What Are E-Way Bills?

E-Way Bill Full Form Electronic Way Bill (E-Way Bill) is a yielding mechanism wherein, through a digital interface or software, the person moving goods uploads the relevant information and data before the beginning of goods and produces an e-way bill on the GST portal. E-way Bill meaning is that an e-way bill is a receipt or a report published by a carrier giving specifications and instructions describing the shipment of a consignment of goods. The highlights incorporate the Consignor's name, consignee, the point of origin of the consignment or shipment, its purpose, and direction. The E-way Bill System for Inter-State transferal of goods across the nation was inaugurated on 01 April 2018. E-Way Bills are required for Inter-State transportation of goods of consignment surpassing Rs.50,000/- in the motorized carrier.

When Shall an E-way Bill Be Generated?

An e-way bill must be produced before the goods are transmitted or dispatched, and it should incorporate aspects of the goods, their Consignor, recipient and transporter. Know how e way bill works and how e-way bill is generated online for:

- Supply of goods

- When there is Return, or

- In a situation when there is an Inward Supply of goods from an unregistered person.

- Non-supply transactions similar to export/import, Return of goods, job work, line sales, sale on a permission basis, semi or knocked down supply, supply of goods for exhibition or fair, and goods used for own consumption.

How to Prepare an E-Way Bill and How Is E-way Bill Generated?

- All registered persons who may be consignors, consignees, recipients, or transporters should produce an e-way bill if the transportation is being prepared through their own or rented means of transport (air/rail/road).

- An unregistered person who is furnishing a registered recipient. Hither, the recipient will be required to comprehend the compliance method because the supplier is not registered.

- The transporter should produce an e-way bill if both the Consignor and the consignee neglect to generate an e-way bill notwithstanding having handed over the goods to the transporter for conveyance by road.

Note: The Consignor can approve the transporter/courier agency/e-commerce operator to fulfill PART-A of the e-way bill on their support. An online waybill should be generated irrespective of the amount of the consignment even if the amount is lesser than Rs.50,000 in two cases:

- When a principal supplies the goods to a job working in an inter-state transaction.

- Meanwhile, an inter-state transfer of handicraft goods by a supplier has been exempted from GST registration

How to Generate an E-Way Bill?

Any taxpayer who requires an e-way bill download for the consignment must have admittance first to the Government portal. For the specific measures concerning the generation, you can visit this page.

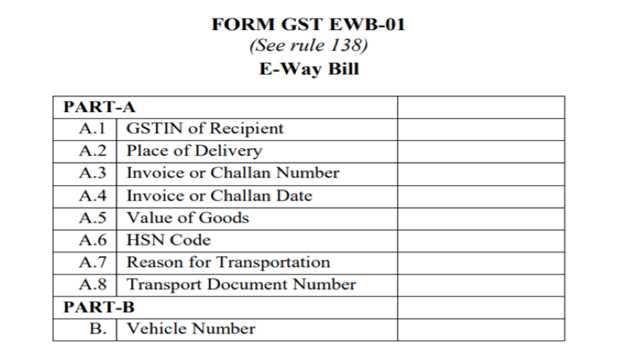

E-way Bill Format

Following is the E way bill format download or presentation of an e-way bill

E-way Bill Validity

The validity of an e-way bill is determined from the date of its generation. E-way bill validity depends on two major things

- Kilometers or days whichever is earlier; and

- Cargo used for the movement (Normal Cargo or Over dimensional cargo)

Conveyance Type | Kilometers (Distance) | E-Way Bill Validity |

Normal cargo | Up to 100 kilometers | one day |

Every additional 100 Kilometer | one additional day | |

Over dimensional cargo | Up to 20 kilometers | one day |

Every additional 20 kilometers | one additional day |

The validity of an e-way bill can be increased either before four hours of its expiry period or after four hours after expiry. So, in inclusive, there are eight hours with the possessor of an e-way bill to increase the expiry period. If the holder or taxpayer does not extend or increase its efficacy, he will be punished respectively.

Penalties for Not Carrying the E-way Bill

If the transporter is traveling without an e-way bill, he must be punished. There are two kinds of penalties which are taxed on the transporters as explained.

Monetary Penalty

In this case when there is a movement of consignment without an invoice and e-way bill the transporter shall be penalized either with 10,000 INR or amount of tax evaded, whichever is higher.

Detention Seizure

When the taxpayer fails to comply with the policies so mentioned, the vehicle and goods can be detained and seized without any notice. However, both can be released if the owner wishes to pay the full tax or half the price of goods. To save the taxpayer from being penalized and hampering the supply of goods, organizations or transporters can use Masters India’s integrated e-way bill software. This software ensures that there will be a smooth movement of goods from one place to another.

Conditions When E-Way Bill is Not Required

There are some exempted goods which do not require an e-way bill. They are as mentioned

- The technique of transportation is a non-motor vehicle or transport.

- Goods moved from Customs port, airport, air cargo complex or land customs service to Inland Container Depot (ICD) or Container Freight Station (CFS) for permission by Customs authority.

- Goods transported under Customs administration or under customs permit

- Goods carried under Customs Bond from ICD to Customs port or from one customs station to another station. Transit cargo moved to or from Nepal or Bhutan

- Transfer of goods affected by defense organization under Ministry of defense as a consignor or consignee Empty Cargo vessels are being brought

- Consignor transporting goods to or from among distance of business and a weighbridge for weighment at a distance of 20 km, followed by a Delivery challan.

- Goods are being conveyed by railway where the Consignor of goods is the Central Government, State Governments or local authority.

- Goods particularized as exempt from E-Way bill provisions in the particular State/Union territory GST Rules.

- Transport of selective designated goods- Attaches the listing of exempt supply of goods, Annexure to Rule 138(14), goods commanded as no supply as per Schedule III, Determined schedule to Central tax Rate notifications. (PDF of List of Goods).

E-Way Bill FAQs

Q1. How to Generate an E-way Bill Without an Invoice?

- Any taxpayer can generate e-way bill online without an invoice if he has the following documents with them:

- Invoice of tax paid

- Credit Notes

- Delivery Challan and Bill of supply or Entry.

Q2. When a Taxpayer Receives Notice of Ewb Cancellation or Other Changes Made by a Transporter in Part-B?

- Every taxpayer who has produced the e-way bill will receive the information for the development in Part-B and any refusal or revocation done. This information will either appear on their designated mobile number or the email-id or both formats.

Q3. How Many E-way Bills Are Required for Most Consignments Sent Directly to the Vehicle?

- Every different consignment that is in the vehicle for the delivery must have various e-way. If the transporter or in charge deserts to determine the EWB, then the goods of that appropriate consignment can be stopped.

Q4. How to Download E Way Bill?

- Various centers can create EWB they are mentioned below

Q5. Is It Possible to Generate a Bulk Amount of E-way Bills?

- Yes, any taxpayer or transporter who activated the automated platform for generating invoices can generate the e-way bill in bulk. Throughout this, the transporter or taxpayer, whichever the position may be, will be ready to abstain from their blunders as well the uncertainties of duplicate entries will also diminish.

- By GST Suvidha Provider (GSP)

- Through ASP (Application Service Provider)

- Android app

- By e-way bill website: https://ewaybillgst.gov.in/login.aspx

- Through site-to-site integration