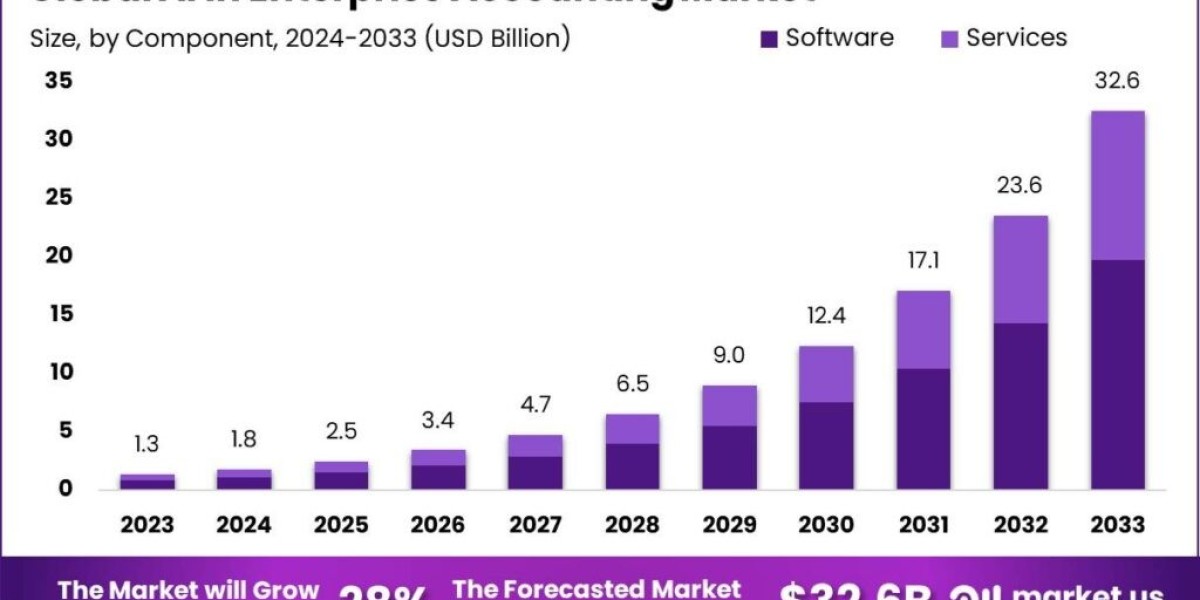

The advent of artificial intelligence (AI) in the enterprise accounting market is revolutionizing how businesses manage their financial operations. Traditionally, accounting has involved a lot of manual tasks, such as data entry and reconciliations, which can be time-consuming and prone to errors. AI technology, however, automates many of these processes, allowing accountants to focus on higher-value activities like strategic planning and analysis. The Global AI in Enterprise Accounting Market size is expected to be worth around USD 32.6 Billion By 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 28% during the forecast period from 2024 to 2033.

Growth Factors

Several key factors are contributing to the growth of AI in the enterprise accounting market. Firstly, the increasing volume of financial data generated by businesses today necessitates advanced tools for effective analysis. As organizations expand globally, they face more complex financial environments that require quick, accurate data processing. Secondly, the push for automation is stronger than ever, driven by the need to reduce operational costs and minimize human error.These growth factors highlight a clear shift toward embracing AI as an essential component of modern accounting practices.

Read more @https://market.us/report/ai-in-enterprise-accounting-market/#overview

Drivers

The main drivers behind the adoption of AI in accounting are the desire for greater accuracy, efficiency, and compliance. AI systems can analyze large datasets faster than humans, significantly reducing the chances of errors in financial reporting and compliance tasks. This capability is especially important in today’s regulatory environment, where businesses must adhere to various rules and standards. Additionally, AI helps organizations manage the increasing complexity of financial transactions, enabling them to maintain transparency and consistency across different regions. As businesses face pressure to remain competitive, leveraging AI technology is becoming a strategic necessity.

Emerging Trends

As AI technology evolves, several trends are emerging in the enterprise accounting space. One significant trend is the rise of predictive analytics, which empowers organizations to forecast financial outcomes based on historical data. This capability allows businesses to anticipate market changes and adjust their strategies accordingly. Another emerging trend is the integration of AI with blockchain technology, enhancing the security and trustworthiness of financial transactions. Furthermore, cloud-based AI solutions are gaining traction, making it easier for companies of all sizes to adopt these advanced tools without heavy upfront investments. These trends indicate a shift towards more sophisticated, interconnected financial management systems.

Top Use Cases

AI is being utilized in various impactful ways within enterprise accounting. One of the most common use cases is automating accounts payable and receivable processes. By streamlining these tasks, businesses can significantly reduce the time spent on manual data entry, speeding up transactions and improving cash flow. AI-driven chatbots are also enhancing customer service, providing instant responses to inquiries related to invoices and payments. Moreover, AI plays a crucial role in fraud detection; its algorithms can analyze transaction patterns to identify anomalies and flag potential fraudulent activities in real time. These use cases illustrate how AI is transforming traditional accounting functions into more dynamic and efficient processes.

Challenges

Despite the many advantages, there are challenges associated with implementing AI in enterprise accounting. One major concern is data privacy and security, as financial information is highly sensitive and must be protected against breaches. Organizations also face difficulties in integrating AI technologies with their existing accounting systems, which can be complex and costly. Additionally, there is a skills gap; many businesses struggle to find personnel who can effectively interpret AI-generated insights and manage these technologies. Addressing these challenges is crucial for organizations looking to successfully implement AI in their accounting practices.

Opportunities

The opportunities presented by AI in the enterprise accounting market are immense. Businesses can leverage AI to enhance their decision-making processes, leading to more informed and strategic financial choices. By automating routine tasks, accountants can focus on analysis and advisory roles, adding more value to the organization. Moreover, AI technologies are continuously evolving, offering innovative solutions to longstanding accounting challenges, such as budgeting and forecasting. As companies become more data-driven, the ability to quickly adapt to changing market conditions and regulations will provide a significant competitive edge.

Conclusion

In conclusion, AI is fundamentally changing the enterprise accounting market, driving efficiency, accuracy, and deeper insights into financial performance. While challenges such as data security and integration complexities remain, the benefits of adopting AI far outweigh these hurdles. Organizations that embrace AI technologies will not only improve their operational efficiency but also enhance their ability to make strategic decisions in a fast-paced business environment. As the landscape of accounting continues to evolve, the integration of AI will play a pivotal role in shaping the future of finance, making it a critical investment for businesses aiming to thrive in a competitive marketplace.