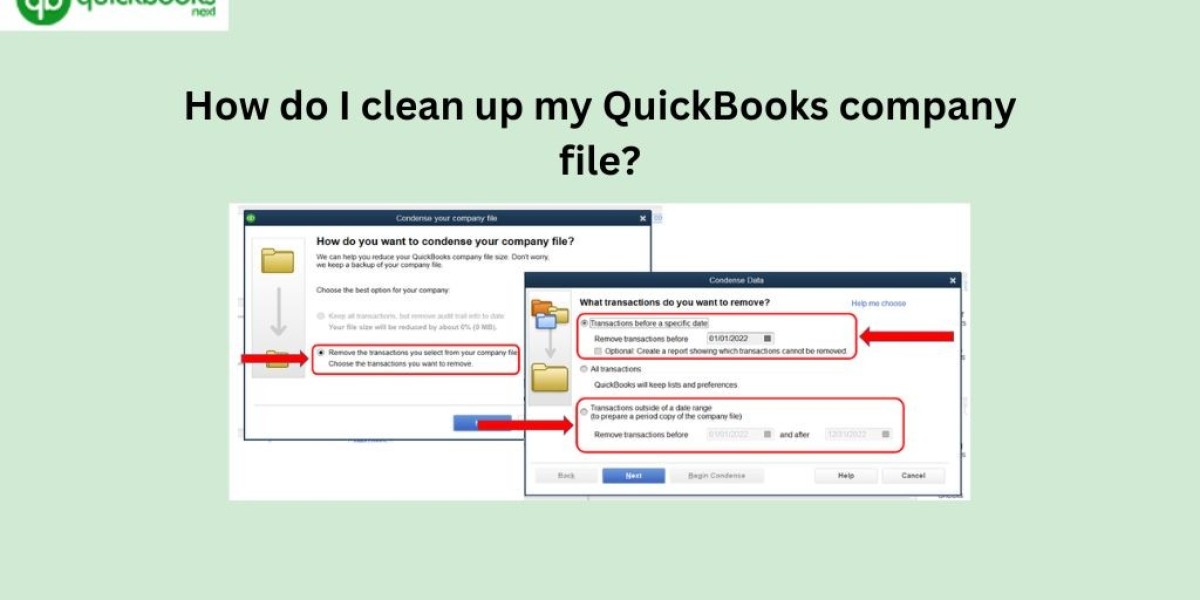

To verify your QuickBooks company file, open the file and go to the File menu. Select "Utilities" and then choose "Verify Data." This will scan your file for any inconsistencies or errors. If the verification process identifies any issues, you can then proceed to rebuild your company file.

To rebuild your QuickBooks company file, go to the File menu, select "Utilities," and then choose "Rebuild Data." This process will reorganise and optimise your file, helping to improve its overall performance and eliminate any underlying problems.

Removing unused accounts and transactions

Next, you'll want to identify and remove any unused accounts or unnecessary transactions from your QuickBooks Company file. This can help streamline your file and make it easier to manage.

Start by reviewing your list of customers, vendors, and other accounts. Look for any inactive or obsolete entries that can be safely deleted. Be careful not to remove any active accounts, as this could have unintended consequences for your financial records.

Similarly, review your transaction history and identify any old or irrelevant entries that can be safely removed. This could include outdated invoices, payments, or other transactions that are no longer relevant to your current business operations.

When deleting accounts or transactions, make sure to follow best practices and create a backup of your QuickBooks company file before making any changes. This will ensure that you can easily restore your file if needed.

Deleting or merging duplicate entries

One of the most common issues with QuickBooks company files is the presence of duplicate entries, such as multiple customer or vendor records. These duplicates can create confusion, lead to inaccurate financial reporting, and make it harder to manage your business.

To address this issue, carefully review your QuickBooks company file and identify any duplicate entries. This may involve comparing customer or vendor names, addresses, or other identifying information to spot potential duplicates.

Once you've identified the duplicates, you'll need to decide whether to delete the unnecessary entries or merge them together. If the duplicates are truly separate entities, you can delete the unnecessary records.

However, if the duplicates represent the same customer or vendor, you can merge the records to consolidate the information.

When merging duplicate entries, be sure to review all the associated transactions and ensure that they are correctly assigned to the correct account. This will help maintain the integrity of your financial records.

Archiving old data in QuickBooks company files

As your business grows and evolves, your QuickBooks company file can become cluttered with old data that is no longer actively used. To keep your file organised and manageable, consider archiving older data that is no longer necessary for your day-to-day operations.

Archiving old data involves moving it to a separate file or location, while keeping it accessible if needed.

To archive old data in QuickBooks, you can use the "Archive Company" feature, which allows you to create a separate file for your historical information. Alternatively, you can export the data to a spreadsheet or other file format and store it securely outside of your active QuickBooks company file.

Backing up and restoring QuickBooks company files

Throughout the process of cleaning up your QuickBooks company file, it's crucial to maintain regular backups of your data. To back up your QuickBooks company file, go to the File menu and select "Backup Company." You can choose to create a local backup or a backup that is stored in the cloud, depending on your preferences and the size of your file.

When restoring your QuickBooks company file, be sure to follow the appropriate steps to ensure a successful restoration. This may involve selecting the correct backup file, choosing the appropriate restore location, and verifying that the restored file is functioning correctly.

It's a good practice to test your backup and restoration process regularly to ensure that your data is being properly protected and that you can quickly recover your QuickBooks company file in the event of an emergency.

Conclusion :

By following the steps outlined in this article, you can effectively clean up your QuickBooks company file and restore it to a well-organised, efficient state.

Remember, maintaining a clean and healthy QuickBooks company file is an ongoing process, and it's essential to implement best practices to prevent clutter and issues from recurring.

Here are some tips to help you maintain a clean QuickBooks company file:

Regularly review and purge unused accounts and transactions: Set aside time each quarter or year to review your QuickBooks company file and identify any accounts or transactions

- Regularly review and purge unused accounts and transactions: Set aside time each quarter or year to review your QuickBooks company file and identify any accounts or transactions that can be safely removed.

- Implement strict data entry protocols: Establish clear guidelines and procedures for how your team should enter data into QuickBooks, such as standardising customer and vendor names, using consistent account codes, and avoiding duplicate entries.

- Conduct periodic data cleanups: Schedule regular data cleanup sessions to address any issues that may have crept into your QuickBooks company file, such as merging duplicate entries or archiving old data.

- Backup your QuickBooks company file frequently: Regularly backup your QuickBooks company file to ensure that you can quickly restore your data in the event of an emergency or system failure.

- Stay up-to-date with QuickBooks updates and best practices: Keep your QuickBooks software and knowledge current by staying informed about the latest updates, features, and best practices for maintaining a healthy company file.

By following these best practices, you can ensure that your QuickBooks company file remains clean, organised, and optimised for your business's needs. Remember, a well-maintained QuickBooks company file can be a powerful tool for driving your business's success.